Holiday Inn 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

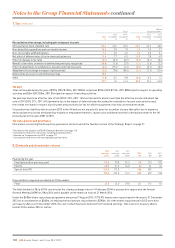

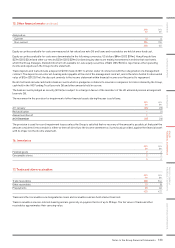

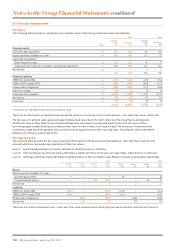

20. Provisions

Onerous

management

contracts

$m

Litigation

$m

Total

$m

At 1 January 2012 311 14

Utilised (1) (11) (12)

At 31 December 2012 2 – 2

Provided – 4 4

Utilised (1) (2) (3)

At 31 December 2013 1 2 3

2013

$m

2012

$m

Analysed as:

Current 31

Non-current –1

32

The onerous management contracts provision relates to the unavoidable net cash outflows that are expected to be incurred under

performance guarantees associated with certain management contracts. The non-current portion of the provision is expected to be

utilised over the period to 2020.

Litigation during 2013 largely relates to actions brought against the Group in the Greater China region and during 2012 in the

Americas region.

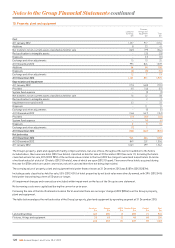

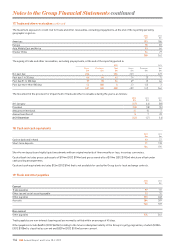

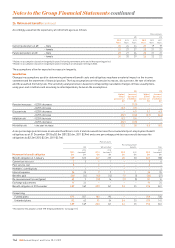

21. Financial risk management

Overview

The Group’s treasury policy is to manage financial risks that arise

in relation to underlying business needs. The activities of the

treasury function are carried out in accordance with Board

approved policies and are subject to regular audit. The treasury

function does not operate as a profit centre.

The treasury function seeks to reduce the financial risks faced by

the Group and manages liquidity to meet all foreseeable cash

needs. Treasury activities may include money market investments,

spot and forward foreign exchange instruments, currency swaps,

interest rate swaps and forward rate agreements. One of the

primary objectives of the Group’s treasury risk management policy

is to mitigate the adverse impact of movements in interest rates

and foreign exchange rates.

Market risk exposure

The US dollar is the predominant currency of the Group’s revenue

andcash flows. Movements in foreign exchange rates can affect

theGroup’s reported profit, net assets and interest cover. To hedge

translation exposure, wherever possible, the Group matches

the currency of its debt (either directly or via derivatives) to the

currency ofits net assets, whilst maximising the amount of US

dollars borrowedto reflect the predominant trading currency.

From time to time, foreign exchange transaction exposure is

managed by the forward purchase or sale of foreign currencies.

Most significant exposures of the Group are in currencies that

are freely convertible.

A general strengthening of the US dollar (specifically a five cent

fall in the sterling:US dollar rate) would increase the Group’s profit

before tax by an estimated $4.1m (2012 $2.8m, 2011 $3.3m) and

increase net assets by an estimated $16.0m (2012 increase of

$1.8m, 2011 decrease of $10.4m). Similarly, a five cent fall in the

euro:US dollar rate would reduce the Group’s profit before tax by

an estimated $2.6m (2012 $2.3m, 2011 $1.9m) and decrease net

assets by an estimated $14.8m (2012 $16.1m, 2011 $10.3m).

Interest rate exposure is managed, using interest rate swaps if

appropriate, within set parameters depending on the term of the

debt, with a minimum fixed proportion of 25% of borrowings for each

major currency. Due to relatively low interest rates and the level of

the Group’s debt, 100% of borrowings in major currencies were fixed

rate debt at 31 December 2013.

Based on the year-end net debt position and given the underlying

maturity profile of investments, borrowings and hedging

instruments atthat date, neither a one percentage point rise in

USdollar, euro nor sterling interest rates would have a material

impact on the annual net interest charge in the current or prior

twoyears.

Notes to the Group Financial Statements 135

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION