ADT 2011 Annual Report Download - page 292

Download and view the complete annual report

Please find page 292 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313

|

|

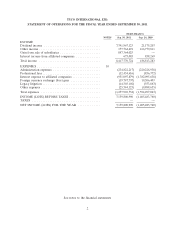

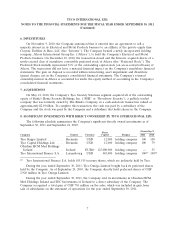

TYCO INTERNATIONAL LTD.

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2011

(Continued)

3. GUARANTEES (Continued)

obligations were CHF 3,258,724 and CHF 3,678,153, which were primarily included in other non-

current liabilities on the balance sheet as of September 30, 2011 and September 24, 2010, respectively,

and were recorded with an offset to shareholders’ equity on the separation date.

As of September 30, 2011, the Company had three outstanding letters of credit totaling

CHF 17,549,482. As of September 24, 2010, the Company had two outstanding letters of credit totaling

CHF 3,954,860.

The Company is a member of a ‘‘Swiss VAT Group’’ (the ‘‘Group’’). All companies in the Group

maintain primary responsibility for their own Swiss VAT liabilities. However, in the event of non-

compliance by any company in the Group, all companies within the Group are jointly and severally

liable for any Swiss VAT liabilities.

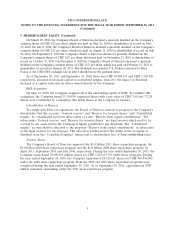

4. COMMITMENTS AND CONTINGENCIES

In connection with the 2007 Separation, the Company entered into a liability sharing agreement

regarding certain legal actions that were pending against Tyco prior to the 2007 Separation. Under the

Separation and Distribution Agreement, the Company, Covidien and TE Connectivity are jointly and

severally liable for the full amount of any judgments resulting from the actions subject to the

agreement, which generally relate to legacy matters that are not specific to the business operations of

any of the companies. The Separation and Distribution Agreement also provides that the Company will

be responsible for 27%, Covidien 42% and TE Connectivity 31% of payments to resolve these matters,

with costs and expenses associated with the management of these contingencies being shared equally

among the parties. In addition, under the agreement, the Company will manage and control all the

legal matters related to assumed contingent liabilities as described in the Separation and Distribution

Agreement, including the defense or settlement thereof, subject to certain limitations.

During the year ended September 30, 2011, certain contingencies related to the previously

disclosed settlement of the Stumpf v. Tyco International Ltd. class action lawsuit elapsed. This matter,

which was subject to the liability sharing provisions of the Separation and Distribution Agreement with

Covidien and TE Connectivity, had previously received final court approval for its settlement. As a

result of the lapsing of time periods for certain class members to state a claim against the Company,

the Company adjusted its remaining reserve for this and other legacy securities matters. Since June

2007, the Company has resolved substantially all of the legacy claims related to securities fraud and

similar matters.

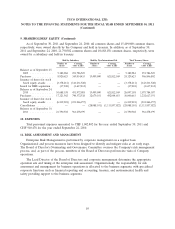

The Company has received and responded to various allegations and other information that certain

improper payments were made by the Company’s subsidiaries and agents in recent years. For example,

two subsidiaries in the Company’s Flow Control business in Italy have been charged, along with

numerous other parties, in connection with the Milan public prosecutor’s investigation into allegedly

improper payments made to certain Italian entities. During the fourth quarter of 2011, the Company’s

subsidiaries were acquitted of these charges. The Company reported to the U.S. Department of Justice

(‘‘DOJ’’) and the Securities and Exchange Commission (‘‘SEC’’) the investigative steps and remedial

measures that it has taken in response to these and other allegations and its internal investigations. The

Company also informed the DOJ and the SEC that it retained outside counsel to perform a Company-

wide baseline review of its policies, controls and practices with respect to compliance with the U.S.

Foreign Corrupt Practices Act (‘‘FCPA’’), and that it would continue to investigate and make periodic

5