ADT 2011 Annual Report Download - page 295

Download and view the complete annual report

Please find page 295 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2011

(Continued)

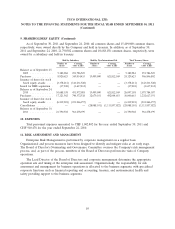

9. SHAREHOLDERS’ EQUITY

As of September 30, 2011, the Company’s share capital amounted to CHF 3,258,632,435 or

486,363,050 registered common shares with a par value of CHF 6.70 per share following the cancellation of

28,088,101 registered common shares with a par value of CHF 6.70 per share. As of September 24, 2010,

the Company’s share capital amounted to CHF 3,683,470,241 or 514,451,151 registered common shares with

a par value of CHF 7.16 per share.

Until March 9, 2013, the Board of Directors may increase the Company’s share capital by a maximum

amount of CHF 1,628,100,000 by issuing a maximum of 243,000,000 shares. In addition, (i) the share capital

of the Company may be increased by an amount not exceeding CHF 321,127,717 through the issue of a

maximum of 47,929,510 shares through the exercise of conversion and/or option or warrant rights granted

in connection with bonds, notes or similar instruments and (ii) the share capital of the Company may be

increased by an amount not exceeding CHF 321,127,717 through the issue of a maximum of 47,929,510

shares to employees and other persons providing services to the Company.

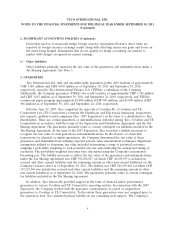

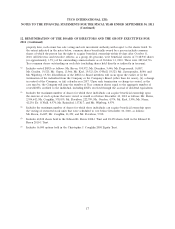

Reserve for

Share General treasury Contributed Accumulated Net income/

(CHF) capital reserve shares surplus deficit (loss) Total

Balance as of September 25, 2009 . . 3,867,911,465 817,677,442 251,786,525 36,064,811,699 (31,815,666,282) (1,025,500,722) 8,161,020,127

Capital Reduction ........... (451,627,204) 1,503,920 (450,123,284)

Allocation of prior year net loss . . . (1,025,500,722) 1,025,500,722 —

Net loss for the year ......... (1,405,483,760) (1,405,483,760)

Net movement due to BHS

acquisition .............. 267,185,980 (1,617,412) 1,247,830,901 1,513,399,469

Purchases and issuances of treasury

shares ................ 823,615,274 (823,615,274) —

Balance as of September 24, 2010 . . 3,683,470,241 817,677,442 1,073,784,387 36,490,531,246 (32,841,167,004) (1,405,483,760) 7,818,812,552

Capital Reduction ........... (236,647,529) 10,004,333 (226,643,196)

Allocation of prior year net loss . . . (1,405,483,760) 1,405,483,760 —

Net income for the year ....... 7,159,800,990 7,159,800,990

Purchases and issuances of treasury

shares ................ 1,001,351,034 (1,001,351,034) —

Cancellation of treasury shares .... (188,190,277) (1,113,857,022) 188,190,277 (1,113,857,022)

Dividend ................ (432,835,783) (432,835,783)

Balance as of September 30, 2011 . . 3,258,632,435 817,677,442 961,278,399 35,254,539,039 (34,246,650,764) 7,159,800,990 13,205,277,541

Dividends

Prior to May 2011, the Company paid dividends in the form of a return of share capital from the

Company’s registered share capital. These payments were made free of Swiss withholding taxes. The

Company now makes dividend payments from its contributed surplus equity position in its Swiss statutory

accounts. These payments are also made free of Swiss withholding taxes. Unlike payments made in the

form of a reduction to registered share capital, which are required to be denominated in Swiss Francs and

converted to U.S. Dollars at the time of payment, payments from the contributed surplus account may

effectively be denominated in U.S. Dollars.

Under Swiss law, the authority to declare dividends is vested in shareholders, and on March 9, 2011, the

Company’s shareholders approved an annual dividend on the Company’s common shares of $1.00 per share,

which is being paid from contributed surplus in four installments of $0.25 per share. As a result, the

Company recorded an accrued dividend of $468 million as of March 9, 2011 and a corresponding reduction

to contributed surplus. The first installment of $0.25 was paid on May 25, 2011 to shareholders of record on

April 29, 2011. The second installment of $0.25 was paid on August 24, 2011 to shareholders of record on

July 29, 2011. The third installment of $0.25 will be paid on November 17, 2011 to shareholders of record on

October 28, 2011. The fourth installment of $0.25 is expected to be paid in February 2012. The Company

records its accrued dividend in accrued and other current liabilities in the Company’s Balance Sheet.

8