United Airlines 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

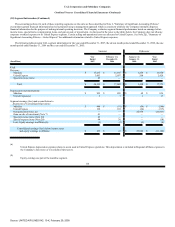

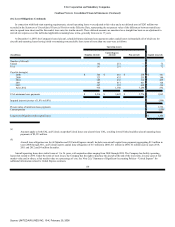

(12) Debt Obligations (Continued)

At December 31, 2007, UAL's contractual principal payments under then-outstanding long-term debt agreements in each of the next five calendar years are

as follows: 2008—$678 million; 2009—$737million; 2010—$918 million; 2011—$824 million; 2012—$385 million and thereafter—$3,802 million. At

December 31, 2007, United's contractual principal payments under then-outstanding long-term debt agreements in each of the next five calendar years are as

follows: 2008—$678 million; 2009—$736 million; 2010—$917 million; 2011—$824 million; 2012—$385 million and thereafter—$3,801 million.

In addition to the Amended Credit Facility collateral described above, aircraft having an aggregate book value of $5.6 billion at December 31, 2007 were

pledged as security under various loan agreements. As of December 31, 2007, 113 aircraft with a net book value of $2.0 billion were unencumbered.

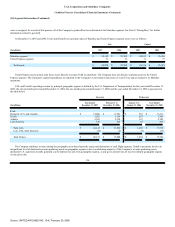

(13) UAL Preferred Stock

The following instrument has been pushed down to United and is reflected on United's books as part of fresh-start reporting.

UAL is authorized to issue 250 million shares of preferred stock (without par value), 5 million shares of 2% convertible preferred stock (par value $0.01 per

share) and two shares of junior preferred stock (par value $0.01 per share).

The 2% convertible preferred stock was issued to the PBGC on the Effective Date. The shares were issued at a liquidation value of $100 per share,

convertible at any time following the second anniversary of the issuance date into common stock of Successor UAL at an initial conversion price of $46.86 per

common share; with dividends payable in kind semi-annually (in the form of increases to the liquidation value of the issued and outstanding shares). The

preferred stock ranks pari passu with all current and future UAL or United preferred stock and is redeemable at any time at the then-current liquidation value

(plus accrued and unpaid dividends) at the option of the issuer. The preferred stock is mandatorily convertible 15 years from the date of issuance. Upon a

fundamental change or a change in ownership as defined in UAL's restated certificate of incorporation, holders of shares of the preferred stock are also entitled to

receive payment equal to the amount they would receive in an actual liquidation of UAL. At December 31, 2007 and 2006, 5 million shares of 2% convertible

preferred stock were outstanding with an aggregate liquidation value of $519 million and $509 million, respectively, which includes $19 million and $9 million,

respectively, of accrued and paid in kind dividends. At December 31, 2007 and 2006, the carrying value of the 2% convertible preferred stock was $371 million

and $361 million, respectively. The carrying value includes $19 million and $9 million of accrued and paid in kind dividends at December 31, 2007 and 2006,

respectively. In addition, the two shares of junior preferred stock were issued in 2006. In February 2008, 1.0 million preferred shares were converted into

approximately 2.2 million common shares.

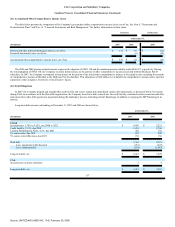

(14) Financial Instruments and Risk Management

Instruments designated as cash flow hedges are accounted for under Statement of Financial Accounting Standards No. 133, Accounting for Derivative

Instruments and Hedging Activities ("SFAS 133"), as long as the hedge is highly effective and the underlying transaction is probable. If both factors are present,

the effective portion of the changes in fair value of these contracts is recorded in accumulated other comprehensive income (loss) until earnings are affected by

the cash flows being

124

Source: UNITED AIR LINES INC, 10-K, February 29, 2008