ADT 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ANNEX A

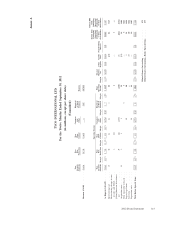

NON-GAAP MEASURES

Organic revenue, free cash flow (outflow) (FCF), and income from continuing operations before special items

are non-GAAP measures and should not be considered replacements for GAAP results. Organic revenue is a

useful measure used by the company to measure the underlying results and trends in the business. The difference

between reported net revenue (the most comparable GAAP measure) and organic revenue (the non-GAAP

measure) consists of the impact from foreign currency, acquisitions and divestitures, and other changes that do not

reflect the underlying results and trends (for example, revenue reclassifications). Organic revenue and the rate of

organic growth or decline as presented herein may not be comparable to similarly titled measures reported by

other companies. Organic revenue is a useful measure of the company’s performance because it excludes items

that: i) are not completely under management’s control, such as the impact of foreign currency exchange; or ii) do

not reflect the underlying results of the company’s businesses, such as acquisitions and divestitures. It may be used

as a component of the company’s compensation programs. The limitation of this measure is that it excludes items

that have an impact on the company’s revenue. This limitation is best addressed by using organic revenue in

combination with the GAAP numbers.

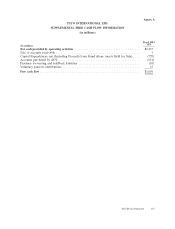

FCF is a useful measure of the company’s cash which is free from any significant existing obligation. The

difference between Cash Flows from Operating Activities (the most comparable GAAP measure) and FCF (the

non-GAAP measure) consists mainly of significant cash flows that the company believes are useful to identify. FCF

permits management and investors to gain insight into the number that management employs to measure cash that

is free from any significant existing obligation. It, or a measure that is based on it, may be used as a component in

the company’s incentive compensation plans. The difference reflects the impact from:

• net capital expenditures,

• accounts purchased by ADT,

• cash paid for purchase accounting and holdback liabilities, voluntary pension contributions, and

• the sale of accounts receivable programs.

Capital expenditures and accounts purchased by ADT are subtracted because they represent long-term

commitments. Cash paid for purchase accounting and holdback liabilities is subtracted because these cash outflows

are not available for general corporate uses. Voluntary pension contributions and the impact from the sale of

accounts receivable programs are added or subtracted because this activity is driven by economic financing

decisions rather than operating activity.

The limitation associated with using FCF is that it adjusts for cash items that are ultimately within

management’s and the Board of Directors’ discretion to direct and therefore may imply that there is less or more

cash that is available for the company’s programs than the most comparable GAAP measure. This limitation is best

addressed by using FCF in combination with the GAAP cash flow numbers. FCF as presented herein may not be

comparable to similarly titled measures reported by other companies. The measure should be used in conjunction

with other GAAP financial measures.

The company has presented its income from continuing operations and margin before special items. Special

items include charges and gains related to divestitures, acquisitions, restructurings, impairments, legacy legal and

tax charges and other income or charges that may mask the underlying operating results and/or business trends of

the company or business segment, as applicable. The company utilizes these measures to assess overall operating

performance and segment level core operating performance, as well as to provide insight to management in

evaluating overall and segment operating plan execution and underlying market conditions. One or more of these

measures may be used as components in the company’s incentive compensation plans. These measures are useful

for investors because they may permit more meaningful comparisons of the company’s underlying operating results

and business trends between periods. The difference between income from continuing operations before special

items and income from continuing operations (the most comparable GAAP measures) consists of the impact of the

special items noted above on the applicable GAAP measure. The limitation of these measures is that they exclude

the impact (which may be material) of items that increase or decrease the company’s reported income from

continuing operations. This limitation is best addressed by using the non-GAAP measures in combination with the

most comparable GAAP measures in order to better understand the amounts, character and impact of any increase

or decrease on reported results.

2012 Proxy Statement A-1