HSBC 2010 Annual Report Download - page 336

Download and view the complete annual report

Please find page 336 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

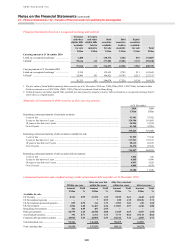

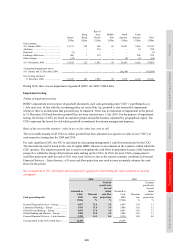

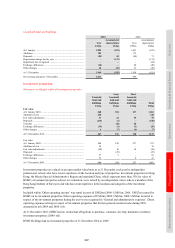

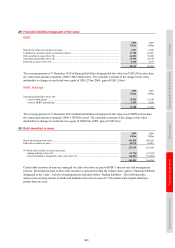

24 – Goodwill and intangible assets

334

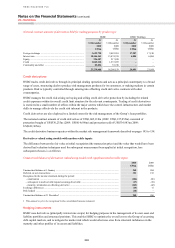

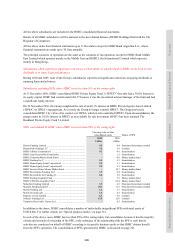

At 1 July 2010, aggregate goodwill of US$4,674m (1 July 2009: US$4,475m) had been allocated to CGUs that were

not considered individually significant. These CGUs do not carry on their balance sheets any significant intangible

assets with indefinite useful lives, other than goodwill.

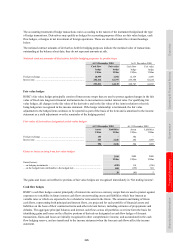

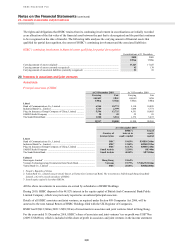

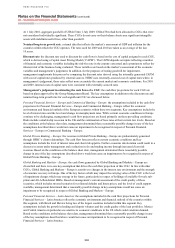

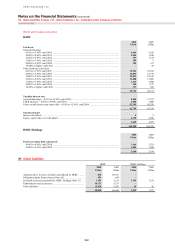

Nominal long-term growth rate: external data that reflects the market’s assessment of GDP and inflation for the

countries within which the CGU operates. The rates used for 2009 and 2010 are taken as an average of the last

10 years.

Discount rate: the discount rate used to discount the cash flows is based on the cost of capital assigned to each CGU,

which is derived using a Capital Asset Pricing Model (‘CAPM’). The CAPM depends on inputs reflecting a number

of financial and economic variables including the risk-free rate in the country concerned and a premium to reflect the

inherent risk of the business being evaluated. These variables are based on the market’s assessment of the economic

variables and management’s judgement. In addition, for the purposes of testing goodwill for impairment,

management supplements this process by comparing the discount rates derived using the internally generated CAPM

with cost of capital rates produced by external sources. HSBC uses externally-sourced cost of capital rates where, in

management’s judgement, those rates reflect more accurately the current market and economic conditions. For 2010

and 2009, internal costs of capital rates were consistent with externally-sourced rates.

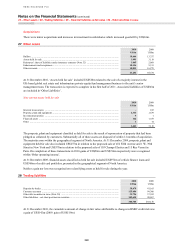

Management’s judgement in estimating the cash flows of a CGU: the cash flow projections for each CGU are

based on plans approved by the Group Management Board. The key assumptions in addition to the discount rate and

nominal long-term growth rate for each significant CGU are discussed below.

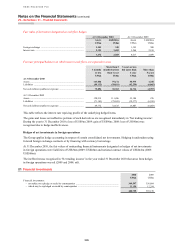

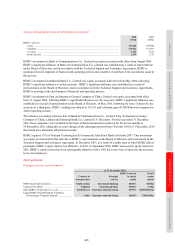

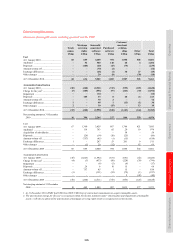

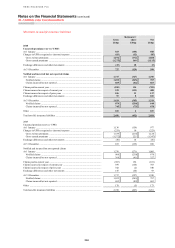

Personal Financial Services – Europe and Commercial Banking – Europe: the assumptions included in the cash flow

projections for Personal Financial Services – Europe and Commercial Banking – Europe reflect the economic

environment and financial outlook of the European countries within these two segments. Key assumptions include the

level of interest rates and the level and change in unemployment rates. While current economic conditions in Europe

continue to be challenging, management’s cash flow projections are based primarily on these prevailing conditions.

Risks include a double-dip recession in the UK and the continuation of base rates at their current low levels. Based on

the conditions at the balance sheet date, management determined that a reasonably possible change in any of the key

assumptions described above would not cause an impairment to be recognised in respect of Personal Financial

Services – Europe or Commercial Banking – Europe.

Global Private Banking – Europe: the revenues in Global Private Banking – Europe are predominately generated

through HSBC’s client relationships. The cash flow forecast reflects current economic conditions and key

assumptions include the level of interest rates and client risk appetite. Further economic deterioration could result in a

decrease in assets under management and a reduction in fee and trading income through increased client risk

aversion. Based on the conditions at the balance sheet date, management determined that a reasonably possible

change in any of the key assumptions described above would not cause an impairment to be recognised in respect of

Global Private Banking – Europe.

Global Banking and Markets – Europe: the cash flows generated by Global Banking and Markets – Europe are

diversified and there is no one key assumption that drives the cash flow projection of this CGU. In line with other

CGUs, Global Banking and Markets – Europe is sensitive to changes in the interest rate environment and the strength

of economic recovery in Europe. One of the key factors which may impact the carrying value of this CGU is the level

of impairment charges which may emerge in the future, particularly in respect of holdings of available-for-sale sub-

prime and Alt-A Residential MBSs. Based on management’s current assessment of the credit quality of these

securities, which includes stressed scenarios for collateral defaults and house prices, and the level of credit support

available, management determined that a reasonably possible change in key assumptions would not cause an

impairment to be recognised in respect of Global Banking and Markets – Europe.

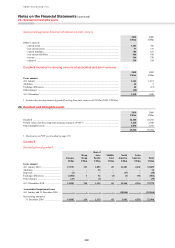

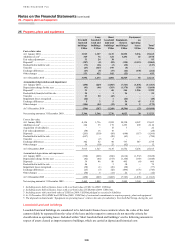

Personal Financial Services – Latin America: the assumptions included in the cash flow projections for Personal

Financial Services – Latin America reflect the economic environment and financial outlook of the countries within

this segment, with Brazil and Mexico being two of the largest countries included within this segment. Key

assumptions include the growth in lending and deposit volumes and the credit quality of the loan portfolios. Mexico

and Central America in particular are sensitive to economic conditions in the US which could constrain demand.

Based on the conditions at the balance sheet date, management determined that a reasonably possible change in any

of the key assumptions described above would not cause an impairment to be recognised in respect of Personal

Financial Services – Latin America.