HSBC 2010 Annual Report Download - page 280

Download and view the complete annual report

Please find page 280 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

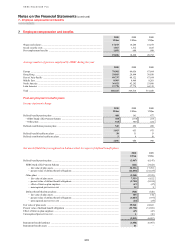

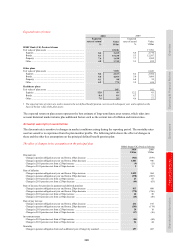

7 – Employee compensation and benefits

278

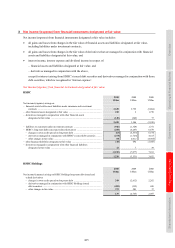

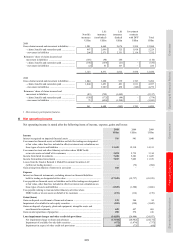

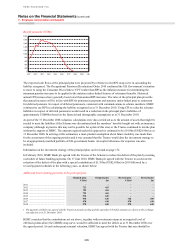

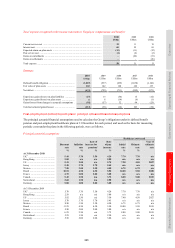

HSBC healthcare benefits plans

HSBC also provides post-employment healthcare benefits under plans in the UK, the US, Bermuda, Canada, Mexico

and Brazil, the majority of which are unfunded. The majority of post-employment healthcare benefits plans are

defined benefit plans and are accounted for in the same manner as defined benefit pension plans. The plans are

reviewed at least annually or in accordance with local practice and regulations by qualified actuaries. The actuarial

assumptions used to calculate the defined benefit obligation and related current service cost vary according to the

economic conditions of the countries in which they are situated.

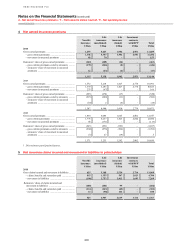

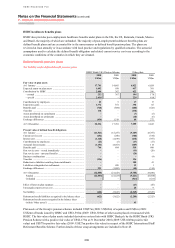

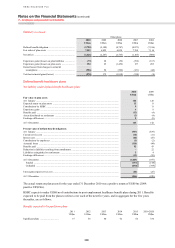

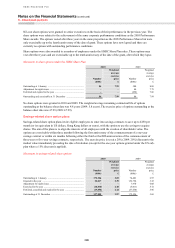

Defined benefit pension plans

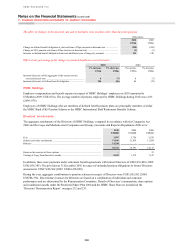

Net liability under defined benefit pension plans

HSBC Bank (UK) Pension Scheme Other plans

2010 2009 2010 2009

US$m US$m US$m US$m

Fair value of plan assets

At 1 January .................................................................................. 17,701 14,865 6,822 6,024

Expected return on plan assets ..................................................... 1,092 959 437 381

Contributions by HSBC ................................................................ 2,890 367 422 596

– normal .................................................................................... 252 367 194 178

– special .................................................................................... 2,638 –228 418

Contributions by employees ......................................................... 23 5 17 17

Experience gains ........................................................................... 1,772 871 394 65

Benefits paid ................................................................................. (744) (884) (440) (522)

Transfers ....................................................................................... 136 – (136) –

Assets distributed on curtailments ................................................ – – (7) (5)

Assets distributed on settlements ................................................. – – (10) (6)

Exchange differences .................................................................... (634) 1,518 60 272

At 31 December ............................................................................ 22,236 17,701 7,559 6,822

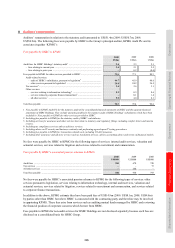

Present value of defined benefit obligations

At 1 January .................................................................................. (21,523) (15,257) (9,109) (8,787)

Current service cost ...................................................................... (252) (260) (300) (334)

Interest cost ................................................................................... (1,148) (1,019) (438) (397)

Contributions by employees ......................................................... (23) (5) (17) (17)

Actuarial (losses)/gains ................................................................ (1,451) (4,563) (669) 114

Benefits paid ................................................................................. 744 884 518 608

Past service cost – vested immediately ........................................ – – (11) (20)

Past service cost – unvested benefits ............................................ – – (20) –

Business combinations ................................................................. – – – (4)

Transfers ....................................................................................... (136) – 136 –

Reduction in liabilities resulting from curtailments ..................... – – 158 41

Liabilities extinguished on settlements ........................................ – 499 12 1

Exchange differences .................................................................... 931 (1,802) (45) (314)

At 31 December ............................................................................ (22,858) (21,523) (9,785) (9,109)

Funded ...................................................................................... (22,858) (21,523) (9,241) (8,588)

Unfunded .................................................................................. ––(544) (521)

Effect of limit on plan surpluses ................................................... – – (47) (47)

Unrecognised past service cost ..................................................... – – 28 9

Net liability ................................................................................... (622) (3,822) (2,245) (2,325)

Retirement benefit liabilities recognised in the balance sheet ..... (622) (3,822) (2,288) (2,325)

Retirement benefit assets recognised in the balance sheet

(within ‘Other assets’) .............................................................. – – 43 –

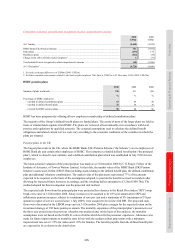

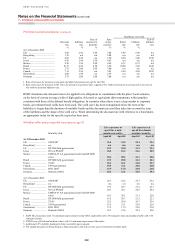

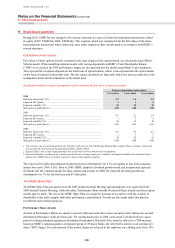

Plan assets of the Group’s pension schemes included US$57m (2009: US$62m) of equities and US$1m (2009:

US$2m) of bonds issued by HSBC and US$1,592m (2009: US$1,925m) of other assets placed or transacted with

HSBC. The fair value of plan assets included derivatives entered into with HSBC Bank plc by the HSBC Bank (UK)

Pension Scheme with a positive fair value of US$2,173m at 31 December 2010 (2009: US$1,049m positive fair

value) and US$77m positive fair value (2009: US$27m positive fair value) in respect of the HSBC International Staff

Retirement Benefits Scheme. Further details of these swap arrangements are included in Note 45.