ADT 2011 Annual Report Download - page 301

Download and view the complete annual report

Please find page 301 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2011

(Continued)

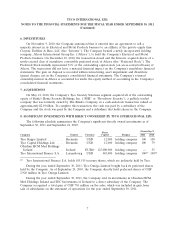

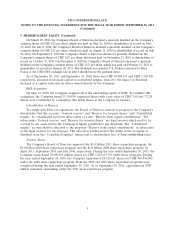

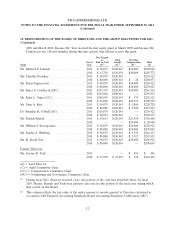

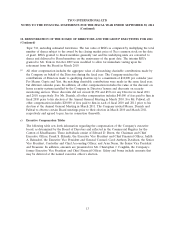

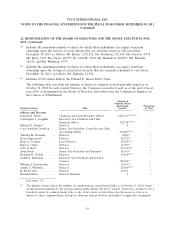

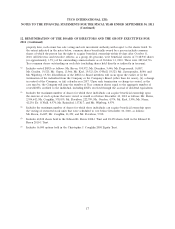

12. REMUNERATION OF THE BOARD OF DIRECTORS AND THE GROUP EXECUTIVES FOR 2011

(Continued)

Summary Compensation Table

Change in

Pension

Value and

Nonqualified

Non-Equity Deferred

Stock/Unit Option Incentive Compensation All Other

Salary Bonus(1) Awards(2) Awards(2) Plan Earnings(4) Compensation(5) Total

Name and Principal Position Year ($) ($) ($) ($) Compensation(3) ($) ($) ($)

(a) (b) (c) (d) (e) (f) ($)(g) (h) (i) (j)

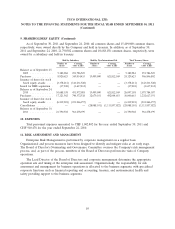

Current Officers

Edward D. Breen ................. 2011 1,625,000 — 4,913,163 4,797,849 2,925,000 3,880,000 2,238,610 20,379,622

Chairman and Chief Executive Officer 2010 1,625,000 — 4,419,090 4,515,932 4,062,500 3,842,000 1,404,351 19,868,873

Frank S. Sklarsky ................. 2011 583,333 500,000 3,163,322 874,517 1,008,000 — 140,502 6,269,674

Executive Vice President and Chief Financial 2010 — — — — — — — —

Officer

Judith A. Reinsdorf ................ 2011 532,500 — 1,102,852 686,570 616,500 — 186,980 3,125,402

Executive Vice President and General Counsel 2010 525,000 — 921,578 796,339 840,000 — 185,452 3,268,369

Carol Anthony Davidson ............. 2011 452,500 — 646,515 403,805 491,500 — 171,875 2,166,195

Senior Vice President, Controller and Chief 2010 445,000 — 672,503 584,450 667,500 — 162,287 2,531,740

Accounting Officer

Arun Nayar .................... 2011 425,000 — 646,515 403,805 464,500 — 150,322 2,090,142

Senior Vice President and Treasurer 2010 410,000 — 672,503 584,450 615,000 — 179,367 2,461,320

Former Officers

Christopher J. Coughlin .............. 2011 800,000 — — — 720,000 — 260,804 1,780,804

Executive Vice President and Chief Financial 2010 800,000 — 3,416,580 4,497,948 1,600,000 — 307,226 10,621,754

Officer

(1) Bonus: The amount reported in column (d) for Mr. Sklarsky reflects the bonus received upon joining the Company in December 2010.

(2) Stock/Unit Awards and Option Awards: The amounts in columns (e) and (f) reflect the fair value of equity awards granted in fiscal 2011 and fiscal

2010, which consisted of stock options, restricted stock units (RSUs) and performance share units. The amounts reported in columns (e) and (f) for

the Company’s executive board represents the fair value of the entire amount of the award calculated in accordance with Financial Accounting

Standards Board ASC Topic 718, excluding the effect of estimated forfeitures. For stock options, amounts are computed by multiplying the fair value

of the award (as determined under the Black-Scholes option pricing model) by the total number of options granted. For RSUs, fair value is

computed by multiplying the total number of shares subject to the award by the closing market price of Tyco common stock on the date of grant. For

performance share units, fair value is based on a model that considers the closing market price of Tyco common stock on the date of grant, the range

of shares subject to such stock award, and the estimated probabilities of vesting outcomes. The value of performance share units included in the table

assumes target performance. The following amounts represent the maximum potential performance share value by individual: Mr. Breen—$9,826,325;

Mr. Sklarsky—$1,792,294; Mr. Coughlin—$0; Ms. Reinsdorf—$1,527,026; Mr. Davidson—$897,757; Mr. Nayar—$897,757. Amounts in columns (f) for

Mr. Coughlin include the incremental fair value of certain modifications made to outstanding options in connection with the fiscal 2010 equity grant.

These prior grants, which total 435,728 stock options, were made as part of the fiscal 2006, 2007 and 2009 annual equity incentive program. The

awards were modified to provide that if Mr. Coughlin remains employed by the Company on October 8, 2011, then the options will remain

exercisable throughout the entire ten-year period commencing on their grant dates, rather than the three-year window that normally follows

retirement, and that any unvested options outstanding on such date (which would consist of 1⁄4 of the stock options granted in connection with the

fiscal 2009 incentive program) would immediately vest.

(3) Non-Equity Incentive Plan Compensation: The amounts reported in column (g) for each named executive officer reflect annual cash incentive

compensation for fiscal 2011 and 2010 (which was based on Company and individual performance in fiscal 2011 and 2010, and paid in the first

quarter of fiscal 2012 and 2011, respectively).

(4) Change in Pension Value and Non-Qualified Deferred Compensation Earnings: The amounts reported in column (h) for Mr. Breen reflect the

aggregate increase in the actuarial present value of his accumulated benefits under all pension plans during fiscal 2011 and 2010, determined using

interest rate and mortality rate assumptions consistent with those used in the Company’s consolidated financial statements.

(5) All Other Compensation: The amounts reported in column (i) for each named executive officer represent cash perquisites, insurance premiums paid

by the Company for the benefit of the officer (and, in some cases, the officer’s spouse), costs related to personal use of Company aircraft, tax gross-

up payments, Company contributions to 401(k) plans and non-qualified plans of the Company and its subsidiaries providing similar benefits, and

other miscellaneous benefits.

14