United Airlines 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the outstanding miles at December 31, 2007 will ultimately be redeemed based on assumptions as of December 31, 2007 and, accordingly, has recorded deferred

revenue of $3.8 billion. At December 31, 2007, a hypothetical 1% change in the Company's outstanding number of miles or the weighted-average ticket value

has approximately a $43 million effect on the liability.

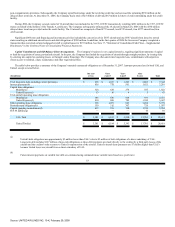

Accounting for Long-Lived Assets. UAL's and United's net book value of operating property and equipment was $11.4 billion and $11.3 billion,

respectively, at December 31, 2007 and $11.5 billion and $11.4 billion, respectively, at December 31, 2006. In addition to the original cost of these assets, as

adjusted by fresh-start reporting at February 1, 2006, their recorded value is impacted by a number of accounting policy elections, including the estimation of

useful lives and residual values and, when necessary, the recognition of asset impairment charges.

Except for the adoption of fresh-start reporting at February 1, 2006, whereby the Company remeasured long-lived assets at fair value, it is the Company's

policy to record assets acquired, including aircraft, at acquisition cost. Depreciable life is determined through economic analysis, such as reviewing existing fleet

plans, obtaining appraisals and comparing estimated lives to other airlines that operate similar fleets. Older generation aircraft are assigned lives that are

generally consistent with the experience of United and the practice of other airlines. As aircraft technology has improved, useful life has increased and the

Company has generally estimated the lives of those aircraft to be 30 years. Residual values are estimated based on historical experience with regard to the sale of

both aircraft and spare parts, and are established in conjunction with the estimated useful lives of the related fleets. Residual values are based on current dollars

when the aircraft are acquired and typically reflect asset values that have not reached the end of their physical life. Both depreciable lives and residual values are

revised periodically to recognize changes in the Company's fleet plan and other relevant information. A one year increase in the average depreciable life of our

flight equipment would reduce annual depreciation expense on flight equipment by approximately $20 million.

In accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, the Company

evaluates the carrying value of long-lived assets whenever events or changes in circumstances indicate that an impairment may exist. The Company's policy is to

recognize an impairment charge when an asset's carrying value exceeds its net undiscounted future cash flows and its fair market value. The amount of the charge

is the difference between the asset's book value and fair market value. The Company estimates the undiscounted future cash flows for its various aircraft with

output from financial models used by the Company to make fleet and scheduling decisions. These models utilize projections on passenger yield, fuel costs, labor

costs and other relevant factors, many of which require the exercise of significant judgment on the part of management. Changes in these projections may expose

the Company to future impairment charges by raising the threshold which future cash flows need to meet. If a triggering event requiring impairment testing

occurs, the Company also evaluates the remaining useful lives of these assets to determine whether the lives are still appropriate. Typically, the Company utilizes

knowledge from personnel in its fleet planning and maintenance departments, along with other external factors, to determine whether the remaining useful lives

are appropriate. See Note 2(g), "Summary of Significant Accounting Policies—Operating Property and Equipment," in the Combined Notes to Consolidated

Financial Statements for additional information regarding the Company's policies on accounting for long-lived assets.

Goodwill and Intangible Assets. In accordance with Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets

("SFAS 142"), the Company applies a fair value-based impairment test to the book value of goodwill and indefinite-lived intangible assets on an annual basis

and, if certain events or circumstances indicate that an impairment loss may have been incurred, on an interim basis. An impairment charge could have a material

adverse effect on the Company's financial position and results of operations in the period of recognition. The Company performed its annual

58

Source: UNITED AIR LINES INC, 10-K, February 29, 2008