HSBC 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

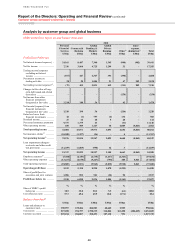

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Customer groups and global businesses > Products and services

38

Products and services

Personal Financial Services

PFS offers its products and services to customers based

on their individual needs. Premier and Advance

services are targeted at mass affluent and emerging

affluent customers who value international

connectivity and benefit from our global reach and

scale. For customers who have simpler everyday

banking needs, we offer a full range of banking

products and services reflecting local requirements.

In addition, we are one of the largest card issuers

in the world, offering HSBC branded cards, co-

b

randed

cards with selected partners and private label (store)

cards.

Typically, customer offerings include personal

banking products (current and savings accounts,

mortgages and personal loans, credit cards, debit cards

and local and international payment services) and

wealth management services (insurance and

investment products and financial planning services).

• HSBC Premier provides preferential banking services and

global recognition to our high net worth customers and their

immediate families with a dedicated relationship manager,

specialist wealth advice and tailored solutions. Customers can

access emergency travel assistance, priority telephone banking

and an online ‘global view’ of their Premier accounts around

the world with free money transfers between them.

• HSBC Advance provides a range of preferential products and

services customised to meet local needs. With a dedicated

telephone service, access to wealth advice and online tools to

support financial planning, it gives customers an online ‘global

view’ of their Advance accounts with money transfers between

them.

• Wealth Solutions & Financial Planning: a financial

planning process designed around individual customer needs

to help our clients to protect, grow and manage their wealth

through best-in-class investment and wealth insurance

products manufactured by in-house partners (Global Asset

Management, Global Markets and HSBC Insurance) and by

selected third party providers.

Customers can transact with the bank via a range of channels

such as internet banking and self-service terminals in addition to

traditional and automated branches and telephone service centres.

Commercial Banking

We segment our CMB business into Corporate, to

serve both Corporate and Mid-Market companies with

more sophisticated financial needs and Business

Banking, to serve the small and medium-sized

enterprises (‘SME’s) sector. This enables the

development of tailored customer propositions while

adopting a broader view of the entire commercial

banking sector, from sole proprietors to large

corporations. This allows us to provide continuous

support to companies as they expand both domestically

and internationally, and ensures a clear focus on the

b

usiness banking segments, which are typically the key

to innovation and growth in market economies.

We place particular emphasis on international

connectivity to meet our business customers’ needs and

aim to be recognised as the leading international bank

in all our markets and the best bank for business in our

largest markets.

• Financing: we offer a broad range of financing, both

domestic and cross-border, including overdrafts, receivables

finance, term loans and syndicated, leveraged, acquisition and

project finance. Asset finance is offered in selected sites,

focused on leasing and instalment finance for vehicles, plant

and equipment.

• Payments and cash management: we are a leading

provider of domestic and cross-border payments and

collections, liquidity management and account services

worldwide, delivered through our e-platform, HSBC net.

• International trade: we provide various international trade

products and services, to both buyers and suppliers such as

export finance, guarantees, documentary collections and

forfeiting to improve efficiency and help mitigate risk

throughout the supply chain.

• Treas ur y: CMB customers are volume users of our foreign

exchange, derivatives and structured products.

• Capital markets & advisory: capital raising on debt and

equity markets and advisory services are available as required.

• Commercial cards: card issuing helps customers enhance

cash management, credit control and purchasing. Card

acquiring services enable merchants to accept credit and debit

card payments in person or remotely.

• Insurance: CMB offers key person, employee benefits and a

variety of commercial risk insurance such as property, cargo

and trade credit.

• Direct channels: these include online and direct banking

offerings such as telephone banking, HSBCnet and Business

Internet Banking.