ADT 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

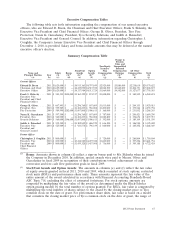

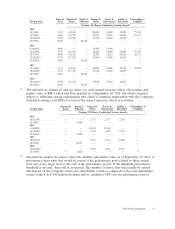

shares subject to such stock award, and the estimated probabilities of vesting outcomes. The value

of performance share units included in the table assumes target performance. The following

amounts represent the maximum potential performance share value by individual for fiscal 2010:

Mr. Breen—$9,826,325; Mr. Sklarsky—$1,792,294; Mr. Coughlin—$0; Mr. Oliver—$1,795,514;

Mr. Gursahaney—$1,795,514; Ms. Reinsdorf—$1,527,026.

Amounts in column (f) for Mr. Coughlin include the incremental fair value of certain

modifications made to outstanding options in connection with the fiscal 2010 equity grant. These

prior grants, which total 435,728 stock options, were made as part of the fiscal 2006, 2007 and 2009

annual equity incentive program. The awards were modified to provide that if Mr. Coughlin

remains employed by the Company on October 8, 2011, then the options will remain exercisable

throughout the entire ten-year period commencing on their grant dates, rather than the three-year

window that normally follows retirement, and that any unvested options outstanding on such date

(which would consist of 1⁄4 of the stock options granted in connection with the fiscal 2009 incentive

program) would immediately vest.

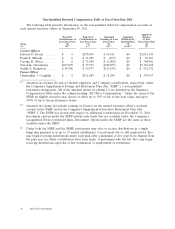

(3) Non-Equity Incentive Plan Compensation: The amounts reported in column (g) for each named

executive officer reflect annual cash incentive compensation for the applicable fiscal year. Annual

incentive compensation is discussed in further detail above under the heading ‘‘Elements of

Compensation—Annual Incentive Compensation.’’

(4) Change in Pension Value and Non-Qualified Deferred Compensation Earnings: The amounts

reported in column (h) for Mr. Breen reflect the aggregate increase in the actuarial present value

of his accumulated benefits under all pension plans during fiscal 2011, 2010 and 2009, determined

using interest rate and mortality rate assumptions consistent with those used in the Company’s

financial statements. Information regarding the pension plans is set forth in further detail below

following the ‘‘Pension Benefits’’ table.

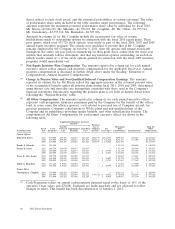

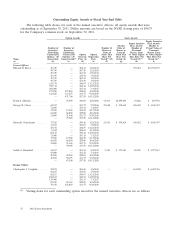

(5) All Other Compensation: The amounts reported in column (i) for each named executive officer

represent cash perquisites, insurance premiums paid by the Company for the benefit of the officer

(and, in some cases, the officer’s spouse), costs related to personal use of Company aircraft, tax

gross-up payments, Company contributions to 401(k) plans and non-qualified plans of the

Company and its subsidiaries providing similar benefits, and other miscellaneous benefits. The

components of All Other Compensation for each named executive officer are shown in the

following table.

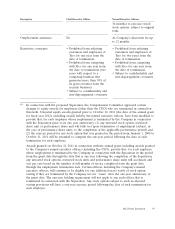

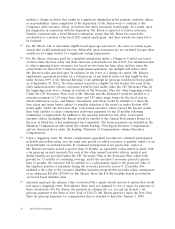

Supplemental Executive Insurance

Benefits(b)

Personal

Variable Use of Retirement Total All

Fiscal Cash Universal Supplemental Long-Term Company Tax Plan Other

Named Executive Year Perquisite(a) Life Disability Care Aircraft(c) Gross-Ups(d) Contributions(e) Miscellaneous(f) Compensation

Current Officers

Edward D. Breen ..... 2011 $70,000 $50,405 $34,683 $15,429 $254,775 $1,512,738 $290,563 $10,017 $2,238,610

2010 $70,000 $50,405 $34,683 $15,429 $213,151 $ 841,566 $174,117 $ 5,000 $1,404,351

2009 $70,000 $50,405 $37,689 $15,428 $238,795 $ 478,964 $236,396 — $1,127,677

Franks S. Sklarsky .... 2011 $52,500 — — — — — $ 23,333 $64,669 $ 140,502

George R. Oliver ..... 2011 $60,750 $14,839 $14,837 $20,347 — — $ 83,380 $10,000 $ 204,153

2010 $60,000 $14,839 $14,837 $20,347 — $ 19,392 $ 36,149 $10,000 $ 175,564

2009 $60,000 $14,839 $14,837 $20,346 — $ 21,011 $ 84,049 $16,750 $ 231,832

Naren K. Gursahaney . . 2011 $59,750 $10,109 $15,008 $19,275 — — $ 86,665 $ 9,614 $ 200,421

2010 $56,000 $10,109 $15,008 $19,275 — $ 23,607 $ 43,475 $ 9,200 $ 176,674

2009 $56,000 $10,109 $15,008 $19,274 — $ 23,782 $ 57,567 $ 7,369 $ 189,109

Judith A. Reinsdorf . . . 2011 $53,250 $ 9,681 $12,762 $29,783 — — $ 71,604 $ 9,900 $ 186,980

2010 $52,500 $ 9,681 $12,762 $29,783 — $ 26,593 $ 44,133 $10,000 $ 185,452

Former Officer

Christopher J. Coughlin . 2011 $70,000 $28,262 $17,990 $21,211 — — $123,333 $ 8 $ 260,804

2010 $70,000 $28,262 $17,990 $21,211 $ 39,302 $ 43,471 $ 76,800 $10,190 $ 307,226

2009 $70,000 $28,262 $17,990 $21,210 — $ 39,959 $116,667 $15,100 $ 309,188

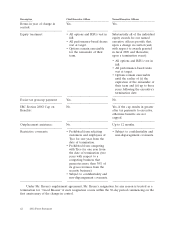

(a) Cash Perquisites reflect an annual cash perquisite payment equal to the lesser of 10% of the

executive’s base salary and $70,000. Payments are made quarterly and are adjusted to reflect

changes in salary. This benefit has been discontinued as of January 1, 2012.

68 2012 Proxy Statement