United Airlines 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

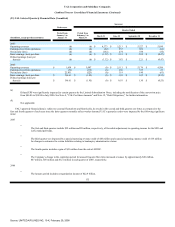

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

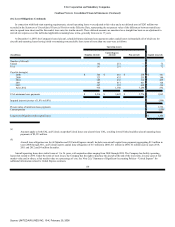

(20) Special Items (Continued)

LAX Municipal Bonds Security Interest. In the fourth quarter of 2006, based on litigation developments, the Company recorded a special item of

$18 million as a charge to operating income to adjust the Company's recorded obligation for the LAX municipal bonds to the amount the Company estimated

was probable to be allowed by the Bankruptcy Court.

2005—Predecessor Company

Aircraft Impairment. During the second quarter of 2005, UAL and United recognized charges of $18 million and $5 million, respectively, for aircraft

impairments related to the planned accelerated retirement of certain aircraft.

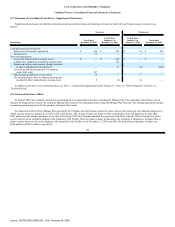

(21) Severance Accrual

The Company has implemented several cost saving initiatives that have resulted in a reduction in workforce such as the outsourcing of administrative

functions, the closing of certain call centers and its announcement of the elimination of certain salaried and management positions through attrition and layoffs.

The Company's severance policy provides the affected employees salary continuation as well as certain insurance benefits for a specified period of time. The

Company recognizes its severance obligations in accordance with Statement of Financial Accounting Standards No. 112 (As Amended), Employers' Accounting

for Postemployment Benefits—an amendment of FASB Statements No. 5 and 43. In 2006, the Company accrued $30 million, which was substantially paid in

2006, for severance primarily due to a significant restructuring program that resulted in the elimination of a significant number of positions.

(22) Distribution Payable

In December 2007, the UAL Corporation Board of Directors approved a special distribution of $2.15 per share to holders of UAL common stock. The

distribution, of approximately $257 million, was paid on January 23, 2008 to the holders of record of UAL common stock on January 9, 2008. The distribution

has been accrued at December 31, 2007 in UAL's Consolidated Statements of Financial Position.

In January 2008, United's Board of Directors approved a dividend of up to $260 million to UAL to fund the January 23, 2008 special distribution to UAL

common stockholders. As such, United did not accrue the distribution at December 31, 2007.

The determination of whether the $2.15 per share distribution is characterized as a return of capital or a dividend for income tax purposes will not be

finalized until January 2009 after UAL determines the amount of its 2008 taxable profit. If all, or a portion of, the distribution exceeds UAL's accumulated or

2008 profits, the excess will be taxed as a return of capital rather than a dividend.

134

Source: UNITED AIR LINES INC, 10-K, February 29, 2008