United Airlines 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

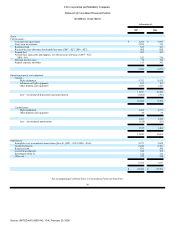

In addition to the cash equivalents and short-term investments included in the table above, UAL and United have $325 million and $291 million of

short-term restricted cash, respectively, and each has $431 million of long-term restricted cash. As discussed in Note 2(e), "Summary of Significant Accounting

Policies—Cash and Cash Equivalents, Short-Term Investments and Restricted Cash" in the Combined Notes to Consolidated Financial Statements, this cash is

being held in restricted accounts for workers' compensation obligations, security deposits for airport leases and reserves with institutions that process United's

credit card ticket sales. Due to the short term nature of these cash balances, the carrying values approximate the fair values. The Company's interest income is

exposed to changes in interest rates on these cash balances. During 2007, the Company also repurchased certain of its own debt instruments, which remain

outstanding at December 31, 2007, with a fair value and carrying value of $91 million. The Company recognizes changes in fair value of these securities through

other comprehensive income; however, on a net basis, the Company is not exposed to market risk due to offsetting changes in the fair value of the Company's

debt obligations.

Price Risk (Aircraft Fuel). United enters into fuel option contracts and futures contracts to reduce its price risk exposure to jet fuel. These contracts are

designed to provide protection against sharp increases in the price of aircraft fuel. The Company may update its hedging strategy in response to changes in

market conditions. The fair value of the Company's fuel related derivatives was $20 million at December 31, 2007. These instruments have a maturity of less

than one year.

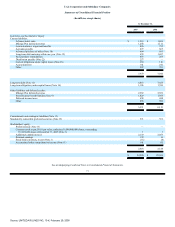

Foreign Currency. United generates revenues and incurs expenses in numerous foreign currencies. Such expenses include fuel, aircraft leases,

commissions, catering, personnel expense, advertising and distribution costs, customer service expenses and aircraft maintenance. Changes in foreign currency

exchange rates impact the Company's results of operations through changes in the dollar value of foreign currency-denominated operating revenues and

expenses.

Despite the adverse effects a strengthening foreign currency may have on demand for U.S.-originating traffic, a strengthening of foreign currencies tends to

increase reported revenue and operating income because the Company's foreign currency-denominated operating revenue generally exceeds its foreign

currency-denominated operating expense for each currency. Likewise, despite the favorable effects a weakening foreign currency may have on demand for

U.S.-originating traffic, a weakening of foreign currencies tends to decrease reported revenue and operating income.

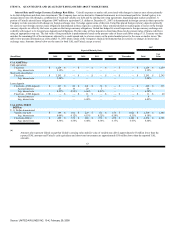

The Company's most significant net foreign currency exposures in 2007, based on exchange rates in effect at December 31, 2007, are presented in the table

below:

Operating revenue net of

operating expense

(In millions)

Currency

Foreign

Currency

Value

USD Value

Canadian dollar 323 $ 324

Chinese renminbi 2,178 298

Australian dollar 158 138

European euro 94 137

Japanese yen 14,040 126

In 2007, the Company began using foreign currency forward contracts to hedge a portion of its exposure to changes in foreign currency exchange rates. As

of December 31, 2007, the Company hedged a portion of its expected foreign currency cash flows in the Australian dollar, Canadian dollar, British pound,

European Euro and Japanese yen. As of December 31, 2007, the notional amount of these foreign currencies hedged with the forward contracts in U.S. dollars

terms was approximately $346 million. These contracts had a fair value of $1 million at December 31, 2007 and expire at various dates through December 2008.

The Company did not have any outstanding foreign currency derivatives at December 31, 2006.

64

Source: UNITED AIR LINES INC, 10-K, February 29, 2008