United Airlines 2007 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

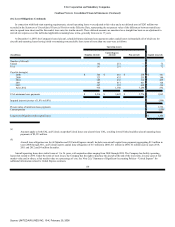

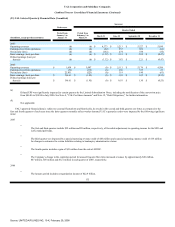

(17) Statement of Consolidated Cash Flows—Supplemental Disclosures

Supplemental disclosures of cash flow information and non-cash investing and financing activities for both UAL and United, except as noted, are as

follows:

Successor

Predecessor

(In millions)

Year Ended

December 31, 2007

Period from

February 1 to

December 31, 2006

Period from

January 1 to

January 31, 2006

Year Ended

December 31, 2005

Cash paid during the period for:

Interest (net of amounts capitalized) $ 614 $ 703 $ 35 $ 456

Income taxes 10 — — —

Non-cash transactions:

Long-term debt incurred to acquire assets $ — $ 242 $ — $ —

Capital lease obligations incurred to acquire assets — 155 — —

Pension and other postretirement changes recorded

in other comprehensive income (loss) — 87 (4) (661)

Accrued special distribution on UAL common

stock (UAL only) 257 — — —

Interest paid in kind on 6% senior notes 15 — — —

Net unrealized gain (loss) on financial instruments

recorded in other comprehensive income (loss) 5 (5) 24 —

In addition to the above non-cash transactions, see Note 1, "Voluntary Reorganization Under Chapter 11," Note 12, "Debt Obligations" and Note 13,

"Preferred Stock."

(18) Advanced Purchase of Miles

In October 2005, the Company entered into an amendment to its agreement with Chase regarding the Mileage Plus Visa card under which Chase pays in

advance for frequent flyer miles to be earned by Mileage Plus members for making purchases using the Mileage Plus Visa card. The existing agreement includes

an annual guaranteed payment for the purchase of frequent flyer miles.

In connection with the Chase Mileage Plus agreement, the Company provided Chase a junior lien upon, and security interest in, all collateral pledged or in

which security interest is granted, as security in the credit facility. The security interest was junior to other credit facility debt, and applied to no more than

$850 million in total advance purchases at any time. In February 2007, the Company amended the agreement with Chase whereby Chase released their junior

security interest in the collateral pledged to the Amended Credit Facility. However under certain circumstances, the Company is obligated to reinstate Chase's

junior security interest in the assets pledged to the Amended Credit Facility. As of December 31, 2007 and 2006, the total advanced purchase of miles was

$694 million and $681 million, respectively.

132

Source: UNITED AIR LINES INC, 10-K, February 29, 2008