ADT 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

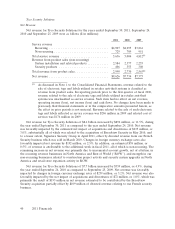

Net revenue for Tyco Flow Control of $3.4 billion decreased by $122 million, or 3.5%, during the

year ended year ended September 24, 2010 as compared to the year ended September 25, 2009. Net

revenue was favorably impacted by changes in foreign currency exchange rates of $218 million, or 6.2%,

as well as the net impact of acquisitions and divestitures of $10 million, or 0.3%. This was more than

offset by decreased revenues due to reduced volume in the Valves and Controls business driven by

decreased demand in end markets.

Operating Income and Operating Margin

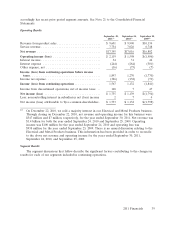

Operating income and operating margin for Tyco Flow Control for the years ended September 30,

2011, September 24, 2010, and September 25, 2009 were as follows ($ in millions):

2011 2010 2009

Operating income ................................ $413 $410 $496

Operating margin ................................ 11.3% 12.2% 14.2%

Operating income of $413 million increased by $3 million, or 0.7%, in the year ended

September 30, 2011 as compared to the year ended September 24, 2010. Operating income was

favorably impacted by changes in foreign currency exchange rates of $22 million, or 5.4%. The increase

in operating income was primarily due to continued strength in the Valves and Controls and Thermal

Controls businesses, which was more than offset by weakness in our Water and Environmental Systems

business. Restructuring charges, net were $11 million during the year ended September 30, 2011 as

compared to $25 million in the prior year. The year ended September 30, 2011 included a $6 million

gain on divestiture, compared to a $1 million gain on divestiture for the year ended September 24,

2010.

Operating income of $410 million decreased by $86 million, or 17.3%, during the year ended

September 24, 2010 as compared to the year ended September 25, 2009, primarily due to decreased

volume in our valves business and an expected loss related to completion of a long-term construction

project of approximately $18 million. These declines were partially offset by favorable changes in

foreign currency exchange rates of $31 million, or 6.3%. The decline in operating income was also

partially offset by savings realized through cost containment and restructuring actions. Operating

income was unfavorably impacted by $24 million of restructuring and divestiture charges, net during

both fiscal 2010 and fiscal 2009. Additionally, management estimated that $5 million of additional

charges resulting from restructuring actions were incurred during the year ended September 25, 2009.

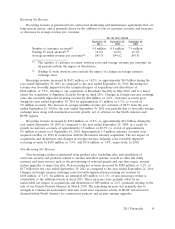

Corporate and Other

Corporate expense decreased $266 million, or 57.6%, to $196 million for the year ended

September 30, 2011 as compared to an expense of $462 million for the year ended September 24, 2010.

The decrease in corporate expense during the year ended September 30, 2011 is related to a

$253 million net gain on divestitures, primarily related to the divestiture of our Electrical and Metal

Products business, compared to a $4 million net loss on divestitures during the year ended

September 24, 2010. Corporate expense was also favorably impacted by cost containment initiatives

during the year ended September 30, 2011, as well as a lower net asbestos charge of $11 million

recorded in connection with the Company’s valuation of its asbestos-related liabilities during the year

ended September 30, 2011 compared to a $52 million, net asbestos charge recorded during the year

ended September 24, 2010. Corporate also recorded a $20 million charge in relation to a legacy legal

matter during the year ended September 30, 2011 as compared to nil during the year ended

September 24, 2010. Additionally, net restructuring charges and acquisition charges for the year ended

September 30, 2011 were $12 million and $1 million respectively, while the year ended September 24,

2010 included restructuring charges and acquisition charges of $1 million and $3 million, respectively.

The year ended September 30, 2011 included $24 million of separation costs primarily related to

48 2011 Financials