United Airlines 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

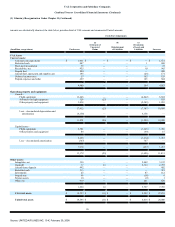

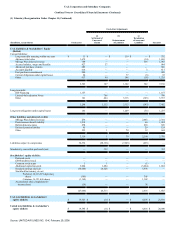

(1) Voluntary Reorganization Under Chapter 11 (Continued)

municipal bonds, $726 million in aggregate principal amount of 4.5% senior limited-subordination convertible notes issued in July 2006 to certain irrevocable

trusts established for the benefit of certain employees, and $500 million in aggregate principal amount of 6% senior notes issued to the PBGC. Pursuant to the

Plan of Reorganization, UAL may also be obligated to issue up to $500 million of 8% senior unsecured notes to the PBGC contingent upon UAL's future

financial performance. See Note 12, "Debt Obligations," for further information.

Significant Bankruptcy Matters Resolved in 2007. During 2007, matters related to the termination of the United Airlines Pilot Defined Benefit Pension

Plan (the "Pilot Plan") were resolved in the Company's favor. The matters generally involved (a) whether the Pilot Plan should have been involuntary terminated

under the Employee Retirement Income Security Act, and (b) the obligation of the Company to make benefit payments under the plan pending the resolution of

such termination. These matters were resolved during 2007 as a result of favorable rulings by the applicable courts and exhaustion of all avenues available for

appeal.

Significant Matters Remaining to be Resolved in Chapter 11 Cases. The following matters remain to be resolved in the Bankruptcy Court or another

court. See Claims Resolution Process, below, for details of special items recognized in the Statements of Consolidated Operations for these matters.

(a)

SFO Municipal Bond Secured Interest. HSBC Bank Inc. ("HSBC"), as trustee for the 1997 municipal bonds related to San Francisco

International Airport ("SFO"), filed a complaint against United asserting a security interest in United's leasehold for portions of its

maintenance base at SFO. Pursuant to Section 506(a) of the Bankruptcy Code, HSBC alleges that it is entitled to be paid the value of that

security interest, which HSBC had claimed was as much as $257 million. HSBC and United went to trial in April 2006 and the Bankruptcy

Court rejected as a matter of law HSBC's $257 million claim. HSBC subsequently alleged that it was entitled to $154 million, or at a

minimum, approximately $93 million. The parties tried the case and filed post-trial briefs which were heard by the Bankruptcy Court. In

October 2006, the Bankruptcy Court issued its written opinion holding that the value of the security interest is approximately $27 million.

United has accrued this amount as its estimated obligation at December 31, 2007. After the Bankruptcy Court denied various post-trial

motions, both parties have appealed to the District Court and those appeals are pending.

(b)

LAX Municipal Bond Secured Interest. There is pending litigation before the Bankruptcy Court regarding the extent to which the Los

Angeles International Airport ("LAX") municipal bond debt is entitled to secured status under Section 506(a) of the Bankruptcy Code. At

December 31, 2006, United had accrued $60 million for this matter. Trial on this matter occurred during April 2007 and the two parties

filed post-trial briefs in the second quarter of 2007. In August 2007, the Bankruptcy Court issued its written opinion holding that the value

of the security interest is approximately $33 million, which United has accrued at December 31, 2007. Both parties have appealed to the

District Court and those appeals are pending.

Claims Resolution Process. As permitted under the bankruptcy process, the Debtors' creditors filed proofs of claim with the Bankruptcy Court. Through

the claims resolution process, the Company identified many claims which were disallowed by the Bankruptcy Court for a number of reasons, such as claims that

were duplicative, amended or superseded by later filed claims, were without merit, or were otherwise overstated. Throughout the Chapter 11 proceedings, the

Company resolved many claims

80

Source: UNITED AIR LINES INC, 10-K, February 29, 2008