ADT 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313

|

|

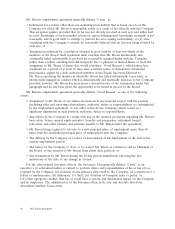

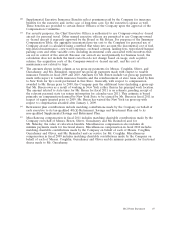

serve as significant risk mitigators. Finally, the Compensation Committee’s authority to approve

performance metrics, targets, minimum thresholds and maximum award caps provide discipline and

help eliminate the incentive for excessive risk-taking behavior.

Based on the foregoing, we believe that our compensation policies and practices do not create

inappropriate or unintended material risk to the company as a whole. We also believe that our

incentive compensation arrangements provide incentives that do not encourage inappropriate

risk-taking; are compatible with effective internal controls and the risk management policies; and are

supported by the oversight and administration of the Compensation Committee with regard to

executive compensation programs.

Stock Ownership Guidelines

In 2003, the Board established stock ownership and share retention guidelines for all Senior

Officers. The Board believes that executives who own and hold a significant amount of Company stock

are aligned with long-term shareholder interests. The guidelines apply to all of our named executive

officers and certain additional senior executives. The Compensation Committee reviews compliance

with our stock ownership guidelines annually.

The current stock ownership requirement for our named executive officers is five times base salary

for Messrs. Gursahaney and Oliver, six times for Mr. Sklarsky and Ms. Reinsdorf and ten times for

Mr. Breen. Tyco shares that count towards meeting the stock ownership requirement include restricted

stock, RSUs, DSUs, performance share units, shares acquired through our 401(k) plan or the Employee

Stock Purchase Program, and shares otherwise beneficially owned by the executive. We do not require

that the stock ownership guidelines be attained within a certain period of time. Instead, the

Compensation Committee reviews executive stock ownership regularly to ensure that our senior

executives are making progress towards meeting their goals or maintaining their requisite ownership.

Tyco’s stock retention guidelines require that our named executive officers and other senior

executives retain 75% of net (after-tax) shares acquired from the exercise of stock options or the

vesting of restricted shares until they attain their target stock ownership goal. Once that goal is

attained, they cannot sell shares if it would result in the executive owning fewer shares than the target

multiple applicable to him or her. When a named executive officer reaches the age of 62, the target

multiple is reduced by 50%. Except for Mr. Sklarsky, who was hired in December 2010, all of the

named executive officers met or exceeded the applicable stock ownership multiple guideline in fiscal

2011.

Pay Recoupment Policy

Tyco’s pay recoupment policy currently provides that, in addition to any other remedies available

to it and subject to applicable law, if the Board or any Compensation Committee of the Board

determines that any annual or other incentive payment, equity award or other compensation received

by a Senior Officer resulted from any financial result or operating metric that was impacted by the

Senior Officer’s fraudulent or illegal conduct, the Board or a Board Committee may recover from the

Senior Officer that compensation it considers appropriate under the circumstances. The Board has the

sole discretion to make any and all determinations under this policy. The Board expects to update the

pay recoupment policy when the regulations mandated by the Dodd-Frank Act are implemented by the

Securities and Exchange Commission. At a minimum, the policy will comply with the Dodd-Frank Act

and related regulations, but will likely retain features of the existing policy that are more expansive

than the requirements of the Act.

2012 Proxy Statement 65