United Airlines 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

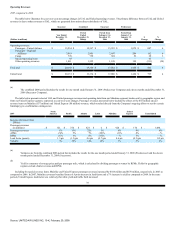

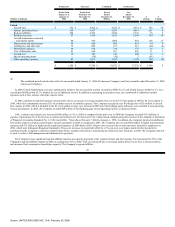

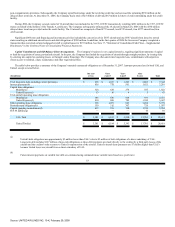

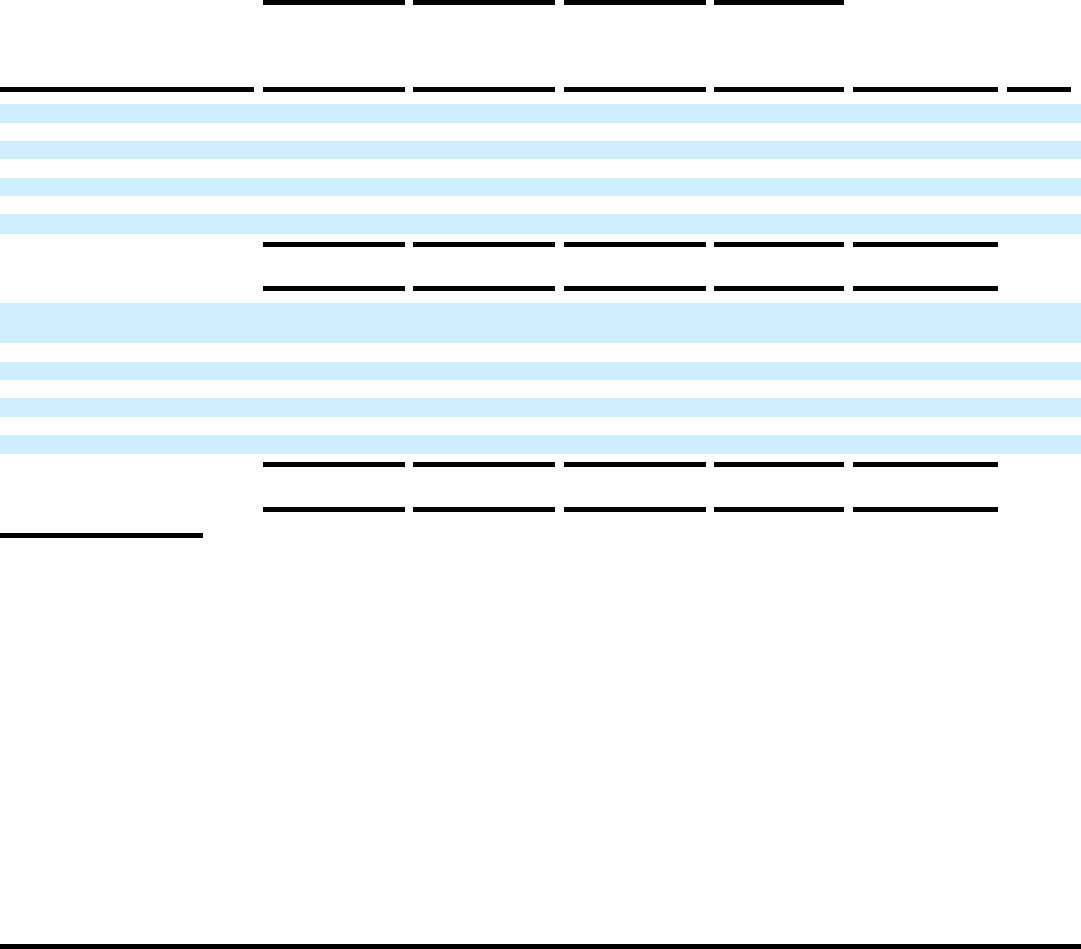

Other Income (Expense).

2007 compared to 2006

The following table illustrates the year-over-year dollar and percentage changes in other income (expense).

Successor

Combined

Successor

Predecessor

(Dollars in millions)

Year Ended

December 31,

2007

Period

Ended

December 31,

2006(a)

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Favorable

(Unfavorable)

%

Change

UAL

Other income (expense):

Interest expense $ (661) $ (770) $ (728) $ (42) $ 109 14

Interest income 257 249 243 6 8 3

Interest capitalized 19 15 15 — 4 27

Gain on sale of investment 41 — — — 41 —

Miscellaneous, net 2 14 14 — (12) (86)

$ (342) $ (492) $ (456) $ (36) $ 150 30

United

Other income (expense):

Interest expense $ (660) $ (771) $ (729) $ (42) $ 111 14

Interest income 260 256 250 6 4 2

Interest capitalized 19 15 15 — 4 27

Gain on sale of investment 41 — — — 41 —

Miscellaneous, net 1 11 11 — (10) (91)

$ (339) $ (489) $ (453) $ (36) $ 150 31

(a)

The combined period includes the results for one month ended January 31, 2006 (Predecessor Company) and eleven months ended December 31, 2006

(Successor Company).

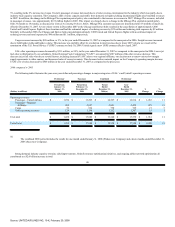

UAL interest expense decreased $109 million, or 14%, in 2007 as compared to 2006. The decrease was due to the February and December 2007

amendments and prepayments of the credit facility, which lowered United's interest rate on these obligations and reduced the total obligations outstanding by

approximately $1.5 billion. Repayments of scheduled maturities of debt obligations and other debt refinancings, which are discussed in "Liquidity and Capital

Resources," below, also reduced interest expense. The 2007 period also included a $22 million reduction in interest expense due to the recognition of a gain on

debt extinguishment. These benefits were offset by interest expense of $17 million for expensing previously capitalized debt issuance costs that were associated

with the February 2007 prepayment of the credit facility, and $6 million for financing costs incurred in connection with the February amendment of the credit

facility. The $500 million Amended Credit Facility prepayment in December 2007 increased interest expense by a net of $4 million from expensing $6 million of

previously capitalized credit facility costs and recording a gain of $2 million to recognize previously deferred interest rate swap gains.

UAL interest income increased $8 million, or 3%, year-over-year. Interest income increased due to the classification of $6 million of interest income as

reorganization items in the January 2006 predecessor period in accordance with SOP 90-7.

The $41 million gain on sale of investment resulted from the Company's sale of its 21.1% interest in ARINC.

47

Source: UNITED AIR LINES INC, 10-K, February 29, 2008