ADT 2011 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

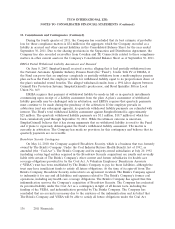

15. Commitments and Contingencies (Continued)

During the fourth quarter of 2011, the Company has concluded that its best estimate of probable

loss for these compliance matters is $34 million in the aggregate, which the Company recorded as a

liability in accrued and other current liabilities in the Consolidated Balance Sheet for the year ended

September 30, 2011. Due to the sharing provisions in the Separation and Distribution Agreement, the

Company has also recorded receivables from Covidien and TE Connectivity related to these compliance

matters in other current assets in the Company’s Consolidated Balance Sheet as of September 30, 2011.

ERISA Partial Withdrawal Liability Assessment and Demand

On June 8, 2007, SimplexGrinnell received a notice alleging that it had partially withdrawn from

the National Automatic Sprinkler Industry Pension Fund (the ‘‘Fund’’). Under Title IV of ERISA, if

the Fund can prove that an employer completely or partially withdraws from a multi-employer pension

plan such as the Fund, the employer is liable for withdrawal liability equal to its proportionate share of

the plan’s unfunded vested benefits. The alleged withdrawal results from a 1994 labor dispute between

Grinnell Fire Protection Systems, SimplexGrinnell’s predecessor, and Road Sprinkler Fitters Local

Union No. 669.

ERISA requires that payment of withdrawal liability be made in full or in quarterly installments

commencing upon receipt of a liability assessment from the plan. A plan’s assessment of withdrawal

liability generally may be challenged only in arbitration, and ERISA requires that quarterly payments

must continue to be made during the pendency of the arbitration. If the employer prevails in

arbitration (and any subsequent appeals), its quarterly withdrawal liability payments are refunded with

interest. The Fund’s total withdrawal liability assessment against SimplexGrinnell is approximately

$25 million. The quarterly withdrawal liability payments are $1.1 million, $18.7 million of which has

been cumulatively paid through September 30, 2011. While the ultimate outcome is uncertain,

SimplexGrinnell believes that it has strong arguments that no withdrawal liability is owed to the Fund,

and it plans to vigorously defend against the Fund’s withdrawal liability assessment. The matter is

currently in arbitration. The Company has made no provision for this contingency and believes that its

quarterly payments are recoverable.

Broadview Security Contingency

On May 14, 2010, the Company acquired Broadview Security, which is a business that was formerly

owned by The Brink’s Company. Under the Coal Industry Retiree Health Benefit Act of 1992, as

amended (the ‘‘Coal Act’’), The Brink’s Company and its majority-owned subsidiaries at July 20, 1992

(including certain legal entities acquired in the Broadview Security acquisition) are jointly and severally

liable with certain of The Brink’s Company’s other current and former subsidiaries for health care

coverage obligations provided for by the Coal Act. A Voluntary Employees’ Beneficiary Associate

(‘‘VEBA’’) trust has been established by The Brink’s Company to pay for these liabilities, although the

trust may have insufficient funds to satisfy all future obligations. At the time of its spin-off from The

Brink’s Company, Broadview Security entered into an agreement in which The Brink’s Company agreed

to indemnify it for any and all liabilities and expenses related to The Brink’s Company’s former coal

operations, including any health care coverage obligations. The Brink’s Company has agreed that this

indemnification survives the Company’s acquisition of Broadview Security. The Company has evaluated

its potential liability under the Coal Act as a contingency in light of all known facts, including the

funding of the VEBA, and indemnification provided by The Brinks Company. The Company has

concluded that no accrual is necessary due to the existence of the indemnification and its belief that

The Brink’s Company and VEBA will be able to satisfy all future obligations under the Coal Act.

136 2011 Financials