United Airlines 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

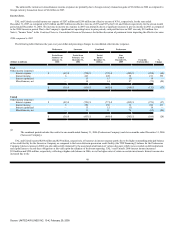

3% resulting in the 6% increase in revenue. Overall, passenger revenues increased due to a better revenue environment for the industry which was partly due to

industry-wide capacity constraint. The Company's shift of some capacity and traffic from domestic to higher yielding international flights also benefited revenues

in 2007. In addition, the change in the Mileage Plus expiration period policy also contributed to the increase in revenues in 2007. Mileage Plus revenue, included

in passenger revenues, was approximately $169 million higher in 2007. This impact was largely due to a change in the Mileage Plus expiration period policy

from 36 months to 18 months, as discussed in Critical Accounting Policies, below. Mileage Plus customer accounts are deactivated after 18 months of inactivity,

effective December 31, 2007. Severe winter storms in December 2007 at the Chicago and Denver hubs resulted in the cancellation of approximately 6,400

United and United Express flights at these locations and had the estimated impact of reducing revenue by $25 million and reducing total expenses by $2 million.

Similarly in December 2006, the Chicago and Denver hubs canceled approximately 3,900 United and United Express flights with an estimated impact of

reducing revenue and total expenses by $40 million and $11 million, respectively.

Cargo revenues increased by $20 million, or 3%, in the year ended December 31, 2007 as compared to the same period in 2006. Freight revenue increased

due to both higher yields and higher volume. This increase was partially offset by a reduction in mail revenue due to lower 2007 volume as a result of the

termination of the U.S. Postal Service ("USPS") contract on June 30, 2006. United signed a new USPS contract effective April, 2007.

UAL other operating revenues decreased by $311 million, or 24%, in the year ended December 31, 2007 as compared to the same period in 2006. Lower jet

fuel sales to third parties by our subsidiary, United Aviation Fuels Corporation ("UAFC") accounted for $307 million of the other revenue decrease. This

decrease in jet fuel sales was due to several factors, including decreased UAFC sales to our regional affiliates, our decision not to renew various low margin

supply agreements to other carriers, and decreased sales of excess inventory. This decrease had no material impact on the Company's operating margin, because

UAFC cost of sales decreased by $306 million in the year ended December 31, 2007 as compared to the prior year.

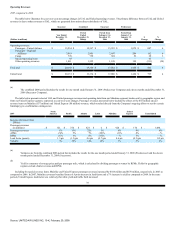

2006 compared to 2005

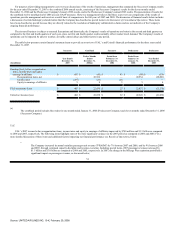

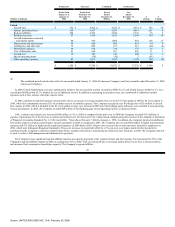

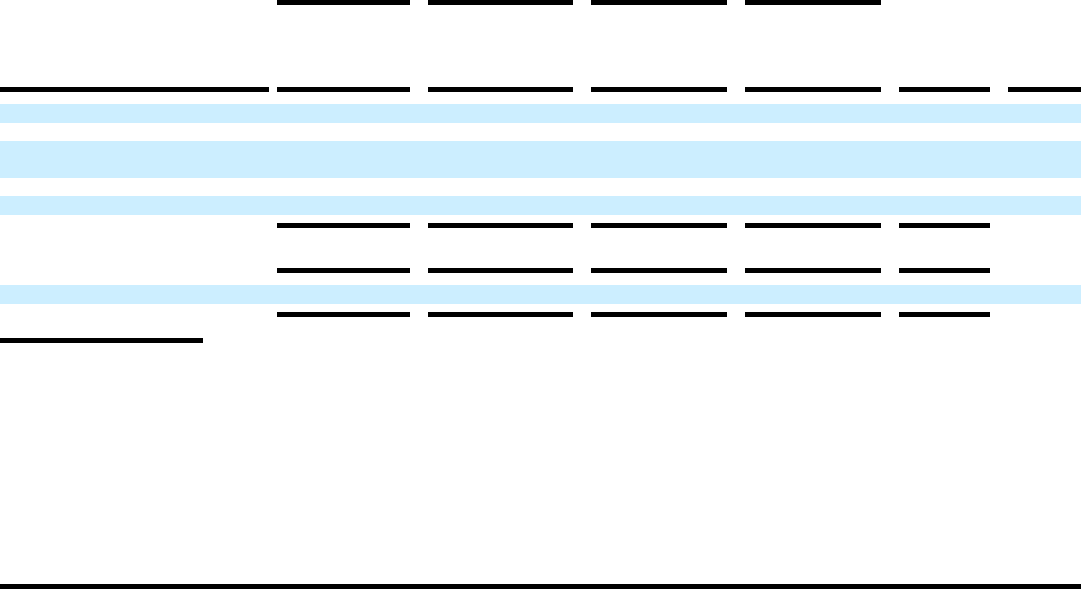

The following table illustrates the year-over-year dollar and percentage changes in major categories of UAL 's and United's operating revenues.

Predecessor

Successor

Combined

Predecessor

(Dollars in millions)

Period from

January 1 to

January 31,

2006

Period from

February 1 to

December 31,

2006

Period

Ended

December 31,

2006(a)

Year

Ended

December 31,

2005

$

Change

%

Change

Operating revenues:

Passenger—United Airlines $ 1,074 $ 13,293 $ 14,367 $ 12,914 $ 1,453 11

Passenger—Regional

Affiliates 204 2,697 2,901 2,429 472 19

Cargo 56 694 750 729 21 3

Other operating revenues 124 1,198 1,322 1,307 15 1

UAL total $ 1,458 $ 17,882 $ 19,340 $ 17,379 $ 1,961 11

United total $ 1,454 $ 17,880 $ 19,334 $ 17,304 $ 2,030 12

(a)

The combined 2006 period includes the results for one month ended January 31, 2006 (Predecessor Company) and eleven months ended December 31,

2006 (Successor Company).

Strong demand, industry capacity restraint, yield improvements, United's resource optimization initiatives, and ongoing airline network optimization all

contributed to a $2.0 billion increase in total

40

Source: UNITED AIR LINES INC, 10-K, February 29, 2008