HSBC 2010 Annual Report Download - page 330

Download and view the complete annual report

Please find page 330 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

21 – Financial investments / 22 – Transfers of financial assets not qualifying for derecognition

328

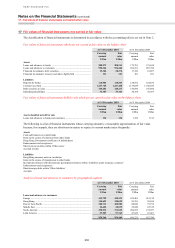

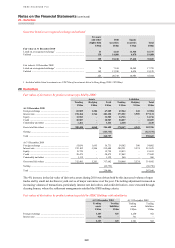

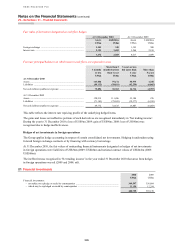

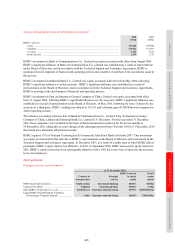

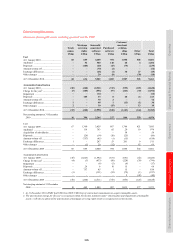

Financial investments listed on a recognised exchange and unlisted

Treasury

and other

eligible bills

available

for sale

Treasury

and other

eligible bills

held to

maturity

Debt

securities

available

for sale

Debt

securities

held to

maturity

Equity

securities

available

for sale

Total

US$m US$m US$m US$m US$m US$m

Carrying amount at 31 December 2010

Listed on a recognised exchange1 ...................... 1,400 – 138,374 4,182 851 144,807

Unlisted2 ............................................................. 55,616 113 177,883 15,204 7,132 255,948

57,016 113 316,257 19,386 7,983 400,755

Carrying amount at 31 December 2009

Listed on a recognised exchange1 ...................... 2,334 – 135,653 2,743 911 141,641

Unlisted2 ............................................................. 55,999 101 148,421 14,783 8,213 227,517

58,333 101 284,074 17,526 9,124 369,158

1 The fair value of listed held-to-maturity debt securities as at 31 December 2010 was US$4,332m (2009: US$2,769m). Included within

listed investments were US$1,902m (2009: US$1,670m) of investments listed in Hong Kong.

2 Unlisted treasury and other eligible bills available for sale primarily comprise treasury bills not listed on a recognised exchange but for

which there is a liquid market.

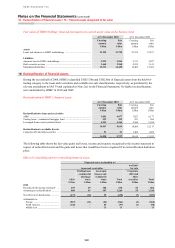

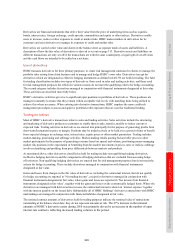

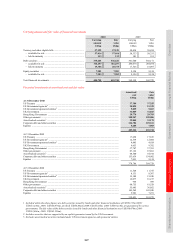

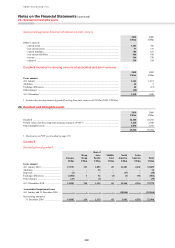

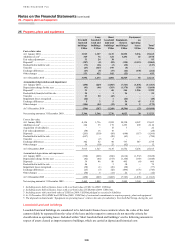

Maturities of investments in debt securities at their carrying amount

At 31 December

2010 2009

US$m US$m

Remaining contractual maturity of total debt securities:

1 year or less ......................................................................................................................................... 92,961 75,782

5 years or less but over 1 year .............................................................................................................. 124,596 141,683

10 years or less but over 5 years .......................................................................................................... 56,926 31,934

Over 10 years ........................................................................................................................................ 61,160 52,201

335,643 301,600

Remaining contractual maturity of debt securities available for sale:

1 year or less ......................................................................................................................................... 91,939 75,160

5 years or less but over 1 year .............................................................................................................. 117,931 135,187

10 years or less but over 5 years .......................................................................................................... 50,113 26,105

Over 10 years ........................................................................................................................................ 56,274 47,622

316,257 284,074

Remaining contractual maturity of debt securities held to maturity:

1 year or less ......................................................................................................................................... 1,022 622

5 years or less but over 1 year .............................................................................................................. 6,665 6,496

10 years or less but over 5 years .......................................................................................................... 6,813 5,829

Over 10 years ........................................................................................................................................ 4,886 4,579

19,386 17,526

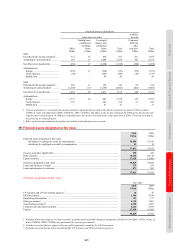

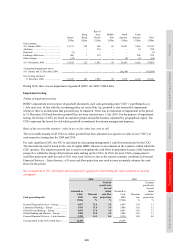

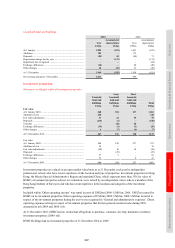

Contractual maturities and weighted average yields of investment debt securities at 31 December 2010

Within one year

After one year but

within five years

After five years but

within ten years After ten years

Amount Yield Amount Yield Amount Yield Amount Yield

US$m % US$m % US$m % US$m %

Available-for-sale

US Treasury ............................................. 8,761 0.95 13,513 1.19 9,225 2.61 4,648 4.32

US Government agencies ........................ – – 7 2.95 230 4.78 20,236 3.71

US Government-sponsored agencies ....... 859 0.70 114 1.75 1,993 3.81 445 3.60

UK Government ....................................... 3,994 2.90 11,407 2.22 13,987 2.97 1,248 2.80

Hong Kong Government ......................... 362 0.55 407 2.95 – – – –

Other governments .................................. 28,779 2.25 44,920 4.00 6,945 4.65 2,073 4.58

Asset-backed securities ........................... 392 0.77 2,311 1.73 7,773 0.66 29,178 0.64

Corporate debt and other securities ......... 49,014 2.26 44,009 2.54 10,342 3.44 4,065 4.72

Total amortised cost ................................. 92,161 116,688 50,495 61,893

Total carrying value ................................. 91,939 117,931 50,113 56,274