United Airlines 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(14) Financial Instruments and Risk Management (Continued)

February 2006, the Successor Company entered into an interest rate swap with an initial notional amount of $2.45 billion that would have decreased to

$1.8 billion over the term of the swap. The swap would have expired in February 2012 and required that the Company pay a fixed rate of 5.14% and receive a

floating rate based on the three-month LIBOR rate.

The Company initially applied hedge accounting for the swap but subsequently discontinued hedge accounting in 2006 as the Company determined that it

was no longer probable that a portion of the forecasted cash flows hedged by the swap would occur, in light of the Company's developing plans to retire a portion

of the credit facility in advance of scheduled maturities. Any gains and losses related to interest rate swap agreements, if any, that are included in earnings are

classified as interest expense. In January 2007, the Company terminated the interest rate swap that had been used to hedge the future interest payments under the

original credit facility.

Foreign Currency Derivatives.

During 2007, the Company began hedging a portion of its remaining 2007 foreign currency risk exposure using foreign currency forward contracts. As of

December 31, 2007, the Company hedged a portion of its expected foreign currency cash flows in the Australian dollar, Canadian dollar, British pound,

European Euro and Japanese yen. As of December 31, 2007, the notional amount of these foreign currencies hedged with the forward contracts in U.S. dollars

terms was approximately $346 million. These contracts expire at various dates through December 2008. For the year ended December 31, 2007, there were no

material gains or losses from these derivative positions.

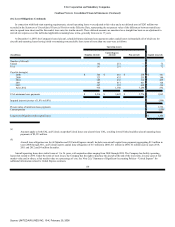

Fair Value of Financial Instruments.

The following methods and assumptions were used to estimate the fair value of each class of financial instruments for which such estimates can be made:

Cash and Cash Equivalents, Restricted Cash and Short-term Investments.

The carrying amounts approximate fair value because of the short-term maturity of these investments.

Derivative Financial Instruments.

Market prices used to determine fair value fuel-related and foreign currency derivatives are primarily based on prices obtained from counterparties or

broker-dealers.

Preferred Stock and Long-Term Debt.

The fair value is based on the quoted market prices for the same or similar issues, discounted cash flow models using appropriate market rates and the

Black-Scholes model to value conversion rights in UAL's convertible preferred stock and debt instruments.

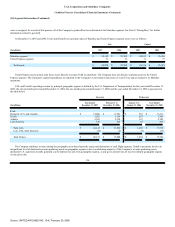

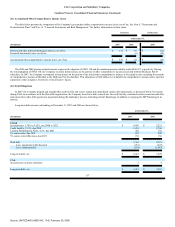

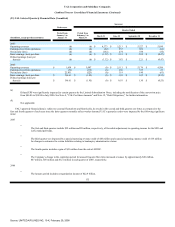

The following table presents the carrying amounts and estimated fair values of the Company's financial instruments at December 31, 2007 and 2006.

Amounts shown below are applicable to both UAL and United except that long-term debt is presented on a UAL consolidated basis, which is approximately

$3 million and $4 million higher than both the carrying value and fair value of United's

126

Source: UNITED AIR LINES INC, 10-K, February 29, 2008