ADT 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 2012 Proxy Statement

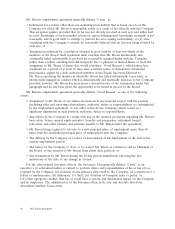

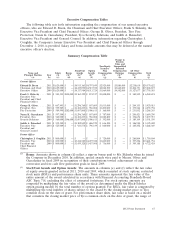

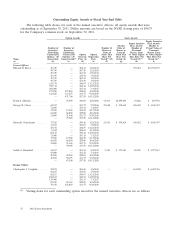

Grants of Plan-Based Awards Table

The following table summarizes cash-based and equity based awards for each of the Company’s named executive officers that were

granted during fiscal 2011 under the 2004 SIP.

All Other All Other Grant

Estimated Possible Payouts Estimated Possible Payouts Stock Option Date

Under Non-Equity Incentive Plan Under Equity Incentive Plan Awards: Awards: Exercise or Fair Value

Awards(1) Awards(2)

Number of Number of Base of Stock

Board or Target Shares Securities Price of and

Committee (Mid- of Stock Underlying Option Option

Grant Approval Threshold Target Maximum Threshold Point) Maximum or Units Options Awards Awards(3)

Name Date Date ($) ($) ($) (#) (#) (#) (#) (#) ($/Sh) ($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m)

Current Officers

Edward D. Breen ...... 12/8/2010 12/8/2010 $1,015,625 $2,031,250 $4,062,500

10/12/2010 10/12/2010 471,700 $37.29 $4,797,849

10/12/2010 10/12/2010 57,285 127,300 254,600 $4,913,163

Frank S. Sklarsky ...... 12/8/2010 12/8/2010 $ 350,000 $ 700,000 $1,400,000

12/9/2010 10/1/2010 72,500 $40.85 $ 874,517

12/9/2010 10/1/2010 9,700 $ 396,245

12/9/2010 10/1/2010 36,700 $1,499,195

12/9/2010 10/1/2010 9,100 $ 371,735

12/9/2010 10/1/2010 8,775 19,500 39,000 $ 896,147

George R. Oliver ...... 12/8/2010 12/8/2010 $ 305,000 $ 610,000 $1,220,000

10/12/2010 10/12/2010 79,400 $37.29 $ 807,609

10/12/2010 10/12/2010 10,700 $ 399,003

10/12/2010 10/12/2010 9,630 21,400 42,800 $ 897,757

Naren K. Gursahaney . . . 12/8/2010 12/8/2010 $ 305,000 $ 610,000 $1,220,000

10/12/2010 10/12/2010 79,400 $37.29 $ 807,609

10/12/2010 10/12/2010 10,700 $ 399,003

10/12/2010 10/12/2010 9,630 21,400 42,800 $ 897,757

Judith A. Reinsdorf .... 12/8/2010 12/8/2010 $ 214,000 $ 428,000 $ 856,000

10/12/2010 10/12/2010 67,500 $37.29 $ 686,570

10/12/2010 10/12/2010 9,100 $ 339,339

10/12/2010 10/12/2010 8,190 18,200 36,400 $ 763,513

Former Officer

Christopher J. Coughlin . . 12/8/2010 12/8/2010 $ 250,000 $ 500,000 $1,000,000

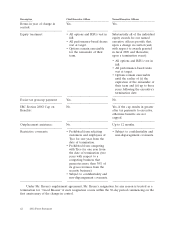

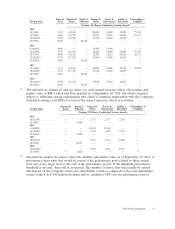

(1) Amounts reported in columns (d) through (f) represent potential annual performance bonuses that the named executive officers could have earned under the

Company’s annual incentive plan for fiscal 2011. The Board approved a maximum bonus payout of 0.50% of net income before special items for Mr. Breen,

subject to a cap of $5.0 million imposed by the 2004 SIP, and 0.25% for the other Senior Officers, subject to a cap of $2.5 million. The Compensation

Committee further established a maximum payout of 200% of target. Threshold amounts assume minimum performance levels are achieved with respect to

each performance measure.

(2) Amounts in (g) through (i) represent potential share payouts with respect to performance share awards that were made in connection with the fiscal year 2011

long-term compensation grant. Performance share units were granted to certain executive officers in October 2010 (December 2010 in the case of

Mr. Sklarsky) and vest at the end of the three-year performance period on September 27, 2013. The number of shares that will be paid out will depend on the

Company’s (i) three-year annualized total shareholder return over the performance period, as compared to the return for the S&P 500 Industrials Index and

(ii) achievement of cumulative earnings per share before special items over the performance period. Equity was granted to Mr. Sklarsky when he joined the

Company in December 2010. A portion of the award granted on December 8, 2010, consisting of (i) restricted stock units with a grant date fair value of

$1.5 million that vest in equal annual installments over a three year period and (ii) restricted stock units with a grant date fair value of $371,735 that vest on

the third anniversary of the grant date, were intended to compensate Mr. Sklarsky for equity and other benefits forfeited with his previous employer.

(3) Amounts in column (m) show the grant date fair value of the option awards and performance share awards granted to named executive officers. Amounts for

performance share awards represent the estimate of the aggregate compensation cost to be recognized over the three year performance period determined as

of the grant date under FASB ASC Topic 718, excluding the effect of estimated forfeitures. The actual number of shares that are paid out will depend on the

Company’s achievement of the performance metrics at the end of the performance period.