ADT 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313

|

|

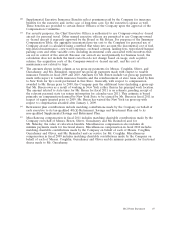

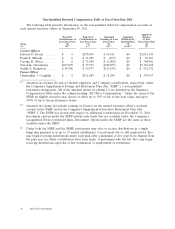

The Company made its annual grant of equity for fiscal 2011 in October 2010. The award for the

Chief Executive Officer consisted of stock options and performance share units. Other named executive

officers also received a mix of stock options, performance share units and restricted stock units.

When the Company grants stock options, the exercise price equals the fair market value of our

common stock on the date of grant. Stock options generally vest in equal installments over a period of

four years, beginning on the first anniversary of the grant date. Each option holder has 10 years to

exercise his or her stock option from the date of grant, unless forfeited earlier.

Performance share units generally vest at the end of the performance period. The number of

shares that are actually earned depends on whether, and at what level, the performance criteria have

been met. Performance share units granted in fiscal 2011 accrue dividends prior to vesting, which are

earned and paid out only to the extent that performance targets are achieved. Performance share units

do not have any voting rights. For performance share units granted in connection with the fiscal 2011

equity award, the relevant metrics are (i) Tyco’s three-year total shareholder return (‘‘TSR’’) between

September 25, 2010 and September 27, 2013 (50% weighting) and (ii) Tyco’s cumulative earnings per

share before special items (‘‘cumulative EPS’’) over the same period (50% weighting). Tyco’ TSR is to

be compared with the total shareholder return of all the companies in the S&P 500 Industrials Index

for the same period. The TSR return measure is based on the average of the closing stock price for the

60 trading days preceding, and the last 60 trading days of, the performance period, plus a total return

factor to reflect the reinvestment of dividends during the three-year period. If Tyco’s total shareholder

return is not equal to or better than the total shareholder return for 35% of the companies constituting

the S&P 500 Industrials Index, no shares will be delivered with respect to the TSR performance metric.

The cumulative EPS metric also contains a minimum performance threshold. The maximum number of

shares each named executive officer can receive with respect to the fiscal 2011 performance share plan

is two times the target number of shares granted. In addition, if the Company’s TSR is negative at the

end of the performance period, the maximum payout for the TSR metric is capped at 125% of the

target number of shares, with a similar cap for the cumulative EPS performance threshold.

Forfeiture provisions related to involuntary terminations are described above under the heading

‘‘Change in Control and Severance Benefits.’’ Special termination provisions apply for employees who

are terminated in connection with the Separation. For a description of these provisions, please refer to

the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on

October 14, 2011.

2012 Proxy Statement 71