HSBC 2010 Annual Report Download - page 296

Download and view the complete annual report

Please find page 296 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

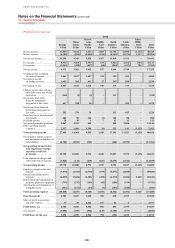

HSBC HOLDINGS PLC

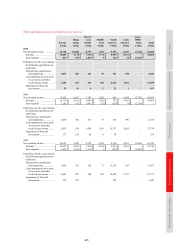

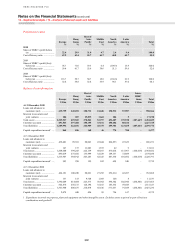

Notes on the Financial Statements (continued)

10 – Tax expense / 11 – Dividends

294

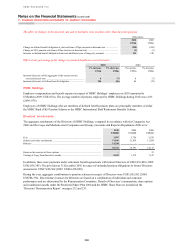

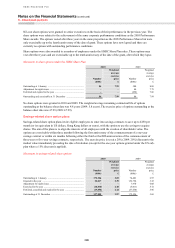

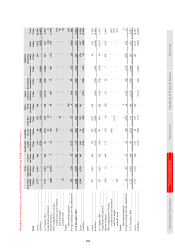

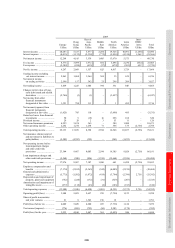

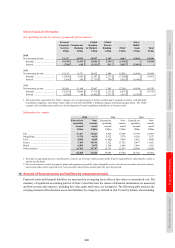

Presentation of deferred tax balances

Deferred tax balances are presented in the consolidated balance sheet after offsetting asset and liability balances

where HSBC has the legal right to set off and intends to settle on a net basis, as follows:

2010 2009

US$m US$m

Deferred tax assets .................................................................................................................................... 7,011 8,620

Deferred tax liabilities .............................................................................................................................. (1,093) (1,837)

5,918 6,783

Analysis of deferred tax assets by country

2010 2009

US$m US$m

US ............................................................................................................................................................. 4,043 5,110

Brazil ......................................................................................................................................................... 883 1,289

Mexico ...................................................................................................................................................... 665 620

UK ............................................................................................................................................................. 383 395

Other ......................................................................................................................................................... 1,037 1,206

7,011 8,620

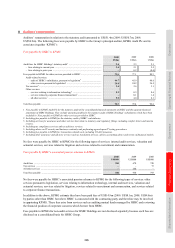

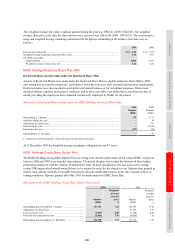

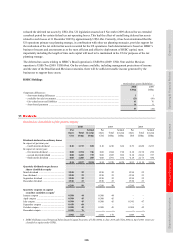

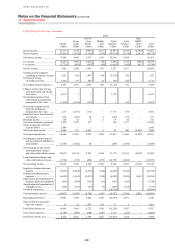

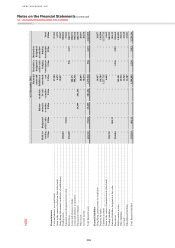

The amount of temporary differences, unused tax losses and unused tax credits excluding the US, for which no

deferred tax asset is recognised in the balance sheet is US$2,473m (2009: US$1,723m). Of this amount, US$2,366m

(2009: US$1,608m) has no expiry date, US$107m (2009: US$115m) is scheduled to expire within 10 years (2009: 10

years) and the remaining will expire after 10 years. The deferred tax asset unrecognised in respect of these items is

US$601m (2009: US$491m), of which US$564m (2009: US$450m) has no expiry date, US$37m (2009: US$40m) is

scheduled to expire within 10 years (2009: 10 years) and the remaining will expire after 10 years.

In the US, the deferred tax asset unrecognised in respect of temporary differences, unused tax losses and unused tax

credits was US$1,715m (2009: US$1,577m), of which US$70m (2009: US$52m) has no expiry date, US$908m

(2009: US$932m) is scheduled to expire within 10 years (2009: 10 years) and the remaining will expire within

20 years.

The US deferred tax assets not recognised of US$1,715m (2009: US$1,577m) comprise unused state losses of

US$694m (2009: US$854m), unused federal losses of US$43m (2009: nil), unused tax credits of US$908m (2009:

US$716m) and other differences of US$70m (2009: US$7m). The gross temporary difference in respect of the

unused state losses is US$12,486m (2009: US$15,517m), the unused federal losses are US$122m (2009: nil), the

other differences are US$200m (2009: US$20m), while no gross equivalent is applied to the unused tax credits.

Deferred tax of US$89m (2009: US$94m) has been provided in respect of distributable reserves of associates that, on

distribution, would attract withholding tax.

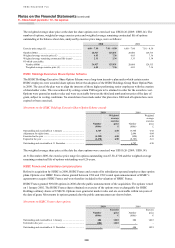

Deferred tax is not recognised in respect of the Group’s investments in subsidiaries and branches where remittance

is not contemplated, and for those associates and interests in joint ventures where it has been determined that no

additional tax will arise. The aggregate amount of temporary differences associated with investments where no

deferred tax liability is recognised is nil (2009: nil; 2008: US$38,443m). Following the change in the UK tax

treatment of dividends on 1 July 2009, no UK tax is expected to arise on distributions from group entities and no

temporary difference exists except where withholding tax or other foreign tax could arise on the investments. No

amount is disclosed for the unrecognised deferred tax or the 2010 and 2009 temporary differences associated with

such investments, as it is impracticable to determine the amount of income taxes that would be payable when any

temporary differences reverse.

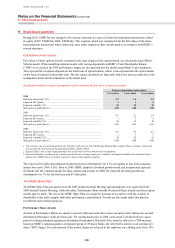

Of the total net deferred tax assets of US$7.0bn at 31 December 2010 (2009: US$8.6bn), US$4.0bn (2009:

US$5.1bn) arose in respect of HSBC’s US operations where there has been a recent history of losses. Management’s

analysis of the recognition of these deferred tax assets significantly discounts any future expected profits from the US

operations and relies to a greater extent on capital support to the US operations from HSBC Holdings plc, including

tax planning strategies implemented in relation to such support. Further to the implementation of this strategy, the

transfer of HSBC Bank Canada, which was part of the sub-group headed by HSBC North America Holdings Inc., to

HSBC Overseas Holdings (UK) Limited in an internal reorganisation on 31 January 2010, provided substantial

support for the recoverability of the US deferred tax assets. The associated taxable gain arising in the US operations