HSBC 2010 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

181

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

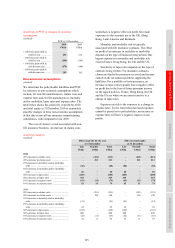

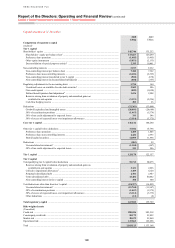

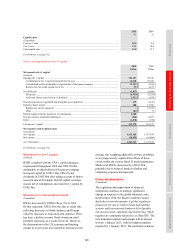

2010 2009

% %

Capital ratios

(Unaudited)

Core tier 1 ratio ......................................................................................................................................... 10.5 9.4

Tier 1 ratio ................................................................................................................................................ 12.1 10.8

Total capital ratio ...................................................................................................................................... 15.2 13.7

For footnotes, see page 182.

Source and application of tier 1 capital

2010

US$m

2009

US$m

Movement in tier 1 capital

(Audited)

Opening tier 1 capital ............................................................................................................................... 122,157 95,336

Contribution to tier 1 capital from profit for the year .......................................................................... 13,218 10,247

Consolidated profits attributable to shareholders of the parent company ........................................... 13,159 5,834

Removal of own credit spread net of tax ............................................................................................. 59 4,413

Net dividends ............................................................................................................................................ (3,827) (3,969)

Dividends .............................................................................................................................................. (6,350) (5,639)

Add back: shares issued in lieu of dividends ....................................................................................... 2,523 1,670

Decrease/(increase) in goodwill and intangible assets deducted ............................................................. 679 (1,819)

Ordinary shares issued .............................................................................................................................. 180 18,399

Rights issue (net of expenses)7 ............................................................................................................. – 18,326

Other ..................................................................................................................................................... 180 73

Hybrid capital securities issued net of redemptions ................................................................................. 2,368 –

Foreign currency translation differences .................................................................................................. (526) 4,837

Other ......................................................................................................................................................... (1,070) (874)

Closing tier 1 capital ................................................................................................................................. 133,179 122,157

Movement in risk-weighted assets

(Unaudited)

At 1 January .............................................................................................................................................. 1,133,168 1,147,974

Movements ............................................................................................................................................... (30,055) (14,806)

At 31 December ........................................................................................................................................ 1,103,113 1,133,168

For footnotes, see page 182.

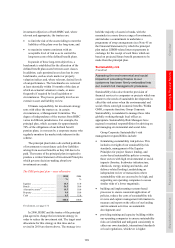

Movement in tier 1 capital

(Audited)

HSBC complied with the FSA’s capital adequacy

requirements throughout 2010 and 2009. Profits

attributable to shareholders of the parent company

increased capital by US$13.2bn, offset by net

dividends of US$3.8bn after taking account of shares

issued in lieu of dividends. Hybrid capital securities

issued, net of redemptions, increased tier 1 capital by

US$2.4bn.

Movement in risk-weighted assets

(Unaudited)

RWAs decreased by US$30.1bn or 3% in 2010.

Of this reduction, US$12.8bn was due to credit risk,

reflecting decreases in North America and Europe

offset by increases in Asia and Latin America. There

has been a decline in some North American retail

portfolio exposures as a result of run off. However,

the deterioration in the US economy and housing

market in recent years has resulted in increases in the

average risk weighting applicable to those portfolios

as we progressively captured the effects of these

events within the various Basel II model parameters.

Market risk RWAs decreased by US$13.2bn,

primarily due to reduced market volatility and

continuing exposure management.

Future developments

(Unaudited)

The regulation and supervision of financial

institutions continues to undergo significant

change in response to the global financial crisis.

In December 2010, the Basel Committee issued

final rules in two documents: A global regulatory

framework for more resilient banks and banking

systems and International framework for liquidity

risk measurement, standards and monitoring, which

together are commonly referred to as ‘Basel III’. The

new minimum capital requirements will be phased

in from 1 January 2013, with full implementation

required by 1 January 2019. The minimum common