HSBC 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

141

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

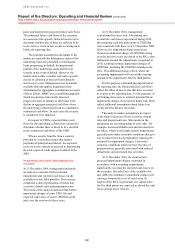

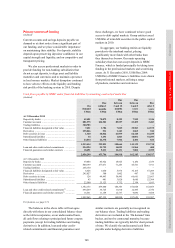

Primary sources of funding

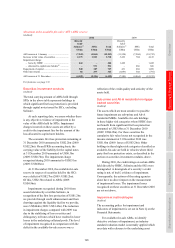

(Audited)

Current accounts and savings deposits payable on

demand or at short notice form a significant part of

our funding, and we place considerable importance

on maintaining their stability. For deposits, stability

depends upon preserving depositor confidence in our

capital strength and liquidity, and on competitive and

transparent pricing.

We also access professional markets in order to

provide funding for non-banking subsidiaries that

do not accept deposits, to align asset and liability

maturities and currencies and to maintain a presence

in local money markets. Market disruption continued

to have adverse effects on the liquidity and funding

risk profile of the banking system in 2010. Despite

these challenges, we have continued to have good

access to debt capital markets. Group entities issued

US$26bn of term debt securities in the public capital

markets in 2010.

In aggregate, our banking entities are liquidity

providers to the interbank market, placing

significantly more funds with other banks than

they themselves borrow. Our main operating

subsidiary that does not accept deposits is HSBC

Finance, which is funded principally by taking term

funding in the professional markets and securitising

assets. At 31 December 2010, US$65bn (2009:

US$82bn) of HSBC Finance’s liabilities were drawn

from professional markets, utilising a range

of products, maturities and currencies.

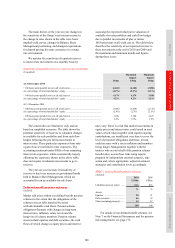

Cash flows payable by HSBC under financial liabilities by remaining contractual maturities

(Audited)

On

demand

US$m

Due

within 3

months

US$m

Due

between

3 and 12

months

US$m

Due

between

1 and 5

years

US$m

Due

after 5

years

US$m

At 31 December 2010

Deposits by banks ......................................................... 42,481 70,072 8,393 7,949 1,346

Customer accounts ........................................................ 881,575 244,501 89,557 23,209 3,483

Trading liabilities .......................................................... 300,703 – – – –

Financial liabilities designated at fair value ................. 7,421 3,786 7,825 35,583 61,575

Derivatives .................................................................... 255,046 531 1,143 2,065 942

Debt securities in issue ................................................. 1,320 48,062 41,939 62,148 16,255

Subordinated liabilities ................................................. 34 1,491 1,863 10,001 51,293

Other financial liabilities .............................................. 24,834 24,378 7,944 2,184 824

1,513,414 392,821 158,664 143,139 135,718

Loan and other credit-related commitments ................ 524,394 51,732 14,023 11,964 400

Financial guarantees and similar contracts .................. 18,491 9,233 12,231 7,082 2,399

2,056,299 453,786 184,918 162,185 138,517

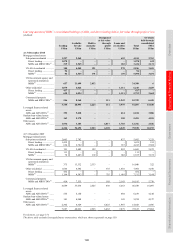

At 31 December 2009

Deposits by banks ......................................................... 39,484 85,922 18,925 6,180 1,359

Customer accounts ........................................................ 800,199 277,071 71,243 45,561 7,911

Trading liabilities .......................................................... 268,130 – – – –

Financial liabilities designated at fair value ................. 6,628 1,050 5,976 36,185 67,209

Derivatives .................................................................... 245,027 300 1,002 467 320

Debt securities in issue ................................................. 124 49,493 38,445 66,661 22,663

Subordinated liabilities ................................................. 43 481 3,020 8,660 52,304

Other financial liabilities .............................................. 22,500 25,123 5,732 2,354 1,103

1,382,135 439,440 144,343 166,068 152,869

Loan and other credit-related commitments54 .............. 494,269 36,726 11,810 12,495 2,750

Financial guarantees and similar contracts54 ................ 16,561 11,169 12,737 9,096 3,688

1,892,965 487,335 168,890 187,659 159,307

For footnote, see page 174.

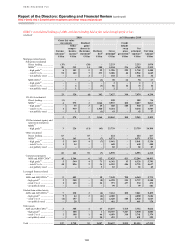

The balances in the above table will not agree

directly with those in our consolidated balance sheet

as the table incorporates, on an undiscounted basis,

all cash flows relating to principal and future coupon

payments (except for trading liabilities and trading

derivatives). In addition, loan and other credit-

related commitments and financial guarantees and

similar contracts are generally not recognised on

our balance sheet. Trading liabilities and trading

derivatives are included in the ‘On demand’ time

bucket, and not by contractual maturity, because

trading liabilities are typically held for short periods

of time. We classify the undiscounted cash flows

payable under hedging derivative liabilities