United Airlines 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

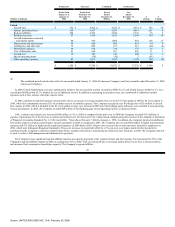

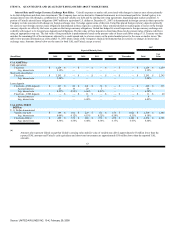

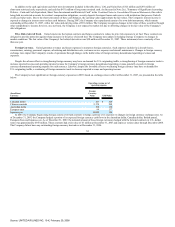

(c)

Mainline includes non-aircraft capital lease payments of $5 million in each of the years 2008 through 2011. United Express payments are all for

aircraft. United has lease deposits of $516 million in separate accounts to meet certain of its future capital lease obligations.

(d)

Amounts represent lease payments that are made by United under capacity agreements with the regional carriers who operate these aircraft on United's

behalf.

(e)

Amounts represent postretirement benefit payments, net of subsidy receipts, through 2017. Benefit payments approximate plan contributions as plans

are substantially unfunded. Not included in the table above are contributions related to the Company's foreign pension plans. The Company does not

have any significant contributions required by government regulations. The Company's expected pension plan contributions for 2008 are $29 million.

(f)

Amounts are principally for aircraft and exclude advance payments. The Company has the right to cancel its commitments for the purchase of 42

A319 and A320 aircraft; however, such action could cause the forfeiture of $91 million of advance payments.

(g)

Represents estimated uncertain income tax position liabilities in accordance with FIN 48. The settlement period is undeterminable.

See Note 2(j), "Summary of Significant Accounting Policies—United Express," Note 9, "Retirement and Postretirement Plans," Note 12, "Debt

Obligations," and Note 16, "Lease Obligations," in the Combined Notes to Consolidated Financial Statements for additional discussion of these items.

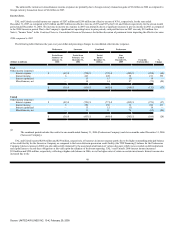

Off-Balance Sheet Arrangements. An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an

unconsolidated entity under which a company has (1) made guarantees, (2) a retained or a contingent interest in transferred assets, (3) an obligation under

derivative instruments classified as equity or (4) any obligation arising out of a material variable interest in an unconsolidated entity that provides financing,

liquidity, market risk or credit risk support to the company, or that engages in leasing, hedging or research and development arrangements with the company. The

Company's off-balance sheet arrangements include operating leases, which are summarized in the contractual obligations table, above, and certain municipal

bond obligations, as discussed below, and letters of credit, of which $102 million was outstanding at December 31, 2007.

Certain municipalities issued municipal bonds on behalf of United to finance the construction of improvements at airport-related facilities. The Company

also leases facilities at airports where municipal bonds funded at least some of the construction of airport-related projects. At December 31, 2007, the Company

guaranteed interest and principal payments on $270 million in principal of such bonds that were originally issued in 1992, subsequently refinanced in 2007, and

are due in 2032 unless the Company elects not to extend its lease in which case the bonds are due in 2023. The outstanding bonds and related guarantee are not

recorded in the Company's Statements of Consolidated Financial Position in accordance with GAAP. The related lease agreement is accounted for as an

operating lease, and the related rent expense is recorded on a straight-line basis. The annual lease payments through 2023 and the final payment for the principal

amount of the bonds are included in the operating lease payments in the contractual obligations table above. For further details, see Note 15, "Commitments,

Contingent Liabilities and Uncertainties—Guarantees and Off-Balance Sheet Financing," in the Combined Notes to Consolidated Financial Statements.

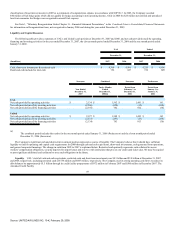

Fuel Consortia. The Company participates in numerous fuel consortia with other carriers at major airports to reduce the costs of fuel distribution and

storage. Interline agreements govern the rights and responsibilities of the consortia members and provide for the allocation of the overall costs to operate the

consortia based on usage. The consortia (and in limited cases, the participating carriers) have entered into long-term agreements to lease certain airport fuel

storage and distribution facilities that are typically financed through tax-exempt bonds (either special facilities lease revenue bonds or general airport revenue

bonds), issued by various local municipalities. In general, each consortium lease

54

Source: UNITED AIR LINES INC, 10-K, February 29, 2008