United Airlines 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(1) Voluntary Reorganization Under Chapter 11 (Continued)

Financial Statement Presentation. The Company has prepared the accompanying consolidated financial statements in accordance with SOP 90-7 and on

a going-concern basis, which assumes continuity of operations, realization of assets and satisfaction of liabilities in the ordinary course of business.

SOP 90-7 requires that the financial statements for periods after a Chapter 11 filing separate transactions and events that are directly associated with the

reorganization from the ongoing operations of the business. Accordingly, all transactions (including, but not limited to, all professional fees, realized gains and

losses and provisions for losses) directly associated with the reorganization and restructuring of the business are reported separately in the financial statements as

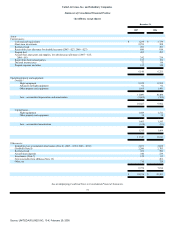

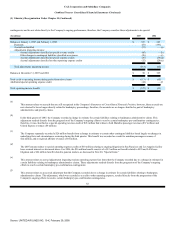

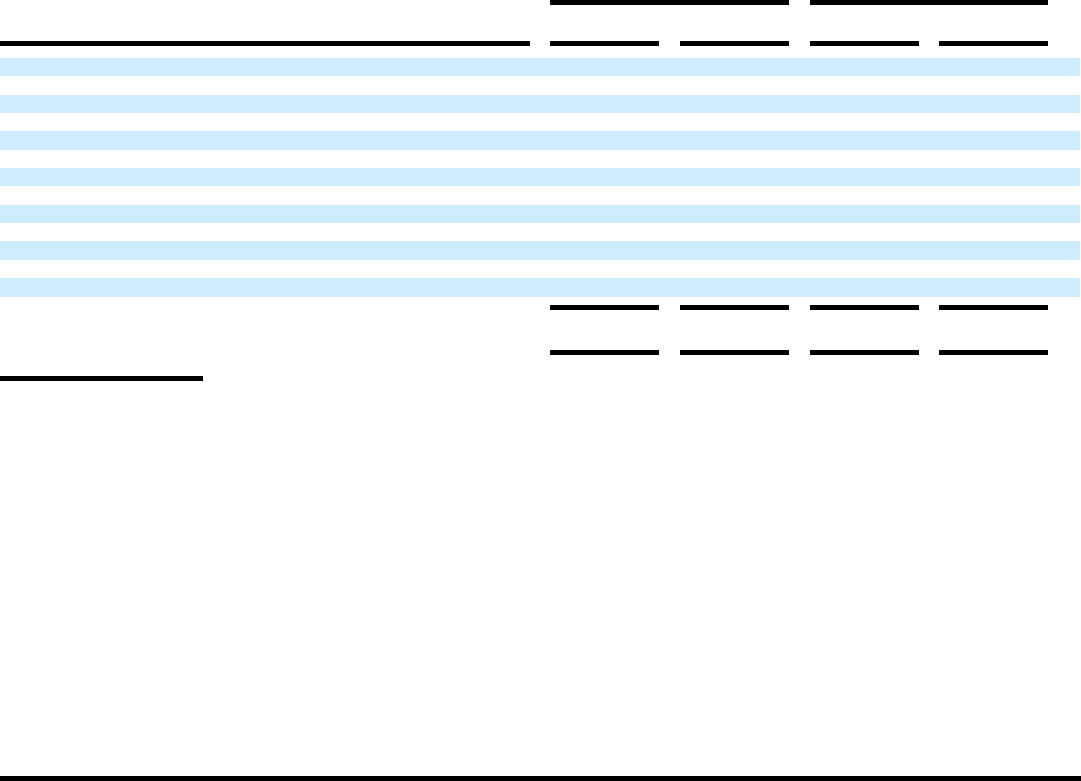

reorganization items, net. For the month ended January 31, 2006 and the year ended December 31, 2005, the Predecessor Company recognized the following

primarily non-cash reorganization income (expense) in its financial statements:

Period from January 1 to January 31,

2006

Year Ended December 31, 2005

(In millions)

UAL

United

UAL

United

Discharge of claims and liabilities $ 24,628 $ 24,389 $ — $ — (a)

Revaluation of frequent flyer obligations (2,399) (2,399) — — (b)

Revaluation of other assets and liabilities 2,106 2,111 — — (c)

Employee-related charges (898) (898) (6,529) (6,529)(d)

Contract rejection charges (429) (421) (523) (523)(e)

Professional fees (47) (47) (230) (230)

Pension-related charges (14) (14) (8,925) (8,925)(f)

Aircraft claim charges — — (3,005) (2,967)(g)

Municipal bond charges — — (688) (688)(h)

Retiree-related charges — — (652) (652)(i)

Impairment on lease certificates — — (134) (3)(j)

Aircraft refinance adjustments — — 60 60 (j)

Other (13) (12) 25 25

$ 22,934 $ 22,709 $ (20,601) $ (20,432)

(a)

The discharge of claims and liabilities primarily relates to those unsecured claims arising during the bankruptcy process, such as those arising from the

termination and settlement of the Company's U.S. defined benefit pension plans and other employee claims; aircraft-related claims, such as those

arising as a result of aircraft rejections; other unsecured claims due to the rejection or modification of executory contracts, unexpired leases and

regional carrier contracts; and claims associated with certain municipal bond obligations based upon their rejection, settlement or the estimated impact

of the outcome of pending litigation. In accordance with the Plan of Reorganization, the Company discharged its obligations to unsecured creditors in

exchange for the distribution of 115 million common shares of Successor UAL and the issuance of certain other UAL securities. Accordingly, UAL

and United recognized a non-cash reorganization gain of $24.6 billion and $24.4 billion, respectively.

(b)

The Company revalued its Mileage Plus Frequent Flyer Program ("Mileage Plus") obligations at fair value as a result of fresh-start reporting, which

resulted in a $2.4 billion non-cash reorganization charge.

(c)

In accordance with fresh-start reporting, the Company revalued its assets at their estimated fair value and liabilities at estimated fair value or the

present value of amounts to be paid. This resulted in a non-cash reorganization gain of $2.1 billion, primarily as a result of newly recognized

intangible assets, offset partly by reductions in the fair value of tangible property and equipment.

83

Source: UNITED AIR LINES INC, 10-K, February 29, 2008