ADT 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

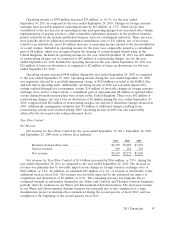

Operating income of $534 million increased $74 million, or 16.1%, for the year ended

September 30, 2011 as compared to the year ended September 24, 2010. Changes in foreign currency

exchange rates favorably impacted operating income by $15 million, or 3.3%. Other factors that

contributed to the net increase in operating income and operating margin were increased sales volume,

implementation of pricing actions to offset commodity inflationary pressures in the products business,

project selectivity in the systems installation business, and cost-containment initiatives. These increases

were partially offset by additional environmental remediation costs of $11 million, net of recoveries

related to an isolated site, and a $5 million decrease to operating income related to the deconsolidation

of a joint venture. Included in operating income for the prior year comparable period is a curtailment

gain of $8 million, which was recognized upon the freezing of certain defined benefit plans in the

United Kingdom. Included in operating income for the year ended September 30, 2011 was $38 million

of restructuring charges, net as compared to $42 million of restructuring charges, net for the year

ended September 24, 2010. Included in operating income for the year ended September 30, 2011 was

$29 million of losses on divestitures as compared to $2 million of losses on divestitures for the year

ended September 24, 2010.

Operating income increased $440 million during the year ended September 24, 2010 as compared

to the year ended September 25, 2009. Operating income during the year ended September 25, 2009

was negatively affected by a goodwill impairment charge of $420 million recorded at the EMEA Fire

and Life Safety reporting units. Additionally, operating income in 2010 was favorably impacted by

savings realized through cost containment actions, $14 million of favorable changes in foreign currency

exchange rates, and to a lesser extent, a curtailment gain of approximately $8 million recognized when

certain defined benefit pension plans were frozen in the United Kingdom. There were $42 million of

restructuring charges, net and a loss on divestiture of $2 million during the year ended September 24,

2010, compared with $62 million of restructuring charges, net and nil of divestiture charges incurred in

2009. Additionally, management estimates that $7 million of additional charges resulting from

restructuring actions were incurred during 2009. Operating income in 2009 was also unfavorably

affected by the decreased sales volume discussed above.

Tyco Flow Control

Net Revenue

Net revenue for Tyco Flow Control for the years ended September 30, 2011, September 24, 2010,

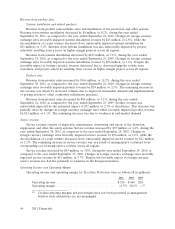

and September 25, 2009 were as follows ($ in millions):

2011 2010 2009

Revenue from product sales ...................... $3,330 $3,089 $3,232

Service revenue ............................... 309 284 263

Net revenue .................................. $3,639 $3,373 $3,495

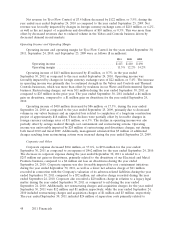

Net revenue for Tyco Flow Control of $3.6 billion increased by $266 million, or 7.9%, during the

year ended September 30, 2011 as compared to the year ended September 24, 2010. The increase in

revenue was primarily due to favorable impacts from changes in foreign currency exchange rates of

$183 million, or 5.4%. In addition, an estimated $45 million, or 1.3%, of revenue is attributable to the

additional week in fiscal 2011. Net revenue was favorably impacted by the estimated net impact of

acquisitions and divestitures of $7 million, or 0.2%. The remaining increase was primarily due to

continued strength in end-market demand in our Valves and Controls and Thermal Controls businesses

partially offset by weakness in our Water and Environmental Systems business. The decreased revenue

in our Water and Environmental Systems business was primarily due to the completion of a large

desalinization project in Australia that commenced during the second quarter of fiscal 2010, and was

completed at the beginning of the second quarter fiscal 2011.

2011 Financials 47