HSBC 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

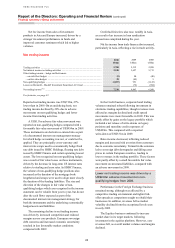

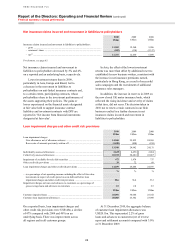

The fall in income from interest-earning assets

was driven by declining yields on loans and

advances to customers following the Group’s

decision to reposition the lending portfolio towards

higher quality assets. Higher yielding unsecured

lending balances decreased, particularly in North

America, where the run-off portfolios continued to

diminish and credit card balances fell as the number

of active accounts declined and repayments by

customers increased. Certain higher risk portfolios

were also managed down in Latin America, Asia and

the Middle East. This reduction was partly offset by

commercial lending growth in CMB and GB&M,

and growth in secured lending in the UK in

residential mortgages.

The interest expense on debt issued by the

Group fell, largely due to a decline in average

balances in debt securities in issue as HSBC

Finance’s funding requirements continued to

decrease in line with the run-off of the residual

balances in Mortgage Services and Consumer

Lending and the sale of the vehicle finance

portfolios.

Net interest income includes the expense of the

internal funding of trading assets, while related

revenue is reported in trading income. The cost of

funding these assets declined as a result of the low

interest rates. In reporting our customer group

results, this cost is included within net trading

income.

Net interest spread decreased due to lower

yields on loans and advances to customers, partly as

a result of the greater focus on secured lending. In

addition, returns on financial investments and

deposit spreads remained constrained due to low

interest rates. Our net interest margin fell by a lesser

amount due to the benefit from an increase in net

free funds as customers held more funds in liquid

non-interest bearing current accounts in the current

low interest rate environment.

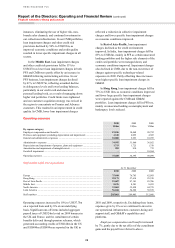

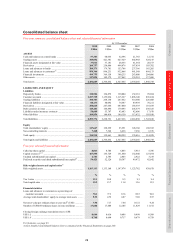

Net fee income

2010

US$m

2009

US$m

2008

US$m

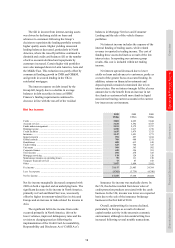

Cards ........................................................................................................................... 3,801 4,625 5,844

Account services ......................................................................................................... 3,632 3,592 4,353

Funds under management ........................................................................................... 2,511 2,172 2,757

Broking income .......................................................................................................... 1,789 1,617 1,738

Credit facilities ........................................................................................................... 1,635 1,479 1,313

Insurance ..................................................................................................................... 1,147 1,421 1,771

Imports/exports ........................................................................................................... 991 897 1,014

Global custody ............................................................................................................ 700 988 1,311

Remittances ................................................................................................................ 680 613 610

Underwriting ............................................................................................................... 623 746 325

Unit trusts ................................................................................................................... 560 363 502

Corporate finance ....................................................................................................... 440 396 381

Trust income ............................................................................................................... 291 278 325

Mortgage servicing ..................................................................................................... 118 124 120

Maintenance income on operating leases ................................................................... 99 111 130

Taxpayer financial services ........................................................................................ 73 87 168

Other ........................................................................................................................... 2,027 1,894 2,102

Fee income .................................................................................................................. 21,117 21,403 24,764

Less: fee expense ........................................................................................................ (3,762) (3,739) (4,740)

Net fee income ............................................................................................................ 17,355 17,664 20,024

Net fee income marginally decreased compared with

2009 on both a reported and an underlying basis. The

significant decrease in fee income in North America,

primarily in Card and Retail Services, was mostly

offset by higher investment-related fees in Asia and

Europe and an increase in trade-related fee income in

Asia.

The significant fall in fee income from cards

occurred primarily in North America, driven by

lower volumes, improved delinquency rates and the

revision to charging practices following the

implementation of the Credit Card Accountability,

Responsibility and Disclosure Act (‘CARD Act’).

Insurance fee income was markedly down. In

the US, the decline resulted from lower sales of

credit protection products associated with the cards

business. In the UK, income was lower on a reported

basis due to the sale of the insurance brokerage

business in the first half of 2010.

Overall, underwriting fee income declined,

particularly in Europe as a result of reduced

capital market activity in the uncertain economic

environment, although in Asia underwriting fees

increased following several notable transactions.