Holiday Inn 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

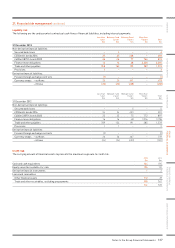

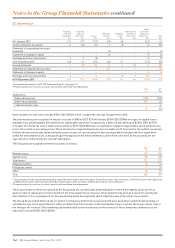

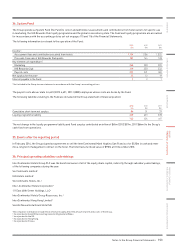

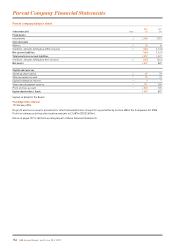

27. Deferred tax

Property,

plant and

equipment

$m

Deferred

gains on

loan notes

$m

Losses

$m

Employee

benefits

$m

Intangible

assets

$m

Undistributed

earnings of

subsidiaries

$m

Other

short-term

temporary

differences2

$m

Total

$m

At 1 January 2012 221 137 (133) (59) 38 –(153) 51

Income statement (restated1)12 (26) (74) 5(6) –(1) (90)

Statement of comprehensive income

(restated1)–––(5) ––1(4)

Statement of changes in equity –––(4) – – (1) (5)

Exchange and other adjustments 3 3 (8) – 1 – (1) (2)

At 31 December 2012 236 114 (215) (63) 33 –(155) (50)

Income statement 1(8) 20 2 2 63 888

Statement of comprehensive income –––24 –––24

Statement of changes in equity – – – – – – 4 4

Exchange and other adjustments 319–(1) 3(14) 1

At 31 December 2013 240 107 (186) (37) 34 66 (157) 67

1 Restated for the adoption of IAS 19R ‘Employee Benefits’ (see page 111).

2 Primarily relates to provisions, accruals, amortisation and share-based payments.

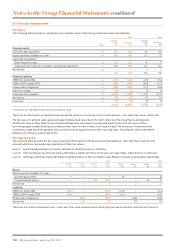

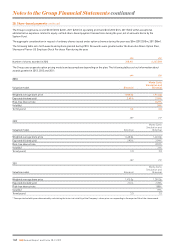

2013

$m

2012

$m

Analysed as:

Deferred tax assets (108) (204)

Deferred tax liabilities 175 93

Liabilities held for sale –61

67 (50)

Deferred gains on loan notes includes $55m (2012 $55m) which is expected to fall due for payment in 2016.

The deferred tax asset recognised in respect of losses of $186m (2012 $215m) includes $53m (2012 $78m) in respect of capital losses

available to be utilised against the realisation of capital gains which are recognised as a deferred tax liability and $133m (2012 $137m)

in respect of revenue tax losses. Deferred tax assets of $17m (2012 $22m) are recognised in relation to legal entities which suffered a tax

loss in the current or preceding period. These assets are recognised based upon future taxable profit forecasts for the entities concerned.

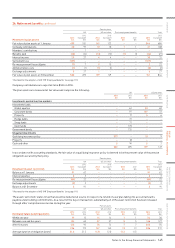

A deferred tax provision was made during the year in respect of current and prior year earnings which are expected to be repatriated

within the foreseeable future, consequent upon the disposal of the InterContinental London Park Lane hotel as the proceeds are not

expected to be reinvested by the relevant subsidiaries.

The Group has unrecognised deferred tax assets as follows:

2013

$m

2012

$m

Revenue losses 127 132

Capital losses 85 140

Total losses1212 272

Employee benefits 16 32

Foreign tax credits –34

Other255 53

Total 283 391

1

These may be carried forward indefinitely other than $12m which expires after three years, $1m which expires after seven years, $1m which expires after eight years

and $9m which expires after nine years (2012 $11m which expires after four years and $1m which expires after eight years).

2 Primarily relates to provisions, accruals, amortisation and share-based payments.

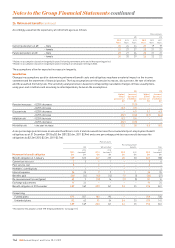

These assets have not been recognised as the Group does not currently anticipate being able to offset these against future profits or

gains in order to realise any economic benefit in the foreseeable future. However, future benefits may arise as a result of resolving tax

uncertainties, or as a consequence of case law and legislative developments which make the value of the assets more certain.

The Group has provided deferred tax in relation to temporary differences associated with post-acquisition undistributed earnings of

subsidiaries only to the extent that it is either probable that it will reverse in the foreseeable future or where the Group cannot control

the timing of the reversal. The remaining unprovided liability that would arise on the reversal of these temporary differences is not

expected to exceed $10m (2012 $20m).

146 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued