HSBC 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

105

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

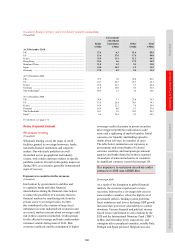

European banks

In May 2010, an FSB review indicated that European

banks would have to make additional loan impairment

charges of up to US$143bn in 2011. Following the

publication of this report, bond spreads on both

European and US banks widened. The size of the

financial sector’s exposure to sovereign debt and

doubts about economic conditions in parts of the

eurozone raised fresh concerns about banks’ credit

ratings. In addition, uncertainty over liquidity,

solvency, funding, changing regulation, capital

requirements and taxation, and speculation over the

stability of the euro, continued to cloud the future for

European banking.

The banking sector in the eurozone remains

under stress, mainly as a consequence of

governments having to finance large budget deficits,

troubles in property markets and weak credit growth.

The Ireland bailout was a direct consequence of the

failure of the Irish banking sector, largely driven by

the domestic property price crash. Worries about the

size and quality of eurozone banks’ exposure to

weaker eurozone countries are entwined with

concerns about their ability to fund themselves.

European banks share nearly three quarters of the

public and private sector debt in Belgium, Greece,

Ireland, Italy, Portugal and Spain. The regional and

local banks in the eurozone are considered more

vulnerable than well-diversified global banks.

During 2010, we were subject to the Committee

of European Banking Supervisors (now the European

Banking Authority) coordinated stress test of 91 EU

financial institutions. Banks were required to meet a

6% minimum tier 1 target under stress. We passed the

test satisfactorily, with a post-stress tier 1 ratio of

10.2% placing us in the top quartile of the institutions

tested. Further stress testing is due to take place in

2011.

We expect that the pace of reforms outlined

by various policymakers will gather speed in 2011,

most notably the Basel III proposals. These regulations

will require banks to hold more capital and a higher

quality of capital and implement new liquidity rules,

and are likely to result in a rise in the cost of funding

and put pressure on credit pricing.

We continue to closely monitor and manage

eurozone bank exposures, and are cautious in lending

to this sector. We regularly update our assessment of

higher-risk eurozone banks and adjust our risk appetite

accordingly. We also, where possible, seek to play a

positive role in maintaining credit and liquidity supply.

Middle East and North Africa

In 2009, Dubai World requested a standstill agreement

with creditors in respect of the indebtedness of certain

Dubai World group companies. The market disruption

that ensued cut would-be borrowers off from the

capital markets, although continued restructuring

efforts throughout 2010 saw the return of significant

positive sentiment from investors. As one of the long-

term bankers to Dubai World and the various entities

related to the Government of Dubai, the Group has

worked closely during 2010 to address the prevailing

issues. In October 2010, Dubai World obtained an

agreement to restructure US$25bn of its debt subject

to final documentation expected to be signed in the

first half of 2011. The arrangement extends loan

maturities for five to eight years at discounted rates,

allowing Dubai World time to sell off its non-core

assets while focusing on its core earnings. The

Group’s exposure to Dubai is primarily spread across

operating companies within the emirate.

Political developments in the region are being

monitored closely and action taken to mitigate their

impact. It is too early to foresee how events may

unfold; hitherto, our business in the region has for

the most part operated without serious disruption. In

the medium term, economic growth in the region

may be adversely affected, with wider implications

if the prices of oil, food and commodities rise

significantly.

Commercial real estate

Our exposure in the commercial real estate sectors is

concentrated in the UK, North America and Hong

Kong. While there were some positive signs of

recovery in markets in the UK and the US, in part

supported by the low levels of interest rates, the

slow speed of the recovery meant that financing and

re-financing activity in the sector remained subdued.

In Hong Kong, the economy recovered robustly

and the market was relatively buoyant in 2010,

characterised by strong demand and continuing

credit appetite.

On a constant currency basis, the aggregate of

our commercial real estate and other property-related

lending of US$107bn at 31 December 2010 was 7%

higher than at 31 December 2009 and represented

11% of total loans and advances to customers. The

increase in exposure was largely in Hong Kong,

offset by a reduction in North America. In 2010,

credit quality across this sector generally showed

signs of stabilising but remained under stress in

certain markets.