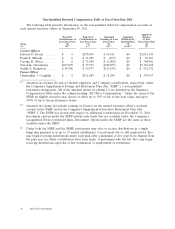

ADT 2011 Annual Report Download - page 92

Download and view the complete annual report

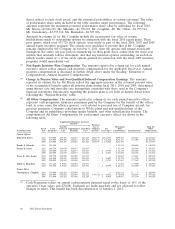

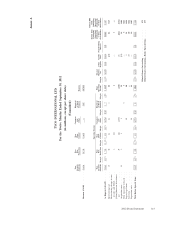

Please find page 92 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.includes a change in duties that results in a significant diminution in his position, authority, duties

or responsibilities. Upon completion of the Separation, if Mr. Breen were to continue as the

Company’s chief executive officer, we believe that these provisions would apply. As a result, upon

his resignation in connection with the Separation, Mr. Breen is expected to receive severance

benefits consistent with a Good Reason termination, except that Mr. Breen has waived the

acceleration of a portion of his fiscal 2012 annual equity grant, and these awards are expected to

be forfeited.

(2) For Mr. Breen, who is retirement eligible based upon age and service, the value of certain equity

awards that would immediately become deliverable upon retirement are not included because these

awards are no longer subject to a significant vesting requirement.

(3) For Mr. Breen, severance paid for a qualified termination under a Change in Control was based

on three times his base salary and three times his actual bonus for fiscal 2010. For termination due

to other triggering events, severance was based on two times his base salary and two times his

actual bonus for fiscal 2010. Under his employment agreement, the multiple will reduce when

Mr. Breen reaches specified ages. In addition, in the event of a change in control, Mr. Breen’s

employment agreement provides for a full gross-up of any federal excise tax that might be due

under Section 4999 of the Internal Revenue Code (although no gross-up would have been payable

as of September 30, 2011). No other named executive is eligible for this benefit. For each of the

other named executive officers, severance would be paid under either the CIC Severance Plan (if

the triggering event were a change in control) or the Severance Plan (for other triggering events).

Under the CIC Severance Plan, each of Mr. Sklarsky and Ms. Reinsdorf would be entitled to a

severance payment of 2.99 times base salary and 2.99 times target bonus for the fiscal year in

which termination occurs, and Messrs. Gursahaney and Oliver would be entitled to 2 times his

base salary and target bonus, subject to possible reduction if the excise tax under Section 4999

would apply. Under the Severance Plan, each named executive officer (except Mr. Breen) would

have been entitled to salary continuation and bonus payments for the 24 months following

termination of employment. In addition to the amounts included in this table, each named

executive officer (including Mr. Breen) would be entitled to the Annual Performance Bonus for

the year in which his or her employment was terminated. The bonus payments are included in the

Summary Compensation table under the column heading ‘‘Non-Equity Incentive Compensation,’’

and are discussed above under the heading ‘‘Elements of Compensation—Annual Incentive

Compensation.’’

(4) Upon a triggering event, Mr. Breen’s employment agreement provides for continued participation

in health and welfare plans over the same time period for which severance is payable, subject to an

18-month limit on medical benefits. If continued participation is not practicable, and/or if

Mr. Breen’s severance period is greater than 18 months, an equivalent cash payment is made, with

a tax gross-up on such amounts. For each of the other named executive officers, medical and

dental benefits are provided under the CIC Severance Plan or the Severance Plan, which both

provide for 12 months of continuing coverage, and if the executive’s severance period is greater

than 12 months, the executive will be entitled to a cash payment equal to the projected value of

the employer portion of premiums during the severance period in excess of 12 months. Not

included is the value of the executive disability insurance program that provides salary continuation

of an additional $25,000 ($75,000 for Mr. Breen) above the $15,000 monthly benefit provided by

our broad based disability plan.

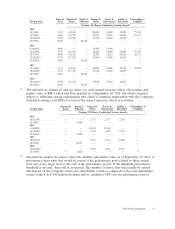

(5) Amounts represent the intrinsic value of unvested Tyco equity awards and stock options that would

vest upon a triggering event. Performance share units are assumed to vest at target for purposes of

these calculations. For Mr. Breen, the amounts in columns (b), (c), (e) and (g) include a tax

gross-up payment to the State of New York of $10,172. Mr. Breen agreed to waive the New York

State tax gross-up payments for compensation that is awarded to him after January 1, 2009.

78 2012 Proxy Statement