United Airlines 2007 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

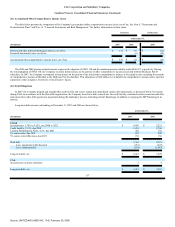

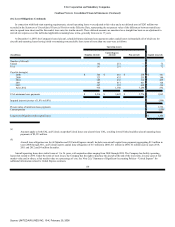

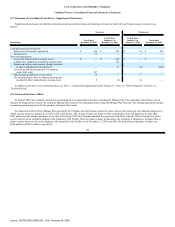

(14) Financial Instruments and Risk Management (Continued)

long-term debt at December 31, 2007 and 2006, respectively, as disclosed in Note 12, "Debt Obligations."

2007

2006

(In millions)

Carrying Amount

Fair Value

Carrying Amount

Fair Value

Long-term debt (including current portion) $ 7,093 $ 6,796 $ 9,140 $ 9,510

Preferred stock 371 401 361 443

Fuel derivative contracts—gains (losses) 20 20 (2) (2)

Interest rate swap loss — — 12 12

Foreign currency derivative contract gains 1 1 — —

Lease deposits 516 531 539 574

(15) Commitments, Contingent Liabilities and Uncertainties

General Guarantees and Indemnifications. In the normal course of business, the Company enters into numerous real estate leasing and aircraft financing

arrangements that have various guarantees included in the contracts. These guarantees are primarily in the form of indemnities. In both leasing and financing

transactions, the Company typically indemnifies the lessors, and any tax/financing parties, against tort liabilities that arise out of the use, occupancy, operation or

maintenance of the leased premises or financed aircraft. Currently, the Company believes that any future payments required under these guarantees or

indemnities would be immaterial, as most tort liabilities and related indemnities are covered by insurance (subject to deductibles). Additionally, certain leased

premises such as fueling stations or storage facilities include indemnities of such parties for any environmental liability that may arise out of or relate to the use

of the leased premises.

Legal and Environmental Contingencies. The Company has certain contingencies resulting from litigation and claims (including environmental issues)

incident to the ordinary course of business. Management believes, after considering a number of factors, including (but not limited to) the information currently

available, the views of legal counsel, the nature of contingencies to which the Company is subject and prior experience, that the ultimate disposition of these

contingencies will not materially affect the Company's consolidated financial position or results of operations.

The Company records liabilities for legal and environmental claims when a loss is probable and reasonably estimatable. These amounts are recorded based

on the Company's assessments of the likelihood of their eventual disposition. The amounts of these liabilities could increase or decrease in the near term, based

on revisions to estimates relating to the various claims.

The Company anticipates that if ultimately found liable, its damages from claims arising from the events of September 11, 2001 could be significant;

however, the Company believes that, under the Air Transportation Safety and System Stabilization Act of 2001, its liability will be limited to its insurance

coverage.

The Company is also currently analyzing whether any potential liability may result from air cargo/passenger surcharge cartel investigations following the

receipt of a Statement of Objections that the European Commission (the "Commission") issued to 26 carriers on December 18, 2007. The Statement of

Objections sets out evidence related to the utilization of fuel and security surcharges and exchange of pricing information that the Commission views as

supporting the conclusion that an illegal price-

127

Source: UNITED AIR LINES INC, 10-K, February 29, 2008