ADT 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2012 Annual Equity Award

For fiscal 2012, the Compensation Committee retained the same mix of performance share units

and stock options for the Chief Executive Officer, and performance share units, stock options and

restricted stock units for our other named executive officers. With respect to the 2012 performance

share units, the Compensation Committee replaced the cumulative earnings per share metric with a

return on invested capital (‘‘ROIC’’) measure, so that the performance shares units are 50% weighted

on TSR and 50% weighted on ROIC. The ROIC metric is designed to reward executives for efficiently

allocating capital and generating profitable growth. The TSR measure for the fiscal 2012 award is

consistent with the TSR measure for the fiscal 2011 award. Additionally, due to the pending

Separation, the performance period for the fiscal 2012 award has been shortened to one year to

coincide with the expected closing date of the Separation. We anticipate that the performance period

for the fiscal 2011 awards will also be shortened (to two years) to coincide with the expected closing

date. The vesting period for these awards will remain three years.

In addition, in fiscal 2012, the Compensation Committee decided to end the cash perquisite

allowance program for all officers of the Company that received the benefit, including the named

executive officers. This program, which was instituted in 2003 to eliminate costly and administratively

burdensome perquisites such as company cars, club dues, and tax preparation services, provided for a

cash payment equal to 10% of the officers base salary (up to a maximum of $70,000) that the officer

could use without limitation. The Compensation Committee determined that, in light of current market

practices at the Company’s peers and in the broader market, the program’s benefits—in attracting and

retaining talented executives—were outweighed by its costs. In connection with the discontinuance of

this plan, existing officers who were receiving the benefit at the time of termination received a one-time

grant of restricted stock units. The fair value of the grant was equal to two times the annual value of

the cash allowance for such officer, and the restricted stock units have a pro-rata vesting schedule of

two years.

Executive Benefit Plans and Other Elements of Compensation

All of our named executive officers are eligible to participate in the benefit plans that are available

to substantially all of our other U.S. employees. These benefit programs include Tyco’s tax-qualified

401(k) Retirement Savings and Investment Plans (‘‘RSIPs’’) and its medical insurance, dental insurance,

life insurance, long-term disability and long-term care plans. The retirement programs at Tyco do not

include active defined benefit plans for our named executive officers or for other U.S. executives,

except that Mr. Breen is entitled to pension benefits under his employment agreement.

Our named executive officers are eligible to participate in the Tyco Supplemental Savings and

Retirement Plan, which is a deferred compensation plan that permits the elective deferral of base

salary and performance-based bonus for executives earning more than $110,000 per year. The SSRP

provides our executives with the opportunity to:

• contribute retirement savings in addition to amounts permitted under the RSIPs;

• defer compensation on a tax-deferred basis and receive tax-deferred market-based growth; and

• receive any Company contributions that were reduced under the RSIPs due to IRS

compensation limits.

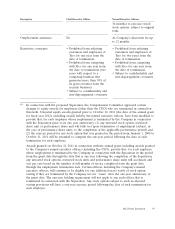

In recent years, the Committee has reviewed the other elements of compensation that were

historically part of the named executive officers’ total compensation and has taken steps to phase-out

programs that it believes are not in line with best practices. The limited perquisites and other benefits

that Tyco has provided to its named executive officers and certain other senior executives consist of the

following:

Supplemental insurance benefits (executive life, disability and long-term care). These programs

provide life insurance, long-term disability insurance and long-term care insurance to certain executives.

2012 Proxy Statement 55