ADT 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

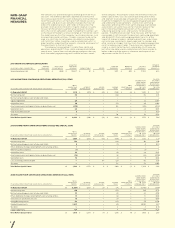

The company has presented organic revenue growth for fiscal

year 2011. The dierence between reported net revenue (the

most comparable GAAP measure) and organic revenue (the non-

GAAP measure) consists of the impact from foreign currency,

acquisitions and divestitures and other changes that may not

reflect the underlying results and trends of the business (for

example, revenue reclassifications). Organic revenue is a useful

measure of the company’s performance because it excludes

items that are not completely under management’s control, such

as the impact of foreign currency exchange, or that do not reflect

the underlying results of the company’s existing businesses, such

as acquisitions and divestitures. Organic revenue should not be

used as a substitute for net revenue calculated in accordance

with GAAP, but rather should be used in combination with it in

order to better understand the amounts, character and impact of

the adjustments to the GAAP results.

The company has presented its income from continuing

operations and diluted EPS from continuing operations before

special items. Special items include charges and gains that may

mask the underlying operating results and/or business trends

NON-GAAP

FINANCIAL

MEASURES

of the company. The company utilizes these financial measures

before special items to assess overall operating performance

and segment-level core operating performance, and to provide

insight to management in evaluating operating plan execution

and underlying market conditions. Income from continuing

operations and diluted EPS from continuing operations before

special items are useful measures for investors because they

permit more meaningful comparisons of the company’s

underlying operating results and business trends between

periods. The dierence between these measures and the most

comparable GAAP measures (income from continuing operations

and diluted EPS from continuing operations) consists of the

impact of charges and gains related to divestitures, acquisitions,

restructurings, impairments, legacy legal and tax charges, and

other income or charges that may mask the underlying operating

results and/or business trends. These measures should not be

used as a substitute for the most comparable GAAP measure,

but rather should be used in combination with them in order to

better understand the amounts, character and impact of any

adjustments to the GAAP results.

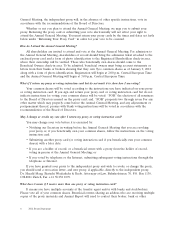

DILUTED

EPS FROM

CONTINUING

OPERATIONS

ATTRIBUTA BLE

TO TYCO

SHAREHOLDERS

INCOME FROM

CONTINUING

OPERATIONS

ATTRIBUTA BLE

TO TYCO

SHAREHOLDERS

NON-

CONTROLLING

INTEREST

INCOME

TAX ES

OTHER

EXPENSE, NET

INTEREST

EXPENSE, NET

TOTAL

OPERATING

INCOME

(IN US$ MILLIONS, EXCEPT PER SHARE DATA) (UNAUDITED)

As Reported (GAAP) $ (1,506) $ (257) $ (7) $ (71) $ (4) $ (1,845) $ (3.90)

Restructuring, net 199 — — (53) — 146 0.32

Restructuring charges in cost of sales and SG&A 33 — — (11) — 22 0.05

Other additional charges resulting from restructuring actions 15 — — (4) — 11 0.02

(Gains)/losses on divestitures, net 15 — — (3) — 12 0.03

Intangible impairments 64 — — (25) — 39 0.08

Goodwill impairments 2,641 — — (41) — 2,600 5.47

Tax items — — — 3 — 3 0.01

Legacy legal items 114 — — 4 — 118 0.25

Total Before Special Items $ 1,575 $ (257) $ (7) $ (201) $ (4) $ 1,106 $ 2.33

2009 INCOME FROM CONTINUING OPERATIONS BEFORE SPECIAL ITEMS

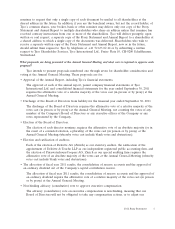

DILUTED

EPS FROM

CONTINUING

OPERATIONS

ATTRIBUTA BLE

TO TYCO

SHAREHOLDERS

INCOME FROM

CONTINUING

OPERATIONS

ATTRIBUTA BLE

TO TYCO

SHAREHOLDERS

NON-

CONTROLLING

INTEREST

INCOME

TAX ES

OTHER

EXPENSE, NET

INTEREST

EXPENSE, NET

TOTAL

OPERATING

INCOME

(IN US$ MILLIONS, EXCEPT PER SHARE DATA) (UNAUDITED)

As Reported (GAAP) $ 1,598 $ (253) $ (75) $ (138) $ (7) $ 1,125 $ 2.31

Restructuring, net 134 — — (42) — 92 0.19

Restructuring charges in cost of sales and SG&A 9 — — (3) — 6 0.01

Other additional charges resulting from restructuring actions 1 — — — — 1 —

ERISA insurance recovery (1) — — — — (1) —

Acquisition costs 35 — — (11) — 24 0.05

Asset impairments and (gains)/losses on divestitures, net (38) — — (4) — (42) (0.09)

Separation costs 10 — — (1) — 9 0.02

Loss on extinguishment of debt — — 87 (25) — 62 0.13

Tax items — — — 32 — 32 0.06

Total Before Special Items $ 1,748 $ (253) $ 12 $ (192) $ (7) $ 1,308 $ 2.68

2010 INCOME FROM CONTINUING OPERATIONS BEFORE SPECIAL ITEMS

DILUTED

EPS FROM

CONTINUING

OPERATIONS

ATTRIBUTA BLE

TO TYCO

SHAREHOLDERS

INCOME FROM

CONTINUING

OPERATIONS

ATTRIBUTA BLE

TO TYCO

SHAREHOLDERS

NON-

CONTROLLING

INTEREST

INCOME

TAX ES

OTHER

EXPENSE, NET

INTEREST

EXPENSE, NET

TOTAL

OPERATING

INCOME

(IN US$ MILLIONS, EXCEPT PER SHARE DATA) (UNAUDITED)

As Reported (GAAP) $ 2,119 $ (210) $ (16) $ (326) $ (2) $ 1,565 $ 3.27

Restructuring, net 86 — — (24) — 62 0.13

Restructuring charges in cost of sales and SG&A 1 — — — — 1 —

Legacy legal items 20 — — 1 — 21 0.04

Acquisition costs 39 — — (13) — 26 0.06

Asset impairments and (gains)/losses on divestitures, net (230) — — 68 — (162) (0.34)

Separation costs 24 — — — — 24 0.05

Note receivable write o 5 — — — — 5 0.01

Tax items — — — 10 — 10 0.02

Total Before Special Items $ 2,064 $ (210) $ (16) $ (284) $ (2) $ 1,552 $ 3.24

2011 INCOME FROM CONTINUING OPERATIONS BEFORE SPECIAL ITEMS

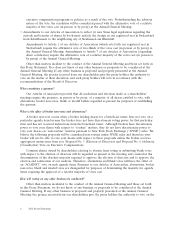

ORGANIC

REVENUE

GROWTH %

2011 NET

REVENUES

ORGANIC

REVENUE

FOREIGN

CURRENCY

BASE YEAR

ADJUSTMENTS

ADJUSTED

2010 BASE

REVENUE ACQUISITIONS OTHER

2010 NET

REVENUES

( IN US$ MILLIONS) (UNAUDITED)

Tyco International Ltd. $ 17,016 $ (959) $ 16,057 $ 61 $ 71 503 $ 663 $ 17,355 4.1%

2011 ORGANIC REVENUE RECONCILIATION