ADT 2011 Annual Report Download - page 293

Download and view the complete annual report

Please find page 293 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313

|

|

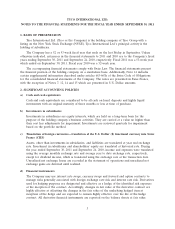

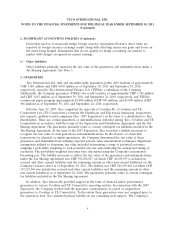

TYCO INTERNATIONAL LTD.

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2011

(Continued)

4. COMMITMENTS AND CONTINGENCIES (Continued)

progress reports to these agencies. The Company has and will continue to communicate with the DOJ

and SEC to provide updates on the baseline review and follow-up investigations, including, as

appropriate, briefings concerning additional instances of potential improper conduct identified by the

Company in the course of its ongoing compliance activities. The baseline review, which has been

completed, revealed that some business practices may not comply with Tyco and FCPA requirements,

and in February 2010, the Company initiated discussions with the DOJ and SEC aimed at resolving

these matters, which remain ongoing. Although the Company has recorded its best estimate of

potential loss related to this matter, it is possible that this estimate may differ from the ultimate loss

determined in connection with the resolution of this matter, as the Company may be required to pay

material fines, consent to injunctions on future conduct, consent to the imposition of a compliance

monitor, or suffer other criminal or civil penalties or adverse impacts, including being subject to

lawsuits brought by private litigants, each of which may have a material adverse effect on the

Company’s financial position, results of operations or cash flows.

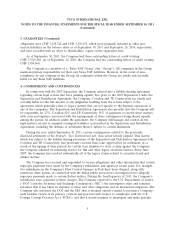

Covidien and TE Connectivity agreed, in connection with the 2007 Separation, to cooperate with

the Company in its responses regarding these matters. Any judgment required to be paid or settlement

or other cost incurred by the Company in connection with the FCPA investigation matters would be

subject to the liability sharing provisions of the Separation and Distribution Agreement, which assigned

liabilities primarily related to the former Healthcare and Electronics businesses of the Company to

Covidien and TE Connectivity, respectively, and provides that the Company will retain liabilities

primarily related to its continuing operations. Any liabilities not primarily related to a particular

segment will be shared equally among the Company, Covidien and TE Connectivity.

In addition to the foregoing, the Company is subject to claims and suits, including from time to

time, contractual disputes and product and general liability claims, incidental to present and former

operations, acquisitions and dispositions. With respect to many of these claims, the Company either

self-insures or maintains insurance through third-parties, with varying deductibles. While the ultimate

outcome of these matters cannot be predicted with certainty, the Company believes that the resolution

of any such proceedings, whether the underlying claims are covered by insurance or not, will not have a

material adverse effect on the Company’s financial condition, results of operations or cash flows beyond

amounts recorded for such matters.

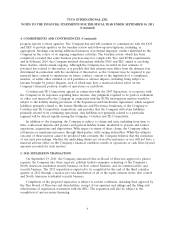

5. 2012 SEPARATION TRANSACTION

On September 19, 2011, the Company announced that its Board of Directors approved a plan to

separate the Company into three separate, publicly traded companies consisting of the Company’s

North American residential security business, its flow control business, and its commercial fire and

security business. The 2012 separation is expected to be completed by the end of the third calendar

quarter of 2012 through a tax-free pro rata distribution of all of the equity interest in the flow control

and North American residential security business.

Completion of the proposed separation is subject to certain conditions, including final approval by

the Tyco Board of Directors and shareholders, receipt of tax opinions and rulings and the filing and

effectiveness of registration statements with the SEC. The separation will also be subject to the

completion of any necessary financing.

6