HSBC 2010 Annual Report Download - page 368

Download and view the complete annual report

Please find page 368 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

44 – Legal proceedings, investigations and regulatory matters

366

Plaintiffs (including funds, fund investors, and the Madoff Securities trustee) have commenced Madoff-related

proceedings against numerous defendants in a multitude of jurisdictions. Various HSBC companies have been named

as defendants in suits in the US, Ireland, Luxembourg, and other jurisdictions. The suits (which include US class

actions) allege that the HSBC defendants knew or should have known of Madoff’s fraud and breached various duties

to the funds and fund investors. In December 2010, the Madoff Securities trustee commenced suits against various

HSBC companies in the US bankruptcy court and in the English High Court. The US action (which also names

certain funds, investment managers, and other entities and individuals) seeks US$9bn in damages and additional

recoveries from HSBC and the various co-defendants. It seeks damages against HSBC for allegedly aiding and

abetting Madoff’s fraud and breach of fiduciary duty. It also seeks, pursuant to US bankruptcy law, recovery of

unspecified amounts received by HSBC from funds invested with Madoff, including amounts that HSBC received

when it redeemed units HSBC held in the various funds. HSBC acquired those fund units in connection with

financing transactions HSBC had entered into with various clients. The trustee’s US bankruptcy law claims also seek

recovery of fees earned by HSBC for providing custodial, administration and similar services to the funds. The

trustee’s English action seeks recovery of unspecified transfers of money from Madoff Securities to or through

HSBC, on the ground that the HSBC defendants actually or constructively knew of Madoff’s fraud.

Between October 2009 and July 2010, Fairfield Sentry Limited and Fairfield Sigma Limited (‘Fairfield’), funds

whose assets were directly or indirectly invested with Madoff Securities, commenced multiple suits in the British

Virgin Islands and the US against numerous fund shareholders, including various HSBC companies that acted as

nominees for clients of HSBC’s private banking business and other clients who invested in the Fairfield funds. The

Fairfield actions seek restitution of amounts paid to the defendants in connection with share redemptions, on the

ground that such payments were made by mistake, based on inflated values resulting from Madoff’s fraud.

There are many factors which may affect the range of possible outcomes, and the resulting financial impact, of the

various Madoff-related proceedings, including but not limited to the circumstances of the fraud, the multiple

jurisdictions in which the proceedings have been brought and the number of different plaintiffs and defendants in

such proceedings. The cases where HSBC companies are named as a defendant are at an early stage. For these

reasons, among others, it is not practicable at this time for HSBC to estimate reliably the aggregate liabilities, or

ranges of liabilities, that might arise as a result of all such claims but they could be significant. In any event, HSBC

considers that it has good defences to these claims and will continue to defend them vigorously.

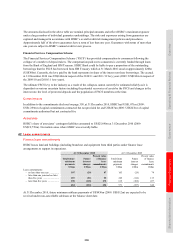

Payment Protection Insurance

Following an extensive period of consultation, on 10 August 2010 the Financial Services Authority (‘FSA’)

published Policy Statement 10/12 (‘PS 10/12’) on the assessment and redress of Payment Protection Insurance

(‘PPI’) complaints. This included (i) new handbook guidance setting out how complaints are to be handled, and

‘redressed fairly’ where appropriate; (ii) an explanation of when and why firms should analyse their past complaints

to identify if there are serious flaws in sales practices that may have affected complainants and non-complainants; and

(iii) an Open Letter setting out common sales failings to help firms identify bad practices.

After extensive consideration, the British Bankers Association (‘BBA’), as the representative body of UK banks, sent

a formal pre-action protocol letter to the FSA and the Financial Ombudsman Service (‘FOS’) setting out its concerns

and what it considered to be the flaws identified in PS 10/12 and Guidance issued by FOS on the handling of PPI

complaints. The letter indicated that, absent a satisfactory reply, it was the BBA’s intention to apply to the High

Court for a Judicial Review of both PS 10/12 and the FOS Guidance. The FSA and FOS responded on 28 September

2010 denying that they had acted unlawfully in introducing the Policy Statement or relying on the Guidance.

On 8 October 2010, an application for Judicial Review was issued by the BBA seeking an order to quash PS 10/12

and the FOS Guidance. The FSA subsequently issued a statement on 24 November 2010 seeking to clarify aspects of

PS 10/12 and the Open Letter. The FSA and FOS filed defences to the Judicial Review application on 10 December

2010. The Judicial Review application was heard by the Court on 25 – 28 January 2011, and judgement is currently

awaited.

HSBC believes that the BBA has a strongly arguable case against both the FSA and the FOS. If the Court ultimately

concludes, however, after any appeals of the judgement that may follow from any of the parties, that PS 10/12 and

the FOS Guidance stand, in whole or in part, then these would need to be taken into consideration when determining

complaints alleging the mis-sale of PPI.

If, contrary to HSBC’s current assessment, a decision is reached in the case that results in a potential liability for

HSBC, a large number of different outcomes is possible, each of which would have a different financial impact.