United Airlines 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

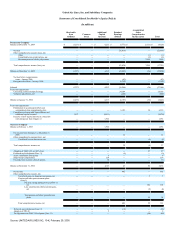

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

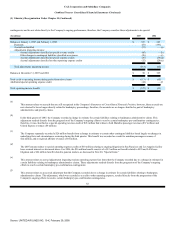

(1) Voluntary Reorganization Under Chapter 11 (Continued)

Accordingly, the Company's consolidated financial statements on or after February 1, 2006 are not comparable to its pre-emergence consolidated financial

statements because they are, in effect, those of a new entity. See the Company's Statements of Consolidated Financial Position, below.

Fresh-start reporting reflects the value of the Company as determined in the confirmed Plan of Reorganization. Under fresh-start reporting, the Company's

asset values are remeasured using fair value, and are allocated in conformity with Statement of Financial Accounting Standards No. 141, Business Combinations

("SFAS 141"). The excess of reorganization value over the fair value of net tangible and identifiable intangible assets and liabilities is recorded as goodwill in the

accompanying Statements of Consolidated Financial Position. In addition, fresh-start reporting also requires that all liabilities, other than deferred taxes, should

be stated at fair value or at the present values of the amounts to be paid using appropriate market interest rates. Deferred taxes are determined in conformity with

Statement of Financial Accounting Standards No. 109, Accounting for Income Taxes ("SFAS 109"). In accordance with SOP 90-7, the Company was required to

adopt on February 1, 2006 all accounting guidance that was going to become effective within the subsequent twelve-month period. In accordance with

SFAS 141, the preliminary allocation of the reorganization value was subject to additional adjustment within one year after emergence from bankruptcy to

provide the Company with the time to complete the valuation of its assets and liabilities. See (c) "Revaluation of Assets and Liabilities," below, for further

information about adjustments recorded by the Company after the Effective Date.

Estimates of fair value represent the Company's best estimates, which are based on industry data and trends and by reference to relevant market rates and

transactions, and discounted cash flow valuation methods, among other factors. To facilitate the calculation of the enterprise value of the Successor Company,

the Company developed a set of financial projections. Based on these financial projections, the equity value was determined by the Company, using various

valuation methods, including (i) a comparison of the Company and its projected performance to the market values of comparable companies; (ii) a review and

analysis of several recent transactions of companies in similar industries to the Company; and (iii) a calculation of the present value of the future cash flows of

the Company under its projections. The estimated enterprise value, and corresponding equity value, is highly dependent upon achieving the future financial

results set forth in the projections as well as the realization of certain other assumptions. The estimated equity value of the Company was calculated to be

approximately $1.9 billion. The estimates and assumptions made in this valuation are inherently subject to significant uncertainties and the resolution of

contingencies beyond the reasonable control of the Company. Accordingly, there can be no assurance that the estimates, assumptions, and amounts reflected in

the valuations will be realized, and actual results could vary materially. Moreover, the market value of UAL's common stock may differ materially from the

equity valuation.

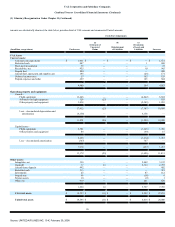

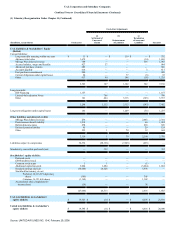

The implementation of the Plan of Reorganization and the effects of the consummation of the transactions contemplated therein, which included settlement

of various liabilities, issuance of certain securities, incurrence of new indebtedness, repayment of old indebtedness, and other cash payments and the adoption of

fresh-start reporting in the Company's Statements of Consolidated Financial Position are presented below. As discussed in Note 12, "Debt Obligations," certain

instruments issued by UAL have been pushed down to United and are reflected as obligations of United. As the UAL and United

85

Source: UNITED AIR LINES INC, 10-K, February 29, 2008