United Airlines 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

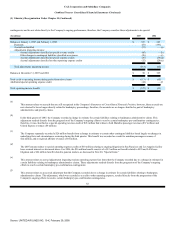

(2) Summary of Significant Accounting Policies (Continued)

intended flight, unless the date is extended by notification from the customer on or before the intended flight date. Fees charged in association with changes or

extensions to nonrefundable tickets are recorded as passenger revenue at the time the fee is incurred. Change fees related to non-refundable tickets are considered

a separate transaction from the air transportation because they represent a charge for the Company's additional service to modify a previous order. Therefore, the

pricing of the change fee and the initial customer order are separately determined and represent distinct earnings processes. Refundable tickets expire after one

year.

MCO's can be either exchanged for a passenger ticket or refunded after issuance. United also records an estimate of MCO's that will not be exchanged or

refunded as revenue ratably over the validity period based on historical results.

United records an estimate of tickets that have been used, but not recorded as revenue due to system processing errors, as revenue in the month of sale based

on historical results. Due to complex industry pricing structures, refund and exchange policies, and interline agreements with other airlines, certain amounts are

recognized as revenue using estimates both as to the timing of recognition and the amount of revenue to be recognized. These estimates are based on the

evaluation of actual historical results. United recognizes cargo and mail revenue as service is provided.

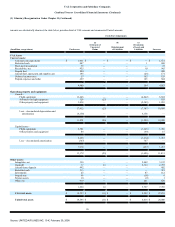

(e) Cash and Cash Equivalents, Short-Term Investments, Restricted Cash—Cash in excess of operating requirements is invested in short-term, highly

liquid, income-producing investments. Investments with a maturity of three months or less on their acquisition date are classified as cash and cash equivalents.

Other investments are classified as short-term investments. Investments classified as held-to-maturity are stated at amortized cost, which approximates market

due to their short-term maturities. Investments in debt securities classified as available-for-sale are stated at fair value. The gains or losses from sales of

available-for-sale securities are included in interest income.

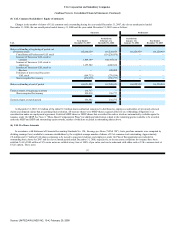

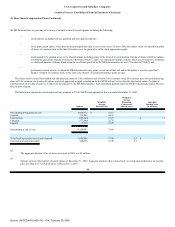

At December 31, 2007, UAL's and United's investments in debt securities classified as held-to-maturity included $1.3 billion and $1.2 billion, respectively,

recorded in cash and cash equivalents and $2.3 billion recorded in short-term investments for both UAL and United. At December 31, 2006, UAL and United

both had investments in debt securities classified as held-to-maturity of $3.8 billion and recorded in cash and cash equivalents and $312 million and

$308 million, respectively, recorded in short-term investments.

Short-term and long-term restricted cash in the Company's Statements of Consolidated Financial Position represents security for workers' compensation

obligations, security deposits for airport leases and reserves with institutions that process our credit card ticket sales. Financial and other institutions with which

the Company conducts its business may require additional levels of security deposits or reserve holdbacks.

See Note 7, "Investments," for information related to the Company's investments in non-current debt securities.

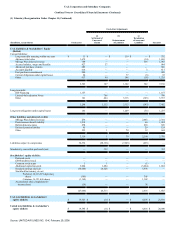

(f) Aircraft Fuel, Spare Parts and Supplies—The Company records fuel, maintenance, operating supplies, and aircraft spare parts at cost when acquired,

and provides an obsolescence allowance for aircraft spare parts.

(g) Operating Property and Equipment—Owned operating property and equipment, and equipment under capital leases, were stated at fair value as of

February 1, 2006. The Company records additions

91

Source: UNITED AIR LINES INC, 10-K, February 29, 2008