HSBC 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Risk > Challenges and uncertainties > Macro-prudential and regulatory

90

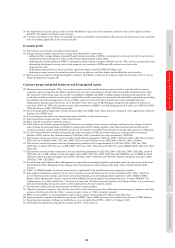

We have significant exposure to

counterparty risk within our portfolio

We have exposure to virtually all major industries

and counterparties, and we routinely execute

transactions with counterparties in financial services,

including brokers and dealers, commercial banks,

investment banks, mutual and hedge funds, and other

institutional clients. Many of these transactions

expose us to credit risk in the event of default by our

counterparty or client. Financial institutions are

necessarily interdependent because of trading,

clearing, counterparty or other relationships. As a

consequence, a default by, or decline in market

confidence in, individual institutions, or anxiety

about the financial services industry generally, can

lead to further individual and/or systemic losses. Our

credit risk may remain high if the collateral taken to

mitigate counterparty risk cannot be realised or has

to be liquidated at prices which are insufficient to

recover the full amount of our loan or derivative

exposure. For further information relating to the

major risk areas, see ‘Areas of Special Interest’ on

page 103.

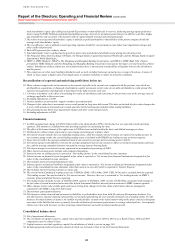

Macro-prudential and regulatory

We face a number of challenges in

regulation and supervision

Financial services providers face increased

regulation and supervision, with more stringent and

costly requirements in the areas of capital and

liquidity management and of compliance relating to

conduct of business and the integrity of financial

services delivery. Increased government intervention

and control over financial institutions, together with

measures to reduce systemic risk, could significantly

alter the competitive landscape.

Recent regulatory and supervisory

developments have largely been shaped by the

leaders, Finance Ministers and Central Bank

Governors of the Group of Twenty nations (‘the

G20’), who delegated the development and issuance

of standards to the Basel Committee of Banking

Supervisors (‘the Basel Committee’). The G20 also

established the Financial Stability Board (‘FSB’) to

assess vulnerabilities affecting the financial system

as a whole, as well as to monitor and advise on

market developments and best practice in meeting

regulatory standards.

In looking to address the systemic failures that

caused the financial crisis of 2007-8, the authorities

asserted two primary objectives: to establish a

resilient system to reduce substantially the risks of

failure of financial institutions and, in case failure in

the end proved unavoidable, to have in place

measures to achieve orderly resolution without cost

to taxpayers. Governments and regulators have

embarked on significant change in the regulation of

the financial system, highlighting the following

priorities:

• a stronger international framework for

prudential regulation, ensuring significantly

increased liquidity and regulatory capital buffers

and enhanced quality of capital;

• convergence towards a single set of high-

quality, global, independent accounting

standards, with particular focus on accounting

for financial instruments and off-balance sheet

exposures;

• strengthening the regulation of hedge funds

and credit rating agencies, and improving the

infrastructure for derivative transactions,

including central counterparty clearing of over-

the-counter derivatives;

• design and implementation of a system which

will allow for the restructuring or resolution of

financial institutions, without taxpayers

ultimately bearing the burden;

• an increased role for colleges of supervisors to

coordinate oversight of systemically significant

institutions such as HSBC, and effective

coordination of resolution regimes for failed

banks;

• measures on financial sector compensation

arrangements to prevent excessive short-term

risk taking and mitigate systemic risk on a

globally consistent basis; and

• a fair and substantial contribution by the

financial sector towards paying for any burden

associated with government interventions,

where they occur, to repair and reduce risks

from the financial system or to fund the

resolution of problems.

Measures proposed by the Basel Committee to

increase resilience in the financial system

The Basel Committee, following consultation,

impact analyses and draft proposals during 2010,

issued final proposals in December 2010, known as

Basel III, on the twin areas of capital and liquidity,

the key aspects of which are set out below.

• Risk weightings: increased weightings for the

trading book and re-securitisations are planned

for implementation by the end of 2011. A

fundamental review of the trading book will

continue during 2011.