ADT 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313

|

|

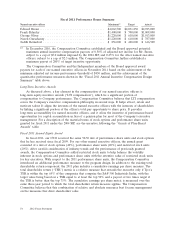

13DEC201119172497

increase of over 20% from the $2.68 achieved in fiscal 2010. Due in part to productivity

initiatives taken by the Company in past years, the operating margin before special items

improved 160 basis points year-over-year, excluding the benefit from the contribution of the

EMP business in the first quarter.

• The Company continued to generate solid free cash flow. Free cash flow was $1.1 billion in fiscal

2011, compared to $1.4 billion in 2010, and included $252 million of cash payments related to

special items. Free cash flow was reduced in 2011 due in part to an increased use of cash to

fund working capital resulting from increased business activity, although working capital days

were in line with fiscal 2010. The Company used its excess cash to make growth oriented

investments and acquisitions. The Company also returned approximately $1.8 billion to

shareholders through share repurchases and dividends, and completed the year with $1.4 billion

in cash and cash equivalents.

• In September 2011, we announced our intention to separate into three independent publicly-

traded companies. Over the last four years, we have worked to strengthen the Company’s

competitive position in its core security, fire protection and flow control businesses by driving

organic growth, investing in research and development and technology, increasing efficiency and

productivity and making strategic acquisitions. As a result, each business is now in a position to

operate independently with a strong financial position, exceptional brands, highly skilled

employees and talented, experienced leadership.

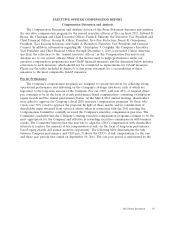

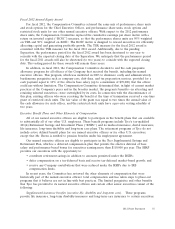

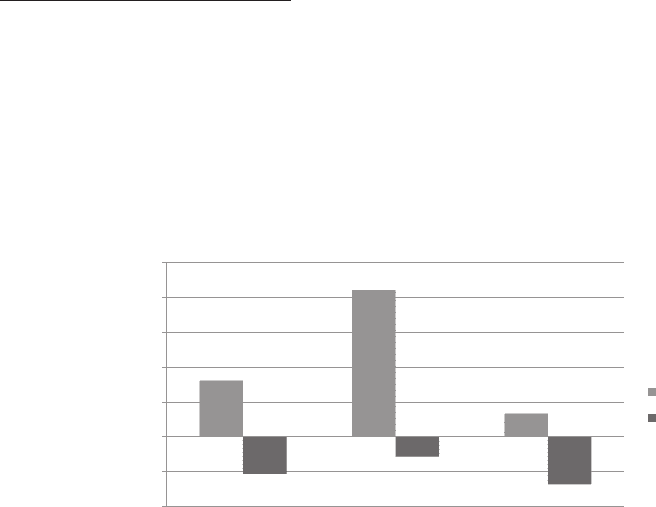

Long Term Equity Compensation

The Compensation Committee believes that the best way to align the chief executive officer’s

compensation with shareholder interests is to place a substantial portion of his compensation at-risk in

the form of long-term performance based equity awards. Since the spin-offs of the Company’s

healthcare and electronics business units in July 2007 (the ‘‘2007 Separation’’), at least 70% of his

targeted direct pay each year has been in the form of long-term equity awards. The value of these

awards is directly linked to sustained shareholder returns, and over the past one, three and five year

periods ending September 30, 2011, Tyco’s total shareholder return has outperformed the S&P 500

Industrials Index:

Tyco TSR vs. S&P 500 Industrials Index

8.06%

21.03%

3.33%

-5.28%

-2.82%

-6.78%

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Tyco

S&P Industrials

1 Year 3 Year 5 Year

TSR (%)

The Compensation Committee has designed the CEO’s long-term equity awards to align with

shareholder returns. The Committee believes that a three-year period is an appropriate time frame to

effectively measure sustained performance, and has used this time-frame in performance share units

granted to the CEO since the 2007 Separation. Each year, performance share units constitute 50% of

the CEO’s long-term equity award. The remaining 50% of the long-term equity award is in the form of

2012 Proxy Statement 47