Holiday Inn 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

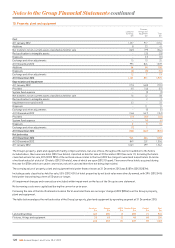

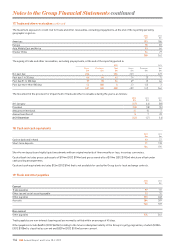

5. Exceptional items

Note

2013

$m

2012

$m

20111

$m

Exceptional operating items

Administrative expenses:

Litigation a(10) – –

Loyalty programme rebranding costs b(10) – –

Pension settlement loss c(147) – –

Reorganisation costs d–(16) –

Resolution of commercial dispute e––(37)

Pension past service gain f––28

(167) (16) (9)

Share of profits of associates and joint ventures:

Share of gain on disposal of a hotel (note 14) 6– –

Other operating income and expenses:

Gain/(loss) on disposal of hotels (note 11) 166 (2) 37

Write-off of software (note 13) –(18) –

Demerger liability released g–9 –

VAT refund h–– 9

166 (11) 46

Impairment:

Impairment charges:

Property, plant and equipment i––(2)

Other financial assets j––(3)

Reversals of previously recorded impairment:

Property, plant and equipment k–23 23

Associates l–– 2

–23 20

5(4) 57

Tax

Tax on exceptional operating items (6) 1(4)

Exceptional tax m(45) 141 43

(51) 142 39

1 See note on ‘Comparatives for 2011’ on page 111.

All items above relate to continuing operations.

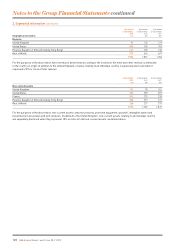

The above items are treated as exceptional by reason of their size or nature.

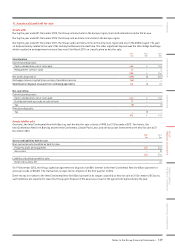

a Relates to an agreed settlement in respect of a lawsuit filed against the Group in the Greater China region.

b Relates to costs incurred in support of the worldwide rebranding of IHG Rewards Club that was announced 1 July 2013.

c Arises from a buy-in of the Group’s UK funded defined benefit obligations with the insurer, Rothesay Life, on 15 August 2013 (see note 26 for further details).

d Arose from a reorganisation of the Group’s support functions together with a restructuring within the AMEA region.

e Related to the settlement of a prior period commercial dispute in the Europe region.

f Related to the closure of the UK defined benefit pension scheme to future accrual with effect from 1 July 2013.

g Resulted from a release of a liability no longer required which arose on the demerger of the Group from Six Continents PLC.

h Arose in the UK relating to periods prior to 1996.

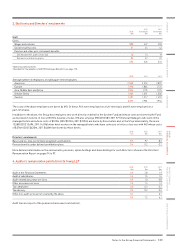

i Arose in respect of a hotel in Europe following a re-assessment of its recoverable amount, based on fair value less costs tosell.

j Related to an available-for-sale equity investment and arose as a result of a significant and prolonged decline in its fair value below cost.

k In 2012, a previously recorded impairment charge relating to a North American hotel was reversed in full following a re-assessment of its recoverable amount,

based on the market value of the hotel as determined by an independent professional property valuer. Of the impairment reversal in 2011, $11m arose on the

classification of a North American hotel as held for sale and was based on the expected net sales proceeds which were subsequently realised on the disposal of the

hotel. Afurther $12m arose in respect of another North American hotel following a re-assessment of its recoverable amount, based on value in use.

l The impairment reversal arose in the Americas region.

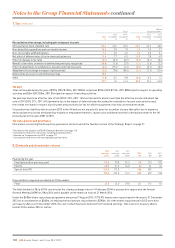

m In 2013, comprises a deferred tax charge of $63m consequent on the disposal of the InterContinental London Park Lane hotel (see note 27), together with charges

and credits of $38m and $19m respectively from associated restructurings (including intra-group dividends) and refinancings, offset by the recognition of $37m

of previously unrecognised tax credits. In 2012, represented the recognition of $104m of deferred tax assets, principally relating to pre-existing overseas tax

losses, whose value had become more certain as a result of a change in law and the resolution of prior period tax matters, together with the associated release

of $37m of provisions. In 2011, related to a $30m revision of the estimated tax impacts of an internal reorganisation completed in 2010 together with the release

of $13m of provisions.

124 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued