United Airlines 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

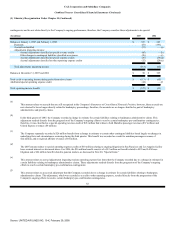

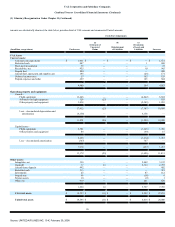

(1) Voluntary Reorganization Under Chapter 11 (Continued)

(d)

In exchange for employees' contributions to the successful reorganization of the Company, including agreeing to reductions in pay and benefits, the

Company agreed in the Plan of Reorganization to provide each employee group a deemed claim which was used to provide a distribution of a portion

of the equity of the reorganized entity to those employees. Each employee group received a deemed claim amount based upon a portion of the value of

cost savings provided by that group through reductions to pay and benefits as well as through certain work rule changes. The total value of this

deemed claim was approximately $7.4 billion. As of December 31, 2005, the Company recorded a non-cash reorganization charge of $6.5 billion for

the deemed claim amount for all union-represented employees. The remaining $0.9 billion associated with non-represented salaried and management

employees was recorded as a reorganization charge in January 2006, upon confirmation of the Plan of Reorganization.

(e)

Contract rejection charges are non-cash costs that include estimated claim values resulting from the Company's rejection or negotiated modification of

certain contractual obligations such as executory contracts, unexpired leases and regional carrier contracts.

(f)

Upon termination and settlement of the Pension Plans, the Company recognized non-cash curtailment charges of $640 million in 2005, associated with

actions taken by the PBGC to involuntarily terminate United Air Lines, Inc. Ground Employees' Retirement Plan (the "Ground Employees Plan"),

United Airlines Flight Attendant Defined Benefit Pension Plan (the "Flight Attendant Plan") and United Airlines Management, Administrative and

Public Contact Defined Benefit Pension Plan ("MAPC Plan"). The PBGC was appointed trustee for the Ground Employees Plan effective May 23,

2005 and the MAPC Plan and the Flight Attendant Plan, both effective June 30, 2005, and the Pilot Plan effective October 26, 2005, assuming all

rights and powers over the pension assets and obligations of each plan. Upon termination and settlement of these plans, the Company recognized

non-cash net settlement losses of approximately $1.1 billion in 2005 in accordance with Statement of Financial Accounting Standards No. 88,

Employer's Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits ("SFAS 88"). Further, the

Company recognized a non-cash charge of $7.2 billion related to a final settlement with the PBGC as a result of the termination of the defined benefit

pension plans. In addition, the Company recognized a non-cash settlement loss in the amount of $10 million during 2005 for the termination of the

non-qualified supplemental retirement plan for management employees who had benefits under the tax-qualified pension plan that could not be paid

under the qualified plan due to Internal Revenue Code limitations.

(g)

Aircraft claim charges include the Company's estimate of claims incurred as a result of the rejection of certain aircraft leases and return of aircraft as

part of the bankruptcy process, together with certain claims resulting from the modification of other aircraft financings in bankruptcy.

(h)

Municipal bond obligations include the Company's best estimate of unsecured claims incurred as a result of certain restructured municipal bond

obligations, together with certain claims expected to result from the rejection and litigation of other municipal bond obligations. The ultimate

disposition of the SFO and LAX security interests remain subject to the uncertain outcome of pending litigation.

(i)

In 2004, the Company reached agreement with representatives of its retirees to modify medical and life insurance benefits for individuals who had

retired from United before July of 2003, as provided under Section 1114 of the Bankruptcy Code ("retiree welfare benefit claims"). As a result, the

Company proposed, as part of the approved Plan of Reorganization, a general unsecured claim for these changes to retiree benefits for each of the

eligible individuals. The aggregate amount of retiree welfare benefit claims allowed by the Bankruptcy Court pursuant to these agreements and the

Company's confirmed Plan of Reorganization was approximately $652 million.

(j)

In accordance with the term sheets reached with the Public Debt Group, UAL agreed to cancel certain 1997-1 EETC certificates that were held by a

related party. Accordingly, in 2005, UAL recorded a non-cash charge in the amount of $134 million for the principal and interest on such certificates.

In addition, the Company recorded adjustments retroactively for aircraft rent and interest expense in the amount of $60 million to reflect the revised

aircraft financing terms.

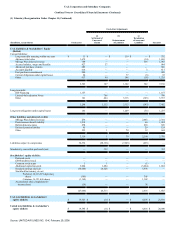

Fresh-Start Reporting. Upon emergence from its Chapter 11 proceedings on February 1, 2006, the Company adopted fresh-start reporting in accordance

with SOP 90-7. The Company's emergence from Chapter 11 resulted in a new reporting entity with no retained earnings or accumulated deficit.

84

Source: UNITED AIR LINES INC, 10-K, February 29, 2008