HSBC 2010 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Directors’ Remuneration Report

Report of the Remuneration Committee > 2010 performance / Regulation / Senior management changes / 2011

220

Report of the Remuneration

Committee

Page

Report of the Remuneration Committee ...................... 220

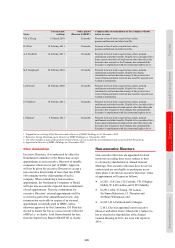

Remuneration Committee – members and advisers ..... 222

Overall principles ......................................................... 222

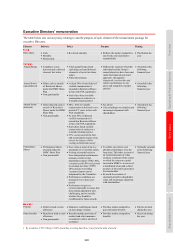

Executive Directors’ remuneration .............................. 223

Executive Directors’ 2010 emoluments and

remuneration ........................................................ 224

Salary ........................................................................ 225

Annual bonus ............................................................ 225

Performance Shares ................................................. 226

Funding .................................................................... 228

Total shareholder return .......................................... 228

Pensions .................................................................... 228

Share ownership guidelines ..................................... 228

Service contracts ...................................................... 228

Other directorships .................................................. 229

Non-executive Directors ............................................... 229

Fees ........................................................................... 230

Pensions ........................................................................ 231

Share Plans ................................................................... 232

The principal purpose of HSBC’s remuneration

strategy is to support and drive sustainable

performance over the long-term. Remuneration

should reward success towards this end, but it must

also not reward failure and it must be properly

aligned with risk which remains on the balance

sheet.

HSBC strives to achieve this through a variety

of ways which are detailed under ‘Overall principles’

on page 222. These include taking a rounded view

of financial and non-financial performance in

determining reward levels, considering affordability

(including cost and quantity of capital and liquidity

considerations), market competitiveness, delivering

awards with high levels of deferral and making all

such deferred awards subject to clawback. Such

clawback is applied at the sole discretion of the

Remuneration Committee (‘the Committee’).

In our view these elements help to reinforce and

reward the delivery of sustainable performance.

2010 performance

Key achievements

The annual financial objectives that we set for

ourselves for 2010 were achieved, although in some

areas they were lower than the established long-term

targets. In the Group’s 2010 performance, particular

note was made of the following:

• good growth in profit before tax on both an

underlying and a reported basis compared with

2009 and ahead of expectations at the start of

2010. This was primarily driven by lower loan

impairment charges and other credit risk

provisions with all regions and customer groups

contributing;

• strong growth was achieved in emerging

markets with loans and advances to customers

and revenue increasing in key markets;

• our capital ratios were above the target range, in

part from the contribution of profit to capital but

also from our ability to raise capital, as shown

in the successful hybrid capital securities issue

in the first half of the year;

• we maintained a highly liquid balance sheet,

with a ratio of customer advances to customer

accounts of 78.1%;

• we increased dividends for our shareholders,

reflecting the profit-generating capability of the

Group;

• return on average shareholders’ equity of 9.5%

was below our target range; and

• revenue declined and costs grew, resulting in

an increase in the cost efficiency ratio from

52.0% to 55.2%. The Group is working on

bringing the ratio back to target levels while

meeting the need to invest for future growth.

Key non-financial achievements of the Group

in 2010, which reflect the objectives set for senior

management, are summarised below:

• process objectives focused on efficiency and

qualitative measures which affect financial

performance and mitigate risk. The target we set

for operational losses as a percentage of revenue

was met;

• progress in meeting customer recommendation

and brand recognition targets was made in a

challenging environment for retail and

commercial banking. Brand health targets for

PFS and Business Banking were met. Customer

recommendation targets were met for the latter

but not for PFS; and

• regarding the Group’s employees, our 2010

employee engagement score was below target

and was less than our 2009 score. However, the

2010 score exceeded the global average and

the global financial sector norm for employee

engagement in the year. The target for the ratio

of revenue to staff costs was also met.

In determining remuneration levels for 2010, the

Committee, applying HSBC’s remuneration strategy

and policy, remained mindful of the interests of the

many stakeholders and the broader external context.

This included taking into account the pay and