HSBC 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Capital > Future developments // Governance > Corporate Governance Report / Directors

182

equity tier 1 requirement of 4.5% and additional

capital conservation buffer requirement of 2.5% will

be phased in sequentially from 1 January 2013,

becoming fully effective on 1 January 2019. Any

additional countercyclical capital buffer requirements

will also be phased in, starting in 2016, in parallel

with the capital conservation buffer to a maximum

level of 2.5% effective on 1 January 2019, although

individual jurisdictions may choose to implement

larger countercyclical capital buffers. The leverage

ratio will be subject to a supervisory monitoring

period, which commenced on 1 January 2011, and a

parallel run period which will run from 1 January

2013 until 1 January 2017. Further calibration of the

leverage ratio will be carried out in the first half of

2017, with a view to migrating to a pillar 1

requirement from 1 January 2018. The Basel

Committee has increased the capital requirements

for the trading book and complex securitisation

exposures which are due to be implemented on

31 December 2011. They will continue to conduct

the fundamental review of the trading book, which

is targeted for completion by the end of 2011. In

addition to the reforms discussed above, institutions

designated as G-SIFIs may be subjected to additional

requirements, which have yet to be proposed by

regulators. The Basel Committee will provide the

approach to defining G-SIFIs by the end of 2011.

On 13 January 2011, the Basel Committee issued

further minimum requirements to ensure that all

classes of capital instruments fully absorb losses

at the point of non-viability before taxpayers are

exposed to loss. Instruments issued on or after

1 January 2013 may only be included in regulatory

capital if the new requirements are met. The capital

treatment of securities issued prior to this date will

be phased out over a 10-year period commencing

1 January 2013.

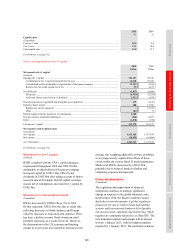

Impact of Basel III

(Unaudited)

In order to provide some insight into the possible

effects of the new Basel III rules on HSBC, we have

estimated the pro forma common equity tier 1 ratio

of the Group on the basis of our interpretation of

those rules, as they would apply at 1 January 2019,

but based on the position at 31 December 2010.

We have estimated that the application of the full

Basel III rules on a pro forma basis would result in a

common equity tier 1 ratio which is lower than the

Basel II core tier 1 ratio by some 250–300 basis

points. However, as the new rules will be phased in

between 1 January 2013 and 1 January 2019, their

impact will be gradual over that period. This

estimate does not, however, take account of any

future retained earnings, nor any management

actions to reduce RWAs. The Basel III changes

relate to increased capital deductions, new regulatory

adjustments and increases in RWAs. The majority of

the increase in RWAs relates to Basel III changes

which are scheduled to come into effect on 1 January

2013, in particular to changes to counterparty credit

risk capital charges and amounts for securitisation

positions that were previously deducted from capital

that will now be risk-weighted instead. Other

increases in RWAs will begin to be phased in from

1 January 2014, including the majority of the

unconsolidated investments that were previously

deducted from capital. The remainder of the RWA

increase arises from increases in trading book capital

requirements which take effect on 31 December

2011, primarily relating to changes in market risk.

The estimated impact of Basel III is subject to

change as regulators develop their requirements

around the practical application and interpretation of

the new rules, in particular the counterparty credit

risk capital charge. Further uncertainty remains

regarding any capital requirements which may be

imposed on the Group over the period to 1 January

2019 in respect of the countercyclical capital buffer

and any additional regulatory requirements for

G-SIFIs. Under the Basel III rules as they will apply

from 1 January 2019, we believe that ultimately the

level for the common equity tier 1 ratio of the Group

may lie in the range 9.5% to 10.5%. This exceeds the

minimum requirement for common equity tier 1

capital plus the capital conservation buffer. HSBC

has a strong track record of capital generation and

actively manages its RWAs. Before these new

rules come into force, we will take appropriate

management action over the implementation period

to 1 January 2019 to reduce the quantum of increase

in RWAs that would have occurred if the new rules

had been in effect at 31 December 2010.

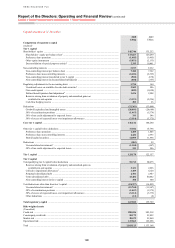

Footnotes to Capital

1 Includes externally verified profits for the year to 31 December 2010.

2 Mainly comprises unrealised losses on available-for-sale debt securities within special purpose entities which are excluded from the

regulatory consolidation.

3 Under FSA rules, unrealised gains/losses on debt securities net of tax must be excluded from capital resources.

4 Under FSA rules, the defined benefit liability may be substituted with the additional funding that will be paid into the relevant schemes

over the following five year period.

5 Mainly comprise investments in insurance entities.

6 Under FSA rules, collective impairment allowances on loan portfolios on the standardised approach are included in tier 2 capital.

7 Rights issue excludes US$493m of losses arising on derivative contracts and certain fees, which are recognised in the income statement.