United Airlines 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

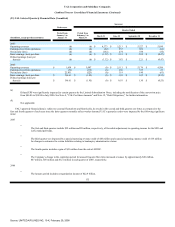

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

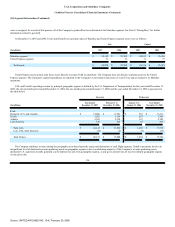

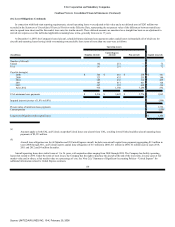

(14) Financial Instruments and Risk Management (Continued)

hedged. To the extent that the designated cash flow hedges are ineffective, gain or loss is recognized currently in earnings. The Company offsets the fair value of

derivative instruments executed with the same counterparty when netting agreements exist.

Instruments classified as economic hedges do not qualify for hedge accounting under SFAS 133. Under this classification all changes in the fair value of

these contracts are recorded currently in income, with the offset to either current assets or liabilities each reporting period. Economic fuel hedge gains and losses

are classified as part of aircraft fuel expense, and foreign currency hedge gains and losses are classified as part of nonoperating income.

Aircraft Fuel Hedges.

The Company has a risk management strategy to hedge a portion of its price risk related to projected jet fuel requirements primarily through collar options.

The collars involve the purchase of fuel call options with the simultaneous sale of fuel put options with identical expiration dates. In the year ended

December 31, 2007 and the eleven months ended December 31, 2006, the Successor Company entered into and settled various derivative positions for its

mainline operations that were classified as economic hedges.

In the year ended December 31, 2007, the Company's Mainline fuel expense included income of $83 million from net gains on economic hedges. The net

hedge gains recorded in 2007 included $20 million of unrealized mark-to-market gains for contracts settling after December 31, 2007. In the eleven months

ended December 31, 2006, the Successor Company recognized a net loss of $26 million which included a $24 million realized loss on settled contracts and

$2 million of unrealized mark-to-market losses for contracts settling after December 31, 2006, all of which were classified as mainline fuel expense in the

Statements of Consolidated Operations. In 2005, the Predecessor Company recognized income of $40 million in non-operating income primarily due to

non-designated hedges.

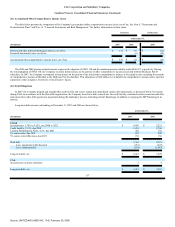

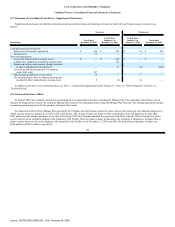

As of December 31, 2007, the Company had hedged 13% of forecasted first quarter 2008 fuel consumption of which 82% is through three-way collars with

upside protection, on a weighted-average basis, beginning from $90 per barrel and capped at $100 per barrel with payment obligations, on a weighted-average

basis, beginning if crude oil drops below $85 per barrel. The remaining 18% is hedged through collars with upside protection beginning, on a weighted-average

basis, at a crude oil equivalent price of $101 per barrel with payment obligations, on a weighted- average basis, beginning if crude oil drops below $91 per barrel.

As of December 31, 2007, the Company had hedged 13% of forecasted fuel consumption for 2008, of which 67% is through three-way collars with upside

protection, on a weighted-average basis, beginning from $87 per barrel and capped at $100 per barrel with payment obligations, on a weighted-average basis,

beginning if crude oil drops below $81 per barrel. The remaining 33% is hedged through collars with upside protection beginning, on a weighted-average, at a

crude oil equivalent price of $94 per barrel with payment obligations, on a weighted-average, beginning if crude oil drops below $81 per barrel.

Interest Rate Swap.

From time to time, the Company uses interest rate swap agreements to effectively limit exposure to interest rate movements within the parameters of the

Company's interest rate hedging policy. In

125

Source: UNITED AIR LINES INC, 10-K, February 29, 2008