HSBC 2010 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

HSBC HOLDINGS PLC

Report of the Directors: Governance (continued)

Employees > Bank payroll tax // Corporate sustainability > Governance / Risk

212

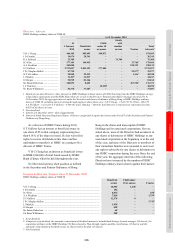

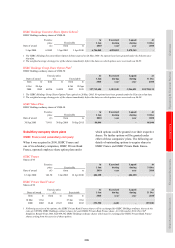

Emoluments of 5 highest paid senior executives

Employee

1 2 3 4 5

£000 £000 £000 £000 £000

Fixed

Cash based ....................................................... 283 623 421 400 467

Total fixed ........................................................ 283 623 421 400 467

Variable1

Cash ................................................................ 493 393 404 406 337

Non-deferred shares2........................................ 493 393 404 406 337

Deferred cash ................................................... 740 590 605 608 505

Deferred shares ................................................ 740 590 605 608 505

Total variable pay ............................................ 2,467 1,967 2,018 2,028 1,683

Total remuneration .......................................... 2,750 2,590 2,439 2,428 2,150

US$000 US$000 US$000 US$000 US$000

Total remuneration .......................................... 4,247 4,000 3,767 3,750 3,320

1 Variable pay in respect of performance year 2010.

2 Vested shares, subject to a 6-month retention period.

The aggregate remuneration of Directors

and Senior Management (being members of the

GMB) for the year ended 31 December 2010 was

US$67,760,722.

The aggregate amount set aside or accrued to

provide pension, retirement or similar benefits for

Directors and Senior Management for the year ended

31 December 2010 was US$3,348,298.

Executive Directors and members of Senior

Management are generally subject to notice periods

of up to 12 months and a normal retirement age

of 65.

Bank payroll tax

In December 2009, the governments of the UK and

France introduced one-off taxes in respect of certain

bonuses payable by banks and banking groups. In

both countries the tax was levied at 50% on bonuses

awarded during a certain period and over a threshold

amount. The taxes are liabilities of the employer and

are payable on awards of both cash and shares. The

amount payable and paid in respect of the relevant

tax was US$282m in the UK and US$42m in France.

Corporate sustainability

At HSBC, we recognise that environmental, social

and economic issues can affect the Group’s long-

term success as a business. For us, corporate

sustainability means achieving sustainable profit

growth so that we can continue to reward

shareholders and employees, build long-lasting

relationships with customers and suppliers, pay taxes

and duties in those countries where we operate, and

invest in communities for future growth.

Our continuing financial success depends, in

part, on our ability to identify and address certain

factors which present risks or opportunities for the

business. These can affect our reputation, drive

employee engagement, help manage the risks of

lending, leverage savings through eco-efficiency and

secure new revenue streams. They generally fall into

one or more of the four broad areas discussed below.

Business finance

We aim to build long-term customer relationships

around the world through the provision of a

consistent and high-quality service and customer

experience. We use the benefits of our scale,

financial strength, geographical reach and strong

brand value to achieve this.

We aim to take advantage of the opportunities

and manage the risks presented by emerging global

trends by leading the development of sustainable

business models to address them. We understand that

the world is changing, with significant examples

being increased longevity, a widening gap in the

relative growth rates of emerging and mature

economies and the need to move to a lower-carbon

economy in order to mitigate some of the effects of

climate change. Over the long term, we anticipate

playing a leading role in shaping the market response

to these challenges and we are among those financial

institutions identifying how business can adapt in

ways that bring both social and environmental

benefits, while providing viable economic returns.