United Airlines 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(9) Retirement and Postretirement Plans (Continued)

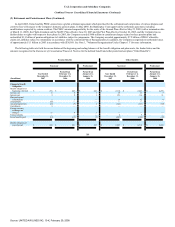

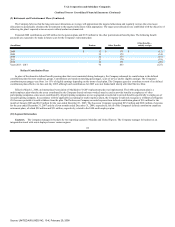

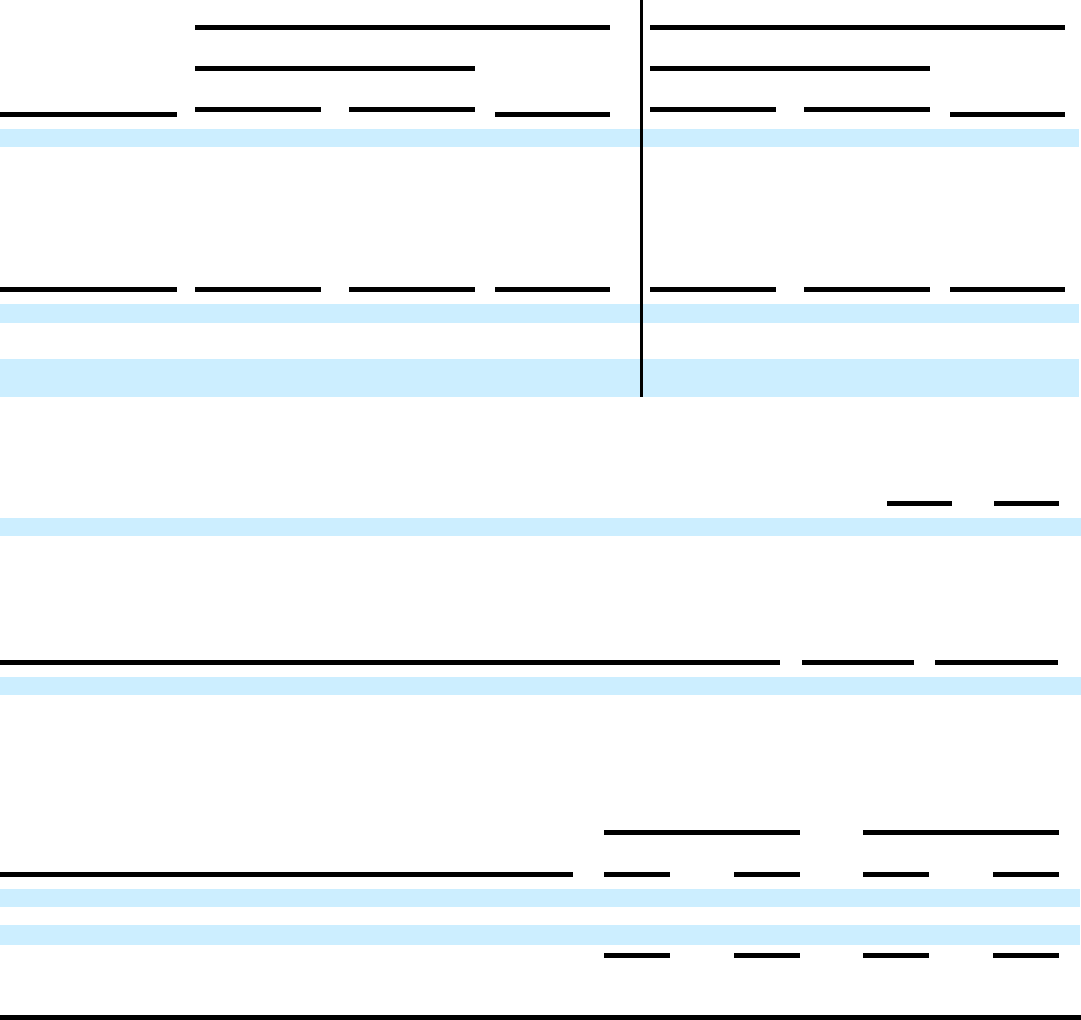

The assumptions below are based on country-specific bond yields and other economic data. The weighted-average assumptions used for the benefit plans

were as follows:

Pension Benefits

Other Benefits

Weighted-average

assumptions used to

determine benefit

obligations

At December 31,

At December 31,

At January 31,

2006

At January 31,

2006

2007

2006

2007

2006

Discount rate 4.16% 3.88% 3.63% 6.27% 5.93% 5.84%

Rate of

compensation

increase 3.22% 3.15% 2.50% — — —

Weighted-average

assumptions used to

determine net expense

Year Ended

December 31,

2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Discount rate 3.88% 3.63% 3.56% 5.93% 5.84% 5.68%

Expected return on

plan assets 6.38% 6.49% 6.49% 6.50% 8.00% 8.00%

Rate of compensation

increase 3.15% 2.50% 2.47% — — —

The expected return on plan assets is based on an evaluation of the historical behavior of the broad financial markets and the Company's investment

portfolio.

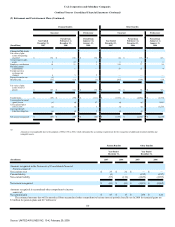

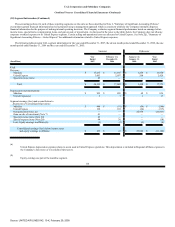

2007

2006

Health care cost trend rate assumed for next year 8.50% 8.50%

Rate to which the cost trend rate is assumed to decline (ultimate trend rate in 2012) 4.50% 4.50%

Assumed health care cost trend rates have a significant effect on the amounts reported for the Other Benefits plan. A 1% change in the assumed health care

trend rate for the Successor Company would have the following additional effects:

(In millions)

1% Increase

1% Decrease

Effect on total service and interest cost for the year ended December 31, 2007 $ 20 $ (15)

Effect on postretirement benefit obligation at December 31, 2007 $ 236 $ (162)

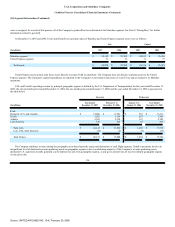

The weighted-average asset allocations for the plans at December 31, 2007 and 2006, by asset category are as follows:

Pension Assets

at December 31

Other

Benefit Assets

at December 31

Asset Category

2007

2006

2007

2006

Equity securities 70% 71% —% —%

Fixed income 25 28 100 100

Other 5 1 — —

Total 100% 100% 100% 100%

112

Source: UNITED AIR LINES INC, 10-K, February 29, 2008